Essay

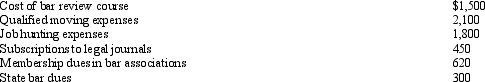

In the current year, Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year, her salary was only $32,100.In terms of deductions from AGI, how much does Bo have?

Since Bo worked just part of the year, her salary was only $32,100.In terms of deductions from AGI, how much does Bo have?

Correct Answer:

Verified

$770.AGI is $30,000 [$32,100 (salary) - ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Bill is employed as an auditor by

Q2: Match the statements that relate to each

Q3: Tom owns and operates a lawn maintenance

Q5: Joyce, age 39, and Sam, age 40,

Q6: Dave is the regional manager for a

Q7: Which, if any, of the following expenses

Q9: After graduating from college, Clint obtained employment

Q10: During the year, Peggy went from Nashville

Q11: Taylor performs services for Jonathan on a

Q47: Once set for a year, when might