Essay

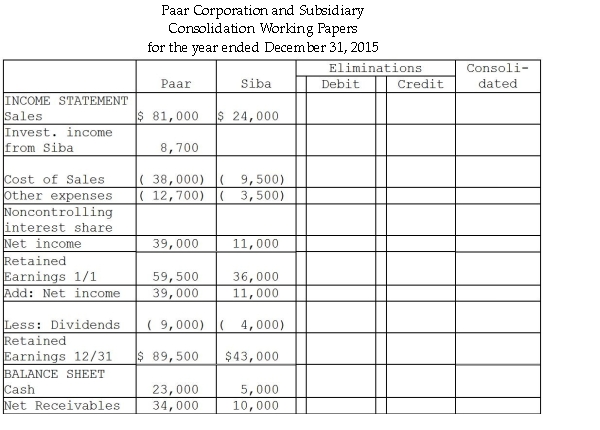

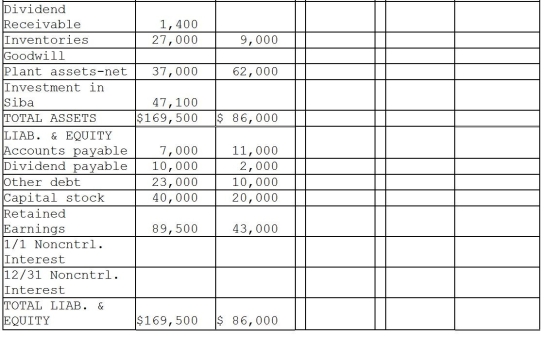

On January 1,2014,Paar Incorporated paid $38,500 for a 70% interest in Siba Enterprises,at a time when Siba's stockholder's equity consisted of $20,000 in Capital stock and $30,000 in Retained Earnings.The fair values of Siba's assets and liabilities equaled their recorded book values at that time,so any additional amount paid was attributed to goodwill.

In 2014,Siba purchased merchandise from Paar at a price of $6,000.The products originally cost Paar $4,000,and 75% of this merchandise remained in inventory at December 31,2014.This inventory was sold in 2015.Siba reported net income of $9,000 and paid dividends of $3,000 during 2014.

In 2015,Siba purchased merchandise from Paar at a price of $8,000.The products had a cost to Paar of $7,000,and 50% of this merchandise remained in inventory at December 31,2015.Siba still owed Paar $1,800 for these purchases at December 31,2015.

Required:

Financial statements of Paar and Siba appear in the first two columns of the partially completed working papers.Complete the consolidation working papers for Paar Corporation and Subsidiary for the year ended December 31,2015.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Use the following information to answer the

Q5: Use the following information to answer the

Q20: The material sale of inventory items by

Q29: Peel Corporation acquired a 80% interest in

Q30: Perry Instruments International purchased 75% of the

Q31: PreBuild Manufacturing acquired 100% of Shoding Industries

Q32: Penguin Corporation acquired a 60% interest in

Q32: Pirate Transport bought 80% of the outstanding

Q39: Use the following information to answer the

Q45: Use the following information to answer the