Exam 4: Activity-Based Management and Activity-Based Costing

Exam 1: Introduction to Cost Accounting98 Questions

Exam 2: Cost Terminology and Cost Behaviors127 Questions

Exam 3: Predetermined Overhead Rates, flexible Budgets, and Absorptionvariable Costing199 Questions

Exam 4: Activity-Based Management and Activity-Based Costing176 Questions

Exam 5: Job Order Costing178 Questions

Exam 6: Process Costing213 Questions

Exam 7: Standard Costing and Variance Analysis220 Questions

Exam 8: The Master Budget150 Questions

Exam 9: Break-Even Point and Cost-Volume-Profit Analysis119 Questions

Exam 10: Relevant Information for Decision Making144 Questions

Exam 11: Allocation of Joint Costs and Accounting for By-Products131 Questions

Exam 12: Introduction to Cost Management Systems100 Questions

Exam 13: Responsibility Accounting, support Department Allocations, and Transfer Pricing175 Questions

Exam 14: Performance Measurement, balanced Scorecards, and Performance Rewards192 Questions

Exam 15: Capital Budgeting183 Questions

Exam 16: Managing Costs and Uncertainty101 Questions

Exam 17: Implementing Quality Concepts108 Questions

Exam 18: Inventory and Production Management165 Questions

Exam 19: Emerging Management Practices69 Questions

Select questions type

For a company that manufactures candy,how would the cost of sugar be classified?

(Multiple Choice)

4.9/5  (37)

(37)

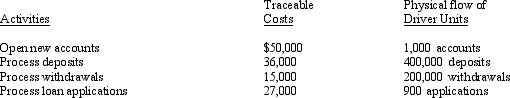

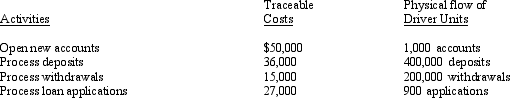

Ada National Bank Ada National Bank had the following activities,traceable costs,and

Physical flow of driver units:

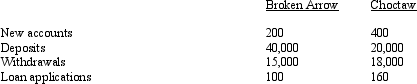

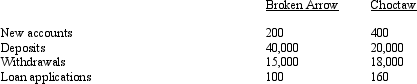

The above activities are used by the Broken Arrow branch and the Choctaw branch:

The above activities are used by the Broken Arrow branch and the Choctaw branch:

Refer to Ada National Bank.What is the cost per driver unit for the loan application activity?

Refer to Ada National Bank.What is the cost per driver unit for the loan application activity?

(Multiple Choice)

5.0/5  (37)

(37)

Ada National Bank Ada National Bank had the following activities,traceable costs,and

Physical flow of driver units:

The above activities are used by the Broken Arrow branch and the Choctaw branch:

The above activities are used by the Broken Arrow branch and the Choctaw branch:

Refer to Ada National Bank.What is the cost per driver unit for new account activity?

Refer to Ada National Bank.What is the cost per driver unit for new account activity?

(Multiple Choice)

4.8/5  (35)

(35)

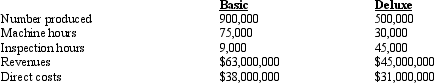

Office Innovations Corporation produces two types of electronic data organizers: basic and deluxe.The following information about the production process is available:

Total factory overhead is $10,000,000.Of this overhead,$4,000,000 is related to utilities and the remainder is related to quality control.

a.Determine the total overhead cost assigned to each type of data organizer using machine hours as the allocation base.Calculate the gross profit per unit for each product.

b.Determine the total overhead cost assigned to each type of data organizer if overhead is assigned using allocation bases appropriate to the overhead costs.Calculate the gross profit per unit of each product.

c.Explain why the unit cost for each model is different between the two methods of allocation.

Total factory overhead is $10,000,000.Of this overhead,$4,000,000 is related to utilities and the remainder is related to quality control.

a.Determine the total overhead cost assigned to each type of data organizer using machine hours as the allocation base.Calculate the gross profit per unit for each product.

b.Determine the total overhead cost assigned to each type of data organizer if overhead is assigned using allocation bases appropriate to the overhead costs.Calculate the gross profit per unit of each product.

c.Explain why the unit cost for each model is different between the two methods of allocation.

(Essay)

5.0/5  (46)

(46)

When non-value added time is greater,manufacturing cycle efficiency is higher.

(True/False)

4.8/5  (31)

(31)

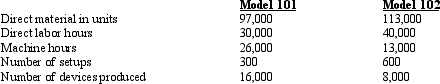

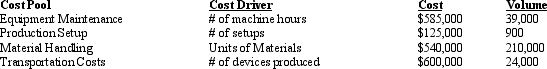

Seattle Grace Corporation manufactures two models of a medical device: Model 101 and Model 102.

Below is the current year production data for the company:

The 210,000 units of material had a total cost of $1,365,000.Direct labor is $17 per hour.

The company has total overhead production costs of $1,850,000.

a.If Seattle Grace Corporation applies factory overhead using direct labor hours,compute the total production cost and the unit cost for each model

b.If Seattle Grace Corporation applies factory overhead using machine hours,compute the total production cost and the unit cost for each model.

c.Assume that Seattle Grace Corporation has established the following activity centers,costs drivers,and costs to apply factory overhead.

The 210,000 units of material had a total cost of $1,365,000.Direct labor is $17 per hour.

The company has total overhead production costs of $1,850,000.

a.If Seattle Grace Corporation applies factory overhead using direct labor hours,compute the total production cost and the unit cost for each model

b.If Seattle Grace Corporation applies factory overhead using machine hours,compute the total production cost and the unit cost for each model.

c.Assume that Seattle Grace Corporation has established the following activity centers,costs drivers,and costs to apply factory overhead.

Compute the total cost and the unit cost for each model.

d.Explain why the unit cost for each model is different across the three methods of overhead application.How can such information benefit an organization?

Compute the total cost and the unit cost for each model.

d.Explain why the unit cost for each model is different across the three methods of overhead application.How can such information benefit an organization?

(Essay)

4.9/5  (35)

(35)

Activity-based costing and generally accepted accounting principles differ in that ABC

(Multiple Choice)

4.9/5  (36)

(36)

For one product that a firm produces,the manufacturing cycle efficiency is 25 percent.If the total production time is 10 hours,what is the total manufacturing time?

(Multiple Choice)

4.7/5  (30)

(30)

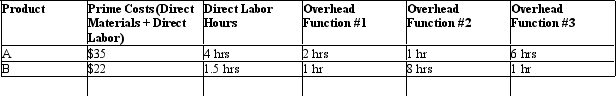

Levine Company Levine Company produces two products: A and BThe company has three overhead functions that are required for both products.

Below is production information for Products A and B:

The company produces 800 units of Product A and 8,000 units of Product B each period.

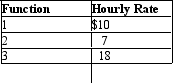

The overhead functions have the following hourly costs:

The company produces 800 units of Product A and 8,000 units of Product B each period.

The overhead functions have the following hourly costs:

Refer to Levine Company If total overhead is assigned to A and B on the basis of direct labor hours,Product A will have an overhead cost per unit of

Refer to Levine Company If total overhead is assigned to A and B on the basis of direct labor hours,Product A will have an overhead cost per unit of

(Multiple Choice)

4.9/5  (32)

(32)

For one product that a firm produces,the manufacturing cycle efficiency is 20 percent.If the total production time is 12 hours,what is the total manufacturing time?

(Multiple Choice)

4.9/5  (36)

(36)

In allocating fixed costs to products in activity-based costing,

(Multiple Choice)

4.9/5  (37)

(37)

An activity that does not increase the value of a product for a customer is referred to as a _________________________ activity.

(Short Answer)

4.9/5  (34)

(34)

When a firm redesigns a product to reduce the number of component parts,the firm is

(Multiple Choice)

4.9/5  (31)

(31)

In the pharmaceutical or food industries,quality control inspections would most likely be viewed as

(Multiple Choice)

4.9/5  (30)

(30)

Building depreciation is generally considered an organizational or facility cost.

(True/False)

4.9/5  (40)

(40)

Business value-added activities increase the value of a product without increasing production time.

(True/False)

4.9/5  (49)

(49)

Relative to traditional product costing,activity-based costing differs in the way costs are

(Multiple Choice)

4.9/5  (44)

(44)

Showing 21 - 40 of 176

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)