Multiple Choice

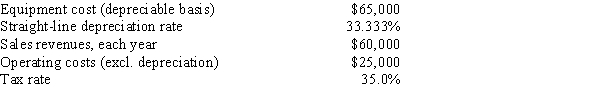

Clemson Software is considering a new project whose data are shown below.The required equipment has a 3-year tax life,after which it will be worthless,and it will be depreciated by the straight-line method over 3 years.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's Year 1 cash flow?

A) $28,115

B) $28,836

C) $29,575

D) $30,333

E) $31,092

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Desai Industries is analyzing an average-risk project,and

Q14: Foley Systems is considering a new investment

Q15: As a member of UA Corporation's financial

Q28: Which of the following statements is CORRECT?<br>A)

Q31: Since the focus of capital budgeting is

Q32: Although it is extremely difficult to make

Q52: Which one of the following would NOT

Q63: The relative risk of a proposed project

Q70: Replacement chain or EAA analysis is required

Q76: Rowell Company spent $3 million two years