Essay

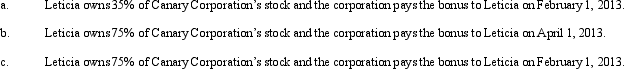

Canary Corporation, an accrual method C corporation, uses the calendar year for tax purposes. Leticia, a cash method taxpayer, is both a shareholder of Canary and the corporation's CFO. On December 31, 2012, Canary has accrued a $75,000 bonus to Leticia. Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Correct Answer:

Verified

Under § 267(a)(2), an accrual method tax...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: An expense that is deducted in computing

Q63: Eagle Corporation owns stock in Hawk Corporation

Q64: On December 28, 2012, the board of

Q66: On December 31, 2012, Peregrine Corporation, an

Q67: Black Corporation, an accrual basis taxpayer, was

Q69: During the current year, Owl Corporation (a

Q70: Compare the basic tax and nontax factors

Q73: Ostrich, a C corporation, has a net

Q89: In the current year,Oriole Corporation donated a

Q98: Copper Corporation owns stock in Bronze Corporation