Multiple Choice

REFERENCE: Ref.03_06

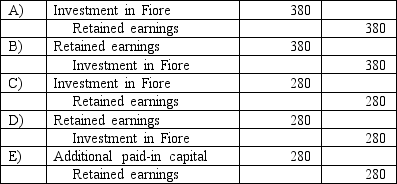

Kaye Company acquired 100% of Fiore Company on January 1,2009.Kaye paid $1,000 excess consideration over book value which is being amortized at $20 per year.Fiore reported net income of $400 in 2009 and paid dividends of $100.

-Assume the initial value method is used.In the years subsequent to acquisition,what additional worksheet entry must be made for consolidation purposes that is not required for the equity method?

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) Entry E.

Correct Answer:

Verified

Correct Answer:

Verified

Q50: From which methods can a parent choose

Q69: All of the following are acceptable methods

Q97: Kaye Company acquired 100% of Fiore Company

Q112: REFERENCE: Ref.03_14<br>Jaynes Inc.obtained all of Aaron Co.'s

Q116: REFERENCE: Ref.03_15<br>Utah Inc.obtained all of the outstanding

Q117: On January 1,2009,Jumper Co.acquired all of the

Q118: REFERENCE: Ref.03_08<br>Goehler,Inc.acquires all of the voting stock

Q119: REFERENCE: Ref.03_01<br>On January 1,2009,Cale Corp.paid $1,020,000 to

Q121: REFERENCE: Ref.03_14<br>Jaynes Inc.obtained all of Aaron Co.'s

Q122: When a company applies the initial method