Essay

PreBuild Manufacturing acquired 100% of Shoding Industries common stock on January 1,2014,for $670,000 when the book values of Shoding's assets and liabilities were equal to their fair values and Shoding's stockholders' equity consisted of $380,000 of Capital Stock and $290,000 of Retained Earnings.

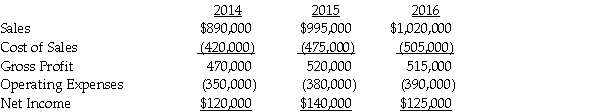

PreBuild's separate income (excluding investment income from Shoding)was $870,000,$830,000 and $960,000 in 2014,2015 and 2016,respectively.PreBuild sold inventory to Shoding during 2014 at a gross profit of $50,000 and 50% remained at Shoding at the end of the year.The remaining 50% was sold in 2015.At the end of 2015,PreBuild has $54,000 of inventory received from Shoding from a sale of $180,000 which cost Shoding $150,000.There are no unrealized profits in the inventory of PreBuild or Shoding at the end of 2016.PreBuild uses the equity method in its separate books.Select financial information for Shoding follows:

Required:

Prepare a schedule to determine PreBuild Manufacturing's Consolidated net income for 2014,2015,and 2016.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Use the following information to answer the

Q20: The material sale of inventory items by

Q23: A parent company regularly sells merchandise to

Q26: Proman Manufacturing owns a 90% interest in

Q28: Paulee Corporation paid $24,800 for an 80%

Q29: Peel Corporation acquired a 80% interest in

Q30: Perry Instruments International purchased 75% of the

Q32: Penguin Corporation acquired a 60% interest in

Q35: On January 1,2014,Paar Incorporated paid $38,500 for

Q39: Use the following information to answer the