Multiple Choice

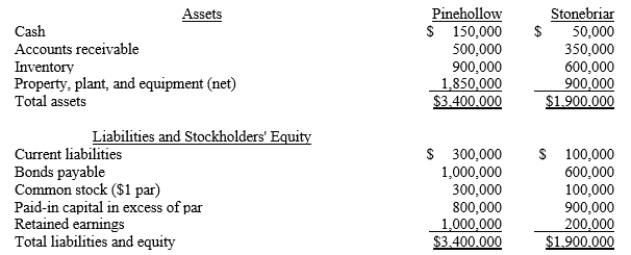

Pinehollow acquired all of the outstanding stock of Stonebriar by issuing 100,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:  The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. What is the amount of property, plant and equipment that will be included in the consolidated balance sheet immediately after the acquisition?

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. What is the amount of property, plant and equipment that will be included in the consolidated balance sheet immediately after the acquisition?

A) $2,570,000

B) $2,750,000

C) $2,850,000

D) $2,650,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Supernova Company had the following summarized balance

Q3: Paro Company purchased 80% of the voting

Q4: Which of the following statements about consolidation

Q5: Supernova Company had the following summarized balance

Q8: The SEC requires the use of push-down

Q8: Pagach Company purchased 100% of the voting

Q9: On December 31, 20X1, Parent Company purchased

Q10: Fortuna Company issued 70,000 shares of $1

Q11: The following consolidated financial statement was prepared

Q12: In an asset acquisition:<br>A)A consolidation must be