Short Answer

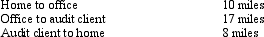

Bill is employed as an auditor by a CPA firm.On most days, he commutes by auto from his home to the office.During one month, however, he has an extensive audit assignment closer to home.For this engagement, Bill drives directly from home to the client's premises and back. Mileage information is summarized below:

If Bill spends 21 days on the audit, what is his deductible mileage?

If Bill spends 21 days on the audit, what is his deductible mileage?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Match the statements that relate to each

Q3: Tom owns and operates a lawn maintenance

Q4: In the current year, Bo accepted employment

Q5: Joyce, age 39, and Sam, age 40,

Q6: Dave is the regional manager for a

Q7: Which, if any, of the following expenses

Q9: After graduating from college, Clint obtained employment

Q10: During the year, Peggy went from Nashville

Q11: Taylor performs services for Jonathan on a

Q47: Once set for a year, when might