REFERENCE: Ref.03_01 On January 1,2009,Cale Corp.paid $1,020,000 to Acquire Kaltop Co.Kaltop Maintained

Multiple Choice

REFERENCE: Ref.03_01

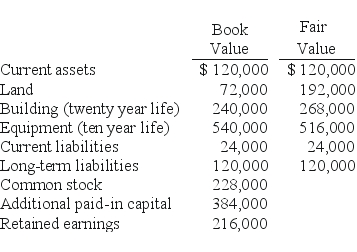

On January 1,2009,Cale Corp.paid $1,020,000 to acquire Kaltop Co.Kaltop maintained separate incorporation.Cale used the equity method to account for the investment.The following information is available for Kaltop's assets,liabilities,and stockholders' equity accounts:

SHAPE \* MERGEFORMAT

Kaltop earned net income for 2009 of $126,000 and paid dividends of $48,000 during the year.

Kaltop earned net income for 2009 of $126,000 and paid dividends of $48,000 during the year.

-If Cale Corp.had net income of $444,000,exclusive of the investment,what is the amount of consolidated net income?

A) $568,400.

B) $570,000.

C) $571,000.

D) $566,400.

E) $444,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q50: From which methods can a parent choose

Q69: All of the following are acceptable methods

Q97: Kaye Company acquired 100% of Fiore Company

Q112: REFERENCE: Ref.03_14<br>Jaynes Inc.obtained all of Aaron Co.'s

Q116: REFERENCE: Ref.03_15<br>Utah Inc.obtained all of the outstanding

Q117: On January 1,2009,Jumper Co.acquired all of the

Q118: REFERENCE: Ref.03_08<br>Goehler,Inc.acquires all of the voting stock

Q120: REFERENCE: Ref.03_06<br>Kaye Company acquired 100% of Fiore

Q121: REFERENCE: Ref.03_14<br>Jaynes Inc.obtained all of Aaron Co.'s

Q122: When a company applies the initial method