Essay

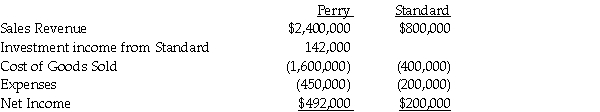

Perry Instruments International purchased 75% of the outstanding common stock of Standard Systems in 1997 when the book values and fair values of Standard's assets and liabilities were equal.The cost of Perry's investment was equal to 75% of the book value of Standard's net assets.Separate company income statements for Perry and Standard for the year ended December 31,2014 are summarized as follows:

During 2014,the companies began to manage their inventory differently,and worked together to keep their inventories low at each location.In doing so,they agreed to sell inventory to each other as needed at a markup of 10% of cost.Perry sold merchandise that cost $100,000 to Standard for $110,000,and Standard sold inventory that cost $80,000 to Perry for $88,000.Half of this merchandise remained in each company's inventory at December 31,2014.

Required:

Prepare a consolidated income statement for Perry Corporation and Subsidiary for 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Use the following information to answer the

Q23: A parent company regularly sells merchandise to

Q25: Pittle Corporation acquired a 80% interest in

Q26: Proman Manufacturing owns a 90% interest in

Q28: Paulee Corporation paid $24,800 for an 80%

Q29: Peel Corporation acquired a 80% interest in

Q31: PreBuild Manufacturing acquired 100% of Shoding Industries

Q32: Penguin Corporation acquired a 60% interest in

Q35: On January 1,2014,Paar Incorporated paid $38,500 for

Q39: Use the following information to answer the