Multiple Choice

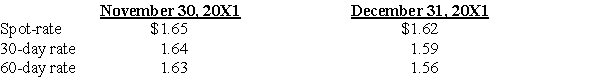

Hunt Co.purchased merchandise for 300,000 British pounds from a vendor in London on November 30,20X1.Payment in British pounds was due on January 30,20X2.The exchange rates to purchase one pound were as follows:

In its December 31,Year One,income statement,what amount should Hunt report as foreign exchange gain?

A) $9,000

B) $12,000

C) $6,000

D) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Company X denominated a December 1,20X9,purchase of

Q35: On December 5,20X8,Texas based Imperial Corporation purchased

Q42: Robert Company sold inventory to an Australian

Q61: On December 1, 20X8, Winston Corporation acquired

Q62: Spiralling crude oil prices prompted AMAR Company

Q64: On December 1, 20X8, Winston Corporation acquired

Q65: On December 5, 20X8, Texas based Imperial

Q67: Taste Bits Inc. purchased chocolates from Switzerland

Q69: Levin company entered into a forward contract

Q70: On September 3,20X8,Jackson Corporation purchases goods for