Essay

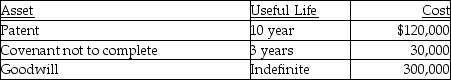

Stellar Corporation purchased all of the assets of Bellavia Company as of January 1 this year for $1 million.Included in the assets acquired are the following intangible assets:

What is Stellar's maximum amortization deduction for the year?

What is Stellar's maximum amortization deduction for the year?

Correct Answer:

Verified

The assets are Sec.197 acquisi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Under the MACRS system,depreciation rates for real

Q43: Enrico is a self-employed electrician.In May of

Q44: Everest Corp.acquires a machine (seven-year property)on January

Q45: During the year 2016,a calendar year taxpayer,Marvelous

Q49: Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property

Q50: In January of 2016,Brett purchased a Porsche

Q51: On May 1,2008,Empire Properties Corp. ,a calendar

Q60: A calendar-year taxpayer places in service one

Q527: Discuss the options available regarding treatment of

Q1085: Jack purchases land which he plans on