Essay

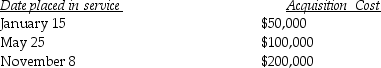

Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property in 2016 and does not use Sec.179.The property does not qualify for bonus depreciation.Mehmet places the property in service on the following schedule:

What is the total depreciation for 2016?

What is the total depreciation for 2016?

Correct Answer:

Verified

More than 40% of the assets a...

More than 40% of the assets a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Under the MACRS system,the same convention that

Q11: Under the MACRS system,depreciation rates for real

Q44: Everest Corp.acquires a machine (seven-year property)on January

Q45: During the year 2016,a calendar year taxpayer,Marvelous

Q46: Stellar Corporation purchased all of the assets

Q50: In January of 2016,Brett purchased a Porsche

Q51: On May 1,2008,Empire Properties Corp. ,a calendar

Q52: In May 2016,Cassie acquired a machine for

Q53: Trenton Corporation places in service $10 million

Q1085: Jack purchases land which he plans on