Multiple Choice

Use the following information to answer the question(s) below.

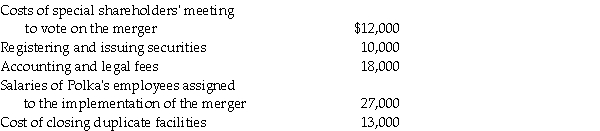

Polka Corporation exchanges 100,000 shares of newly issued $1 par value common stock with a fair market value of $20 per share for all of the outstanding $5 par value common stock of Spot Inc. and Spot is then dissolved. Polka paid the following costs and expenses related to the business combination:

-When considering an acquisition, which of the following is NOT a method by which one company may gain control of another company?

A) Purchase of the majority of outstanding voting stock of the acquired company.

B) Purchase of all assets and liabilities of another company.

C) Purchase all the outstanding voting stock of the acquired company.

D) All of the above methods result in a company gaining control over another company.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Picasso Co.issued 5,000 shares of its $1

Q10: Historically,much of the controversy concerning accounting requirements

Q22: Following the accounting concept of a business

Q27: Bigga Corporation purchased the net assets of

Q27: In reference to the FASB disclosure requirements

Q30: Pali Corporation exchanges 200,000 shares of newly

Q32: On January 2, 2013 Carolina Clothing issued

Q33: Saveed Corporation purchased the net assets of

Q36: On January 2, 2013, Pilates Inc. paid

Q37: A business merger differs from a business