Multiple Choice

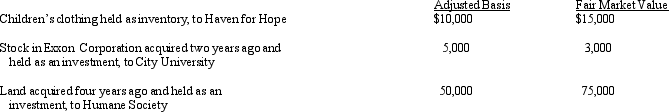

During the current year, Owl Corporation (a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations.  How much qualifies for the charitable contribution deduction?

How much qualifies for the charitable contribution deduction?

A) $63,000.

B) $65,000.

C) $90,500.

D) $92,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: An expense that is deducted in computing

Q21: Double taxation of corporate income results because

Q64: On December 28, 2012, the board of

Q66: On December 31, 2012, Peregrine Corporation, an

Q67: Black Corporation, an accrual basis taxpayer, was

Q68: Canary Corporation, an accrual method C corporation,

Q70: Compare the basic tax and nontax factors

Q73: Ostrich, a C corporation, has a net

Q89: In the current year,Oriole Corporation donated a

Q98: Copper Corporation owns stock in Bronze Corporation