Essay

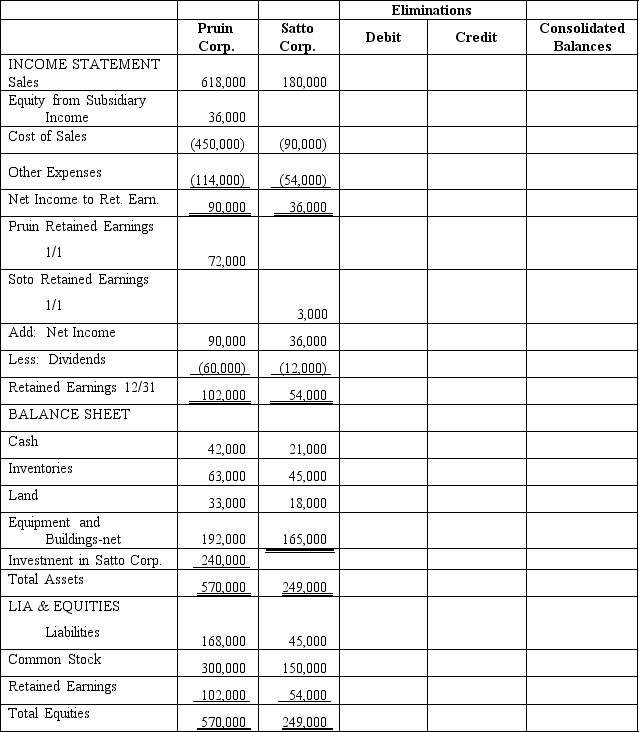

Pruin Corporation acquired all of the voting stock of Satto Corporation on January 1,2016,for $210,000 when Satto had common stock of $150,000 and retained earnings of $24,000.The excess of implied over book value was allocated $9,000 to inventories that were sold in 2016,$12,000 to equipment with a 4-year remaining useful life under the straight-line method,and the remainder to goodwill.

Financial statements for Pruitt and Satto Corporations at the end of the fiscal year ended December 31,2017 (two years after acquisition),appear in the first two columns of the partially completed consolidated statements workpaper.Pruin Corp.has accounted for its investment in Satto using the partial equity method of accounting.

Required:

Complete the consolidated statements workpaper for Pruin Corporation and Satto Corporation for December 31,2017.

Pruin Corporation and Satto Corporation

Consolidated Statements Workpaper

at December 31,2017

Correct Answer:

Verified

Pruin Corporation and Satto Co...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: The excess of fair value over implied

Q14: Pinta Company acquired an 80% interest in

Q17: The entry to amortize the amount of

Q23: Goodwill represents the excess of the implied

Q26: On January 1,2016,Phoenix Company acquired 80% of

Q27: On January 1,2016,Preston Corporation acquired an 80%

Q29: On January 1,2016,Poole Company purchased 75% of

Q30: Pullman Corporation acquired a 90% interest in

Q31: The SEC requires the use of push

Q35: When the value implied by the purchase