Multiple Choice

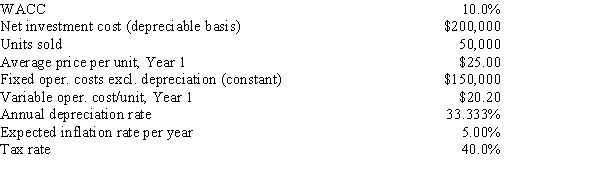

Desai Industries is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years,it will be depreciated on a straight-line basis,and there will be no salvage value.No change in net operating working capital would be required.This is just one of many projects for the firm,so any losses on this project can be used to offset gains on other firm projects.What is the project's expected NPV?

A) $15,925

B) $16,764

C) $17,646

D) $18,528

E) $19,455

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Clemson Software is considering a new project

Q14: Foley Systems is considering a new investment

Q15: As a member of UA Corporation's financial

Q24: The change in net operating working capital

Q28: Which of the following statements is CORRECT?<br>A)

Q31: Since the focus of capital budgeting is

Q52: Which one of the following would NOT

Q63: The relative risk of a proposed project

Q70: Replacement chain or EAA analysis is required

Q76: Rowell Company spent $3 million two years