Multiple Choice

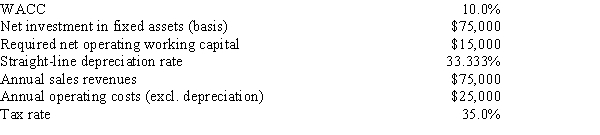

Foley Systems is considering a new investment whose data are shown below.The equipment would be depreciated on a straight-line basis over the project's 3-year life,would have a zero salvage value,and would require additional net operating working capital that would be recovered at the end of the project's life.Revenues and other operating costs are expected to be constant over the project's life.What is the project's NPV? (Hint: Cash flows from operations are constant in Years 1 to 3.)

A) $23,852

B) $25,045

C) $26,297

D) $27,612

E) $28,993

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Desai Industries is analyzing an average-risk project,and

Q10: Although the replacement chain approach is appealing

Q11: Clemson Software is considering a new project

Q15: As a member of UA Corporation's financial

Q25: Which of the following statements is CORRECT?<br>A)

Q31: Since the focus of capital budgeting is

Q32: Although it is extremely difficult to make

Q37: Sensitivity analysis measures a project's stand-alone risk

Q52: Which one of the following would NOT

Q63: The relative risk of a proposed project