Essay

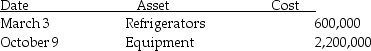

During the year 2016,a calendar year taxpayer,Marvelous Munchies,a chain of specialty food shops,purchased equipment as follows:

Assume the property is all 5-year property,but does not qualify for bonus depreciation.What is the maximum depreciation that may be deducted for the assets this year,2016,assuming the alternative depreciation system is not chosen?

Assume the property is all 5-year property,but does not qualify for bonus depreciation.What is the maximum depreciation that may be deducted for the assets this year,2016,assuming the alternative depreciation system is not chosen?

Correct Answer:

Verified

The mid-quarter convention mus...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Under the MACRS system,depreciation rates for real

Q40: If a new luxury automobile is used

Q43: Enrico is a self-employed electrician.In May of

Q44: Everest Corp.acquires a machine (seven-year property)on January

Q46: Stellar Corporation purchased all of the assets

Q49: Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property

Q50: In January of 2016,Brett purchased a Porsche

Q60: A calendar-year taxpayer places in service one

Q527: Discuss the options available regarding treatment of

Q1085: Jack purchases land which he plans on