Essay

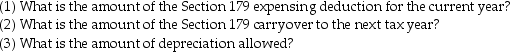

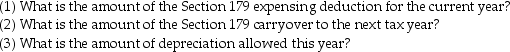

Everest Corp.acquires a machine (seven-year property)on January 10,2016 at a cost of $2,022,000.Everest makes the election to expense the maximum amount under Sec.179.

a.Assume that the taxable income from trade or business is $1,500,000.

b.Assume instead that the taxable income from trade or business is $400,000.

b.Assume instead that the taxable income from trade or business is $400,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Under the MACRS system,depreciation rates for real

Q40: If a new luxury automobile is used

Q43: Enrico is a self-employed electrician.In May of

Q45: During the year 2016,a calendar year taxpayer,Marvelous

Q46: Stellar Corporation purchased all of the assets

Q49: In calculating depletion of natural resources each

Q49: Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property

Q60: A calendar-year taxpayer places in service one

Q527: Discuss the options available regarding treatment of

Q1085: Jack purchases land which he plans on