Multiple Choice

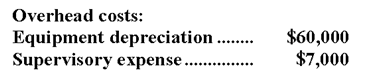

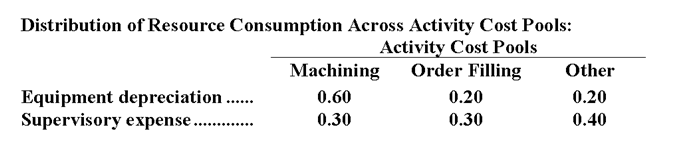

Laningham Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs-equipment depreciation and supervisory expense-are allocated to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption. Data to perform these allocations appear below:

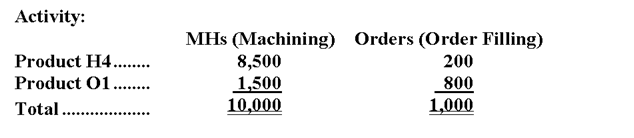

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

-How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

A) $2,100

B) $38,100

C) $36,000

D) $14,800

Correct Answer:

Verified

Correct Answer:

Verified

Q100: The following data have been provided

Q101: Even departmental overhead rates will not correctly

Q102: Would the following activities at a manufacturer

Q103: Sibble Corporation uses activity-based costing to assign

Q104: Andujo Company allocates materials handling cost to

Q106: Yentzer Corporation has an activity-based costing system

Q107: Pressler Corporation's activity-based costing system has three

Q108: Kozloff Wedding Fantasy Company makes very elaborate

Q109: Dykema Corporation uses activity-based costing to compute

Q110: Traughber Corporation uses an activity based costing