Multiple Choice

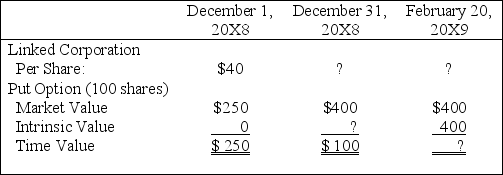

On December 1, 20X8, Winston Corporation acquired 100 shares of Linked Corporation at a cost of $40 per share. Winston classifies them as available-for-sale securities. On this same date, it decides to hedge against a possible decline in the value of the securities by purchasing, at a cost of $250, an at-the-money put option to sell the 100 shares at $40 per share. The option expires on February 20, 20X9. Selected information concerning the fair values of the investment and the options follow:

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

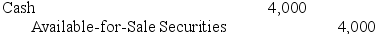

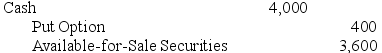

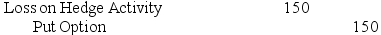

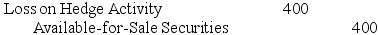

-Based on the preceding information,which of the following journal entries will be made on February 20,20X9?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q35: On December 5,20X8,Texas based Imperial Corporation purchased

Q42: Robert Company sold inventory to an Australian

Q59: Heavy Company sold metal scrap to a

Q60: Taste Bits Inc. purchased chocolates from Switzerland

Q61: On December 1, 20X8, Winston Corporation acquired

Q62: Spiralling crude oil prices prompted AMAR Company

Q65: On December 5, 20X8, Texas based Imperial

Q66: Hunt Co.purchased merchandise for 300,000 British pounds

Q67: Taste Bits Inc. purchased chocolates from Switzerland

Q69: Levin company entered into a forward contract