Exam 24: Events Occurring After Balance Sheet Date

Exam 1: An Overview of the Australian External Reporting Environment50 Questions

Exam 2: The Conceptual Framework of Accounting and Its Relevance to Financ62 Questions

Exam 3: Theories of Financial Accounting61 Questions

Exam 4: An Overview of Accounting for Assets62 Questions

Exam 5: Depreciation of Property, Plant and Equipment62 Questions

Exam 6: Revaluation and Impairment Testing of Non-Current Assets59 Questions

Exam 7: Inventory60 Questions

Exam 8: Accounting for Intangibles63 Questions

Exam 9: Accounting for Heritage Assets and Biological Assets61 Questions

Exam 10: An Overview of Accounting for Liabilities58 Questions

Exam 11: Accounting for Lease66 Questions

Exam 12: Set-Off and Extinguishment of Debt47 Questions

Exam 13: Accounting for Employee Benefits67 Questions

Exam 15: Accounting for Financial Instruments72 Questions

Exam 16: Revenue Recognition Issues64 Questions

Exam 17: The Statement of Comprehensive Income and Statement of Changes in E62 Questions

Exam 19: Accounting for Income Taxes65 Questions

Exam 20: Cash-Flow Statements60 Questions

Exam 21: Accounting for the Extractive Industries60 Questions

Exam 22: Accounting for General Insurance Contracts58 Questions

Exam 23: Accounting for Superannuation Plans62 Questions

Exam 24: Events Occurring After Balance Sheet Date62 Questions

Exam 25: Segment Reporting61 Questions

Exam 26: Related-Party Disclosures60 Questions

Exam 28: Accounting for Group Structures69 Questions

Exam 29: Further Consolidation Issues I: Accounting for Intragroup Transact46 Questions

Exam 30: Further Consolidation Issues Ii: Accounting for Minority Interests34 Questions

Exam 31: Further Consolidation Issues Iii: Accounting for Indirect Ownershi38 Questions

Exam 32: Further Consolidation Issues Iv: Accounting for Changes in the Deg39 Questions

Exam 33: Accounting for Equity Investments67 Questions

Exam 33: Accounting for Equity Investments59 Questions

Exam 35: Accounting for Foreign Currency Transactions59 Questions

Exam 36: Translation of the Accounts of Foreign Operations42 Questions

Exam 37: Accounting for Corporate Social Responsibility59 Questions

Select questions type

Dividends declared after reporting date but before the authorisation for issue of the financial report do not meet the criteria of the present obligation because the identity of the shareholders is unknown until the date of payment.

(True/False)

4.9/5  (36)

(36)

Gowanland Co Ltd is being sued over damage to farmland as a result of an accident in which poisonous chemicals were mixed with fertiliser. At reporting date there was no information about the court decision and a contingent liability had been disclosed. Subsequent to the reporting date, the court handed down its decision and upheld a substantial claim for damages. According to AASB 110 how should this event be treated in the financial statements?

(Multiple Choice)

4.7/5  (37)

(37)

Dividends declared after the reporting period but before the authorization for issue of the financial report are typically recognized as a liability.

(True/False)

4.9/5  (42)

(42)

AASB 110 specifies that adjusting events should be considered against two criteria to determine their treatment. The two criteria are:

(Multiple Choice)

4.7/5  (37)

(37)

The requirements of AASB 110 for additional disclosures in the face of going-concern difficulties revealed after balance sheet date have been argued to be so extensive that they add financial pressure to a business already in financial distress:

(True/False)

4.8/5  (38)

(38)

AASB 110 requires the financial statements to be restated to a liquidation basis and for extensive additional disclosures to be made when a change in going-concern status occurs after reporting date:

(True/False)

4.8/5  (39)

(39)

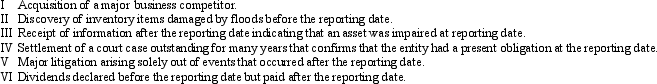

Question 64: The following are material events that occurred for Hervey Bay Ltd between the reporting date and the date when the financial report is authorized for issue.

Which of the following options identify all the adjusting events for Hervey Bay Ltd, in accordance with AASB 110 "Events after the reporting date"?

Which of the following options identify all the adjusting events for Hervey Bay Ltd, in accordance with AASB 110 "Events after the reporting date"?

(Multiple Choice)

4.8/5  (33)

(33)

Wattle Ltd is in the process of completing its financial reports for the period ended 30 June 2009 when its accountant completes the collection of information about the realisable value of inventory as at reporting date. A number of items are reflected at a cost greater than net realisable value with a material effect on the accounts. What treatment does AASB 110 require for this event?

(Multiple Choice)

4.9/5  (37)

(37)

The Directors' Declaration includes a statement that the entity can pay its debts as they fall due:

(True/False)

4.9/5  (41)

(41)

In AASB 110 "Events after the Balance Sheet Date", a contingent liability is an example of an adjusting event:

(True/False)

4.9/5  (40)

(40)

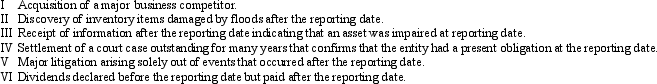

The following are material events that occurred for Fraser Island Ltd between the reporting date and the date when the financial report is authorized for issue.

Which of the following options identify all the non-adjusting events for Fraser Island Ltd, in accordance with AASB 110 "Events after the reporting date"?

Which of the following options identify all the non-adjusting events for Fraser Island Ltd, in accordance with AASB 110 "Events after the reporting date"?

(Multiple Choice)

4.9/5  (36)

(36)

AASB 110 requires that adjusting events that meet two broad criteria should be:

(Multiple Choice)

4.8/5  (40)

(40)

In general a subsequent event is one that occurs, or the occurrence of which becomes known, after the reporting date:

(True/False)

4.8/5  (30)

(30)

The period covered by AASB 110 "Events occurring after balance sheet date" is from?

(Multiple Choice)

4.9/5  (38)

(38)

Cavalier Co Ltd is being sued for negligence in manufacturing a piece of equipment that has allegedly resulted in injury to an employee of the claimant business. The accident occurred after reporting date, but Cavalier has settled quickly so the outcome is now known before the authorisation date of the financial statements. The settlement is for a material amount. How should this transaction be recorded in the financial statements according to AASB 110?

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following statements is incorrect with respect to AASB 110 "Events after the reporting date"?

(Multiple Choice)

4.9/5  (33)

(33)

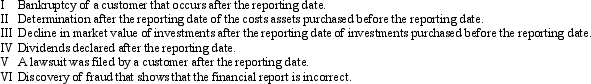

The following are material events that occurred for Virgil Ltd between the reporting date and the date when the financial report is authorized for issue.

Which of the following options identify all the non-adjusting events for Virgil Ltd, in accordance with AASB 110 "Events after the reporting date"?

Which of the following options identify all the non-adjusting events for Virgil Ltd, in accordance with AASB 110 "Events after the reporting date"?

(Multiple Choice)

4.9/5  (38)

(38)

The disclosures AASB 110 requires for a material non-adjusting event include:

(Multiple Choice)

4.7/5  (34)

(34)

After the auditor has signed the audit report the next step in the process is to:

(Multiple Choice)

4.8/5  (35)

(35)

Showing 21 - 40 of 62

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)