Essay

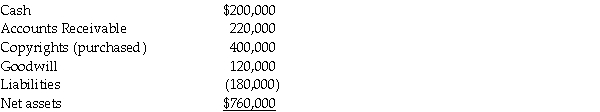

On January 2, 2013, Pilates Inc. paid $700,000 for all of the outstanding common stock of Spinning Company, and dissolved Spinning Company. The carrying values for Spinning Company's assets and liabilities are recorded below.

On January 2, 2013, Spinning anticipated collecting $185,000 of the recorded Accounts Receivable. Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own, and also unrecorded patents with a fair value of $100,000.

On January 2, 2013, Spinning anticipated collecting $185,000 of the recorded Accounts Receivable. Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own, and also unrecorded patents with a fair value of $100,000.

Required:

Calculate the amount of goodwill that will be recorded on Pilate's balance sheet as of the date of acquisition. Then record the journal entry Pilates would record on their books to record the acquisition.

Correct Answer:

Verified

Goodwill is calculated as follows:

Bec...

Bec...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Picasso Co.issued 5,000 shares of its $1

Q10: Historically,much of the controversy concerning accounting requirements

Q22: Following the accounting concept of a business

Q27: Bigga Corporation purchased the net assets of

Q27: In reference to the FASB disclosure requirements

Q30: Pali Corporation exchanges 200,000 shares of newly

Q32: On January 2, 2013 Carolina Clothing issued

Q33: Saveed Corporation purchased the net assets of

Q34: Use the following information to answer the

Q37: A business merger differs from a business