Essay

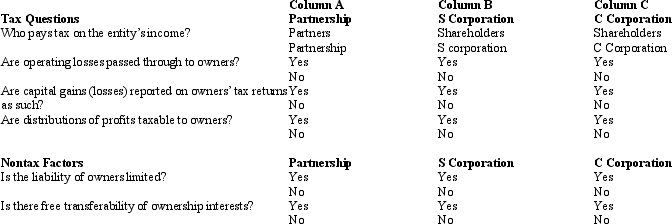

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C corporation. Circle the correct answers.

Correct Answer:

Verified

The correc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: An expense that is deducted in computing

Q21: Double taxation of corporate income results because

Q66: On December 31, 2012, Peregrine Corporation, an

Q67: Black Corporation, an accrual basis taxpayer, was

Q68: Canary Corporation, an accrual method C corporation,

Q69: During the current year, Owl Corporation (a

Q73: Ostrich, a C corporation, has a net

Q75: Jade Corporation, a C corporation, had $100,000

Q89: In the current year,Oriole Corporation donated a

Q98: Copper Corporation owns stock in Bronze Corporation