Multiple Choice

In the AD partnership, Allen's capital is $140,000 and Daniel's is $40,000 and they share income in a 3:1 ratio, respectively. They decide to admit David to the partnership. Each of the following question is independent of the others.

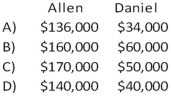

Refer to the information provided above. David directly purchases a one-fifth interest by paying Allen $34,000 and Daniel $10,000. The land account is increased before David is admitted. What are the capital balances of Allen and Daniel after David is admitted into the partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q8: When a partner retires from a partnership

Q13: In the JAW partnership,Jane's capital is $100,000,Anne's

Q17: In the AD partnership, Allen's capital is

Q20: RD formed a partnership on February 10,

Q21: The DEF partnership reported net income of

Q23: Which of the following accounts is not

Q23: The JPB partnership reported net income of

Q34: Which of the following accounts could be

Q35: Shue,a partner in the Financial Brokers Partnership,has

Q41: Paul and Ray sell musical instruments through