Essay

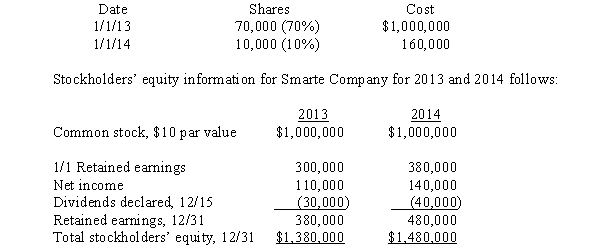

Poole made the following purchases of Smarte Company common stock:

On July 1, 2014, Poole sold 14,000 shares of Smarte Company common stock on the open market for $22 per share.The shares sold were purchased on January 1, 2013.Smarte notified Poole that its net income for the first six months was $70,000.Any difference between cost and book value relates to subsidiary land.Poole uses the cost method to account for its investment in Smarte Company.

Required:

A.Prepare the journal entry made by Poole to record the sale of the 14,000 shares on July 1, 2014.

B.Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31, 2014.

C.Compute the amount of noncontrolling interest that would be reported on the consolidated balance sheet on December 31, 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Pizza Company purchased Salt Company common stock

Q6: Partner Company acquired 85% of the common

Q7: Parr Company owned 24,000 of the 30,000

Q9: Pratt Company purchased 40,000 shares of Silas

Q10: P Corporation purchased an 80% interest in

Q11: Which one of the following statements regarding

Q11: P Company purchased 96,000 shares of the

Q15: The computation of noncontrolling interest in net

Q21: If a subsidiary issues new shares of

Q24: The purchase by a subsidiary of some