Essay

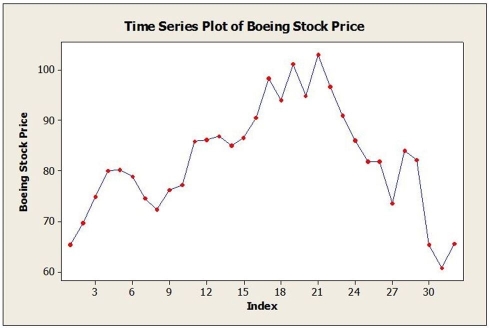

Monthly closing stock prices, adjusted for dividends, were obtained for Boeing Corporation from January 2006 through August 2008 (closing price on the first trading day of the month). The time series graph of these data is shown below.  a. Below are the results of fitting a third-order autoregressive model, AR (3). Write out the model. Are the second and third lagged values significant? Explain.

a. Below are the results of fitting a third-order autoregressive model, AR (3). Write out the model. Are the second and third lagged values significant? Explain.

Final Estimates of Parameters

Type Coef SE Coef T P

Lag 1 0.9247 0.1898 4.87 0.000

Lag 2 0.0429 0.2603 0.16 0.870

Lag 3 -0.0764 0.1959 -0.39 0.699

Constant 8.362 1.223 6.84 0.000

b. Below are the results of fitting a first-order autoregressive model, AR (1). Write out the model. Is this model typical for stock price data? Explain.

Final Estimates of Parameters

Type Coef SE Coef T P

Lag 1 0.9098 0.0969 9.39 0.000

Constant 6.835 1.207 5.67 0.000

Correct Answer:

Verified

Let Boeing stock price be dependent vari...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: A company has recorded annual sales (in

Q7: Annual estimates of the population in the

Q8: Annual estimates of the population in a

Q9: Consider the following to answer the question(s)

Q10: Consider the following to answer the question(s)

Q12: Consider the following to answer the question(s)

Q13: The MSE for the forecasting method used

Q14: A large automobile parts supplier keeps track

Q15: Quarterly sales data (in $10,000) for a

Q16: Consider the following to answer the question(s)