Exam 7: Special Issues in Accounting for an Investment in a Subsidiary

Exam 1: Business Combinations: New Rules for a Long-Standing Business Practice32 Questions

Exam 2: Consolidated Statements: Date of Acquisition29 Questions

Exam 3: Consolidated Statements: Subsequent to Acquisition30 Questions

Exam 4: Intercompany Transactions: Merchandise, Plant Assets, and Notes29 Questions

Exam 5: Intercompany Transactions: Bonds and Leases54 Questions

Exam 6: Cash Flow, Eps, and Taxation44 Questions

Exam 7: Special Issues in Accounting for an Investment in a Subsidiary35 Questions

Exam 8: Subsidiary Equity Transactions; Indirect and Mutual Holdings36 Questions

Exam 9: The International Accounting Environment28 Questions

Exam 10: Foreign Currency Transactions61 Questions

Exam 11: Translation of Foreign Financial Statements62 Questions

Exam 12: Interim Reporting and Disclosures About Segments of an Enterprise50 Questions

Exam 13: Partnerships: Characteristics, Formation, and Accounting for Activities32 Questions

Exam 14: Partnerships: Ownership Changes and Liquidations48 Questions

Exam 15: Governmental Accounting: the General Fund and the Account Groups53 Questions

Exam 16: Governmental Accounting: Other Governmental Funds, Proprietary Funds, and Fiduciary Funds43 Questions

Exam 17: Financial Reporting Issues29 Questions

Exam 18: Accounting for Private Not-For-Profit Organizations45 Questions

Exam 19: Accounting for Not-For-Profit Colleges and Universities and Health Care Organizations64 Questions

Exam 20: Estates and Trusts: Their Nature and the Accountants Role46 Questions

Exam 21: Debt Restructuring, Corporate Reorganizations, and Liquidations44 Questions

Select questions type

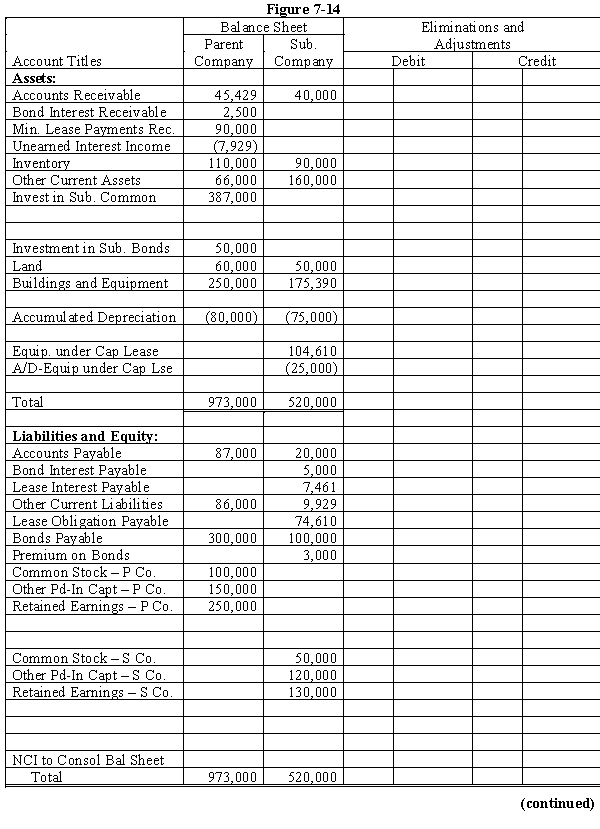

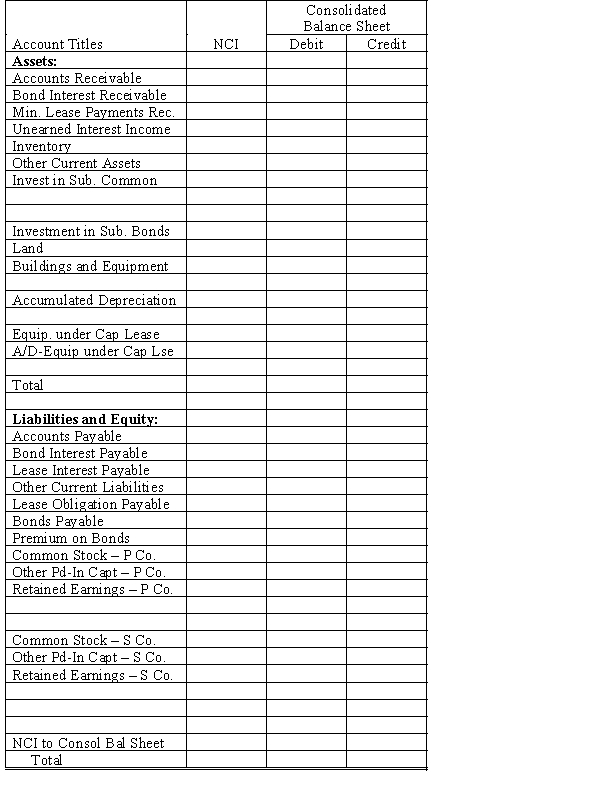

On January 1, 20X1, Parent Company acquired 90% of the common stock of Subsidiary Company for $360,000. On this date, Subsidiary had total owners' equity of $270,000, including retained earnings of $100,000.

On January 1, 20X1, any excess of cost over book value is due to the undervaluation of land, building, and goodwill. Land is worth $10,000 more than cost. Building is worth $50,000 more than book value, has a remaining life of 10 years, and is depreciated using the straight-line method.

During 20X1 and 20X2, Parent accounted for its investment in Subsidiary using the simple equity method.

During 20X2, Subsidiary sold merchandise to Parent for $50,000, of which $10,000 is held by Parent on December 31, 20X2. Subsidiary's gross profit on sales is 40%. On December 31, 20X2, Parent still owes Subsidiary $7,000 for merchandise acquired in December.

On July 1, 20X0, Subsidiary sold $100,000 par value of 10%, 10-year bonds for $104,000. The bonds pay interest semiannually on January 1 and July 1. Straight-line amortization of premium is used. On January 1, 20X2, Parent repurchased one-half of the bonds at par.

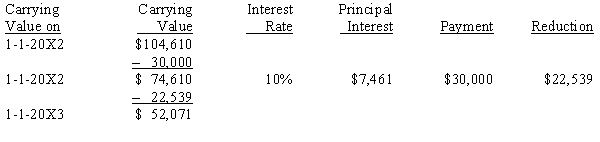

On January 1, 20X2, Parent purchased equipment for $104,610 and immediately leased the equipment to Subsidiary on a 4-year lease. The minimum lease payments of $30,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments. The implicit interest rate is 10%. The useful life of the equipment is 4 years. The lease has been capitalized by both companies. Subsidiary is depreciating the equipment using the straight-line method and assuming a salvage value of $4,610.

A partial lease amortization schedule, applicable to either company, is presented below:

Required:

Prepare a determination and distribution of excess schedule. Next, complete the Figure 7-14 worksheet for a consolidated balance sheet as of December 31, 20X2. Round all computations to the nearest dollar.

Required:

Prepare a determination and distribution of excess schedule. Next, complete the Figure 7-14 worksheet for a consolidated balance sheet as of December 31, 20X2. Round all computations to the nearest dollar.

(Essay)

4.7/5  (32)

(32)

Plant company owns 80% of the common stock of Surf Company. Surf Company also has outstanding preferred stock. Plant Company owned none of the preferred stock prior to January 1, 20X5. Plant Company purchased 100% of the outstanding preferred stock on January 1, 20X5, at a price in excess of book value. The result of this transaction with regard to the consolidated statements is that

(Multiple Choice)

4.9/5  (46)

(46)

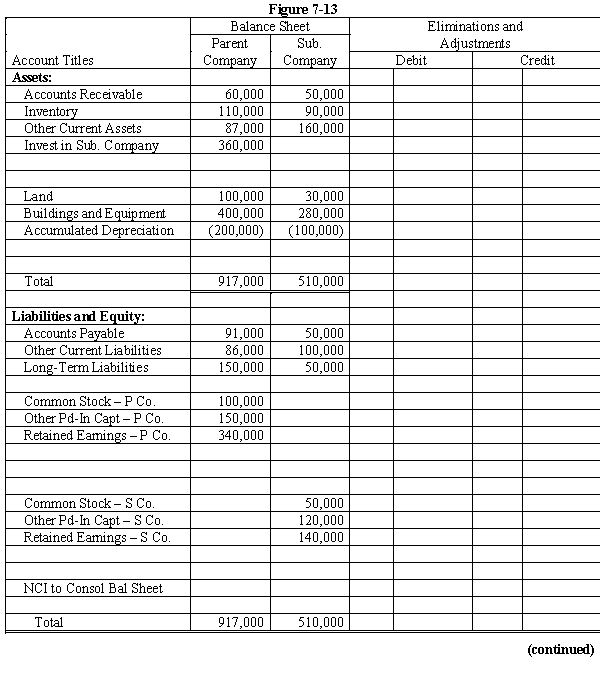

On January 1, 20X1, Parent Company acquired 90% of the common stock of Subsidiary Company for $360,000. On this date, Subsidiary had total owners' equity of $270,000, including retained earnings of $100,000.

On January 1, 20X1, any excess of cost over book value is attributable to the undervaluation of land, building, and goodwill. Land is worth $20,000 more than cost. Building is worth $60,000 more than book value. It has a remaining useful life of 6 years and is depreciated using the straight-line method.

During 20X1, Parent has accounted for its investment in Subsidiary using the cost method.

During 20X1, Subsidiary sold merchandise to Parent for $70,000, of which $20,000 is held by Parent on December 31, 20X1. Subsidiary's usual gross profit on affiliated sales is 50%.

On December 31, 20X1, Parent still owes Subsidiary $5,000 for merchandise acquired in December.

On July 1, 20X1, Parent sold to Subsidiary some equipment with a cost of $40,000 and a book value of $18,000. The sales price was $30,000. Subsidiary is depreciating the equipment over a 4-year life, assuming no salvage value and using the straight-line method.

Required:

Prepare a determination and distribution of excess schedule. Next, complete the Figure 7-13 worksheet for a consolidated balance sheet as of December 31, 20X1.

(Essay)

4.9/5  (36)

(36)

A parent company owns a 90% interest in a subsidiary at the start of the year and during the year sells a 10% interest to reduce its ownership percentage to 80%. The most popular view of the transaction under current consolidations theory is that

(Multiple Choice)

4.9/5  (32)

(32)

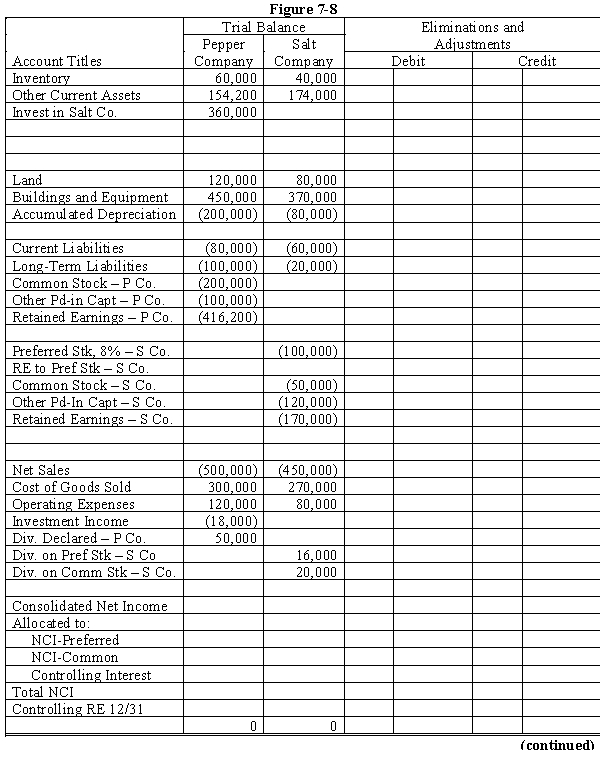

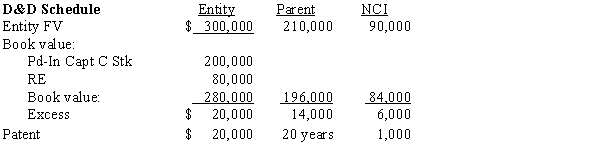

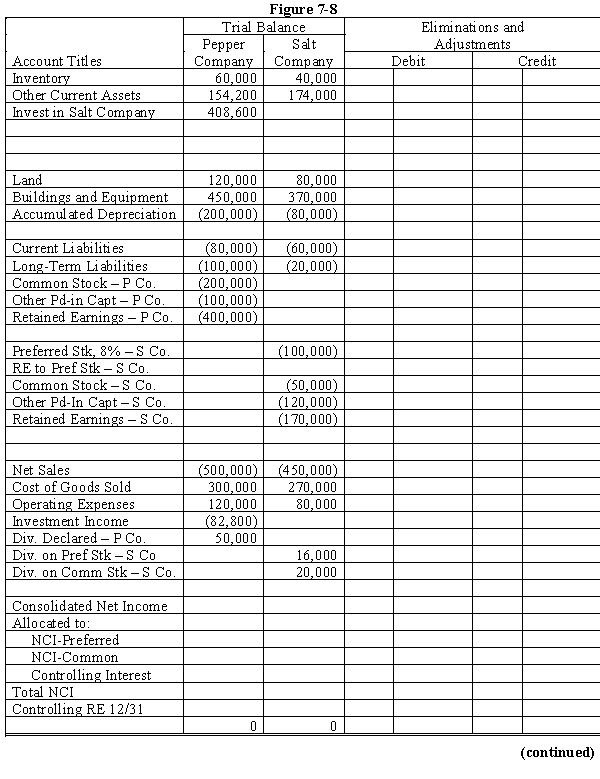

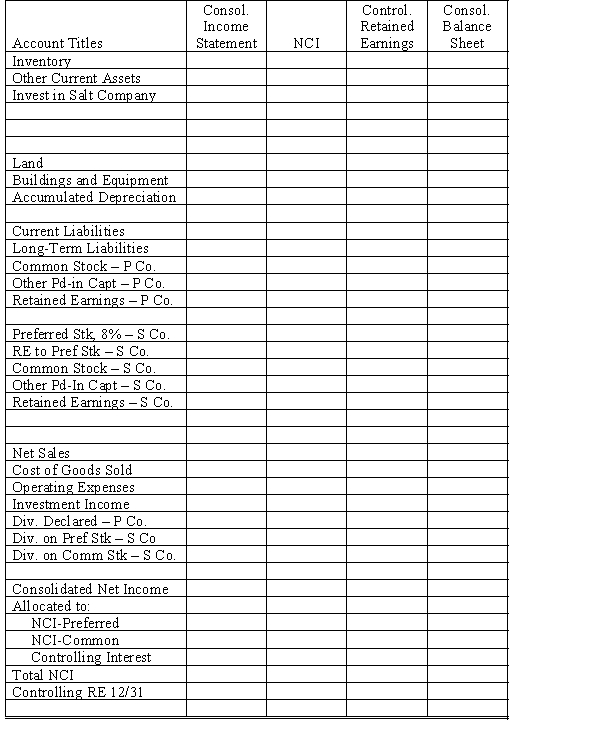

On January 1, 20X1, Pepper Company purchased 90% of the common stock of Salt Company for $360,000 when Salt had total shareholders' equity as follows:

8\% Preferred Stock, \ 100 par \ 100,000 Common Stock, \ 10 par 50,000 Other Paid-in Capital 120,000 Retained Earnings \ 180,000 Total \ 450,000 Any excess of cost over book value on this date is attributed to a patent, to be amortized over 10 years. The 8% preferred stock is cumulative, non-participating, and has a liquidating value of par plus dividends in arrears. There were no preferred dividends in arrears on January 1, 20X1. Pepper elected to account for its investment in Salt using the cost method.

During 20X1, Salt had a net loss of $10,000 and paid no dividends. In 20X2, Salt had net income of $100,000 and paid dividends totaling $36,000.

During 20X2, Salt sold merchandise to Pepper for $40,000, of which $20,000 is still held by Pepper on December 31, 20X2. Salt's usual gross profit is 40%.

Required:

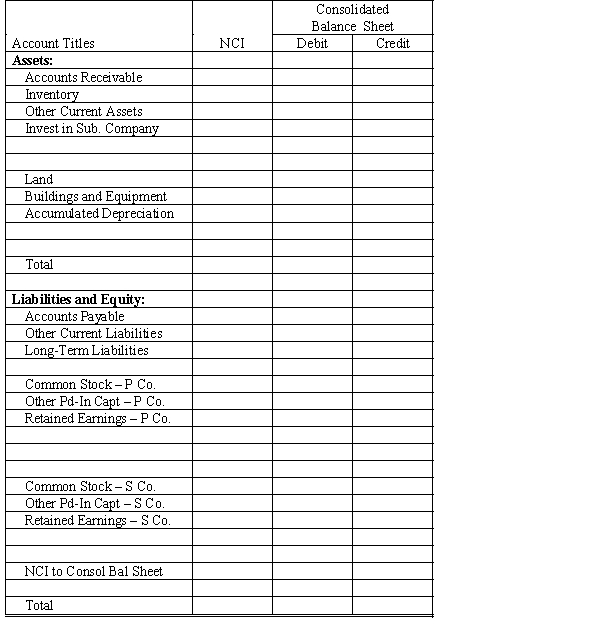

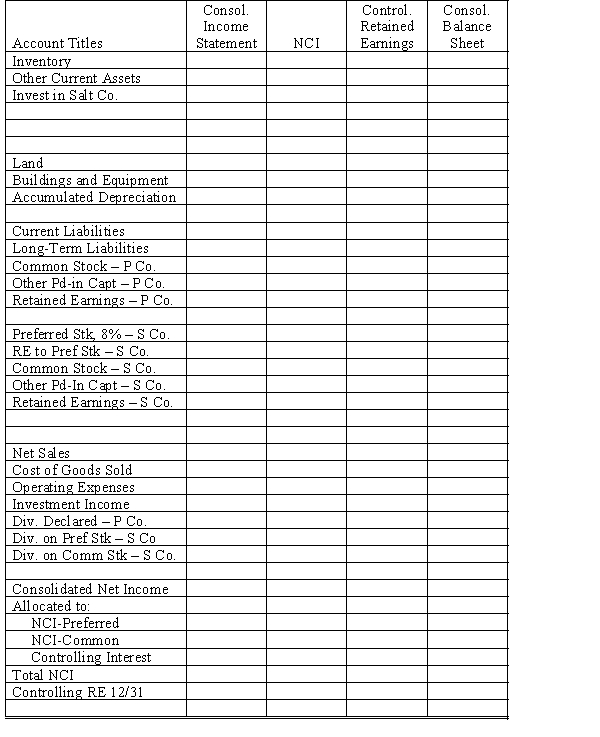

Complete the Figure 7-8 worksheet for consolidated financial statements for the year ended December 31, 20X2.

(Essay)

4.9/5  (33)

(33)

Patten and Salty scenario:

Patten Company purchased an 80% interest in Salty Inc. on January 1, 20X1, for $500,000 when the stockholders' equity of Salty was $500,000. Any excess of cost was attributed to a building with a 20-year life. On July 1, 20X4, Patten sold part of its investment and reduced its ownership interest to 60%. Salty earned $62,000, evenly, during 20X4.

-Refer to the Patten and Salty scenario. The NCI share of 20X4 consolidated income is

(Multiple Choice)

4.8/5  (37)

(37)

Company P Industries purchased a 70% interest in Company S on January 1, 20X1, and prepared the following determination and distribution of excess schedule:

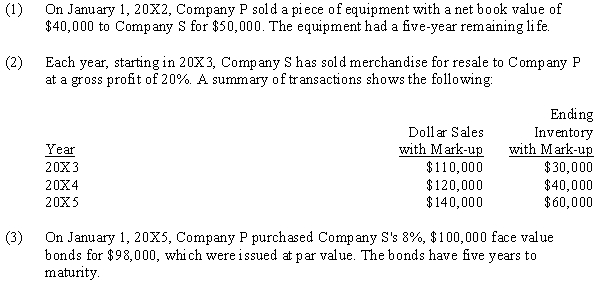

Since the purchase, there have been the following intercompany transactions:

Since the purchase, there have been the following intercompany transactions:

Required:

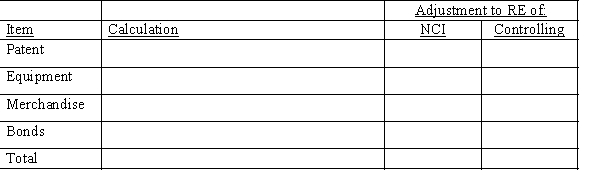

Complete the following schedule to adjust the retained earnings of the noncontrolling and controlling interest on the December 31, 20X5, worksheet for a consolidated balance sheet only. Company P uses the simple equity method to account for its investment.

Required:

Complete the following schedule to adjust the retained earnings of the noncontrolling and controlling interest on the December 31, 20X5, worksheet for a consolidated balance sheet only. Company P uses the simple equity method to account for its investment.

(Essay)

4.7/5  (33)

(33)

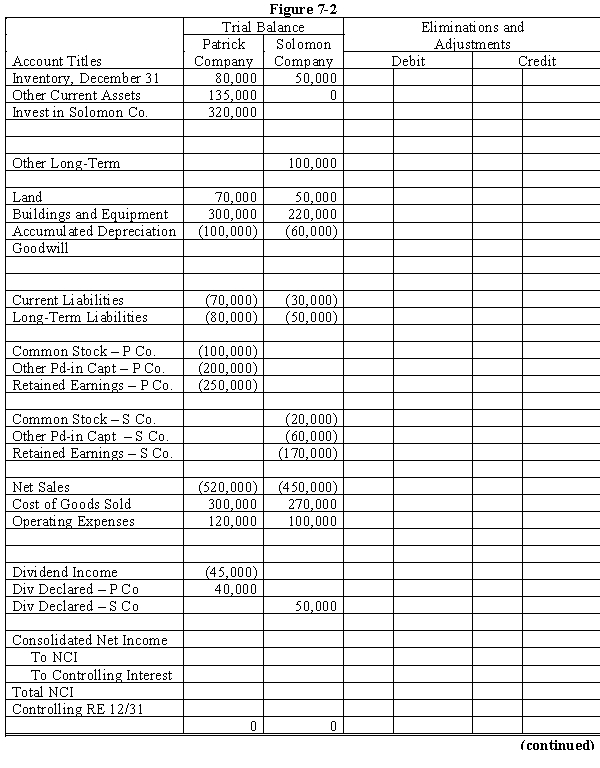

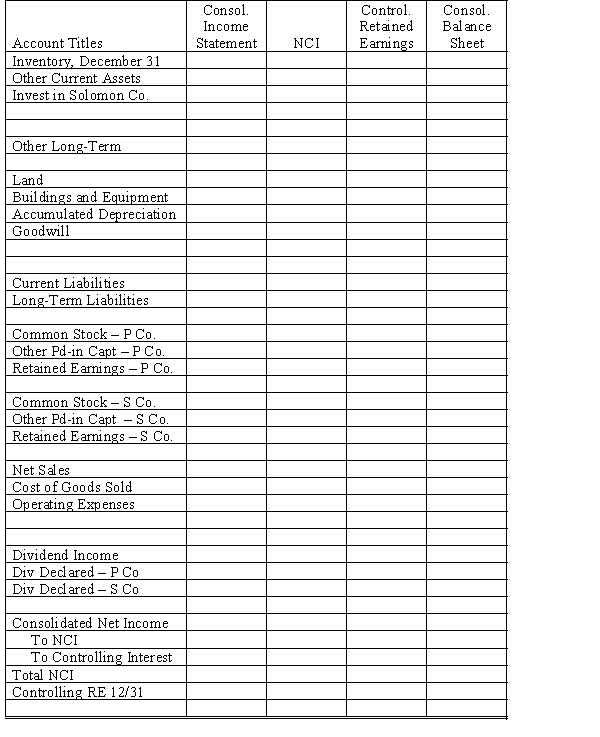

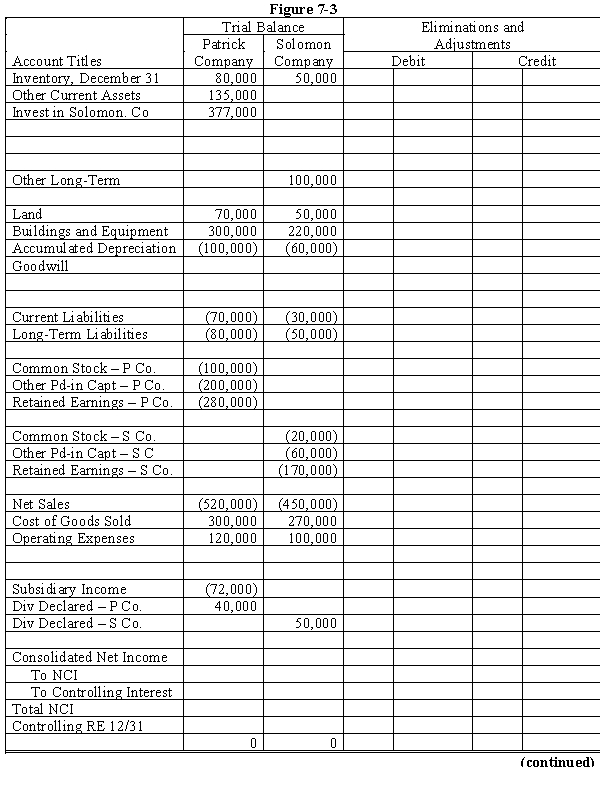

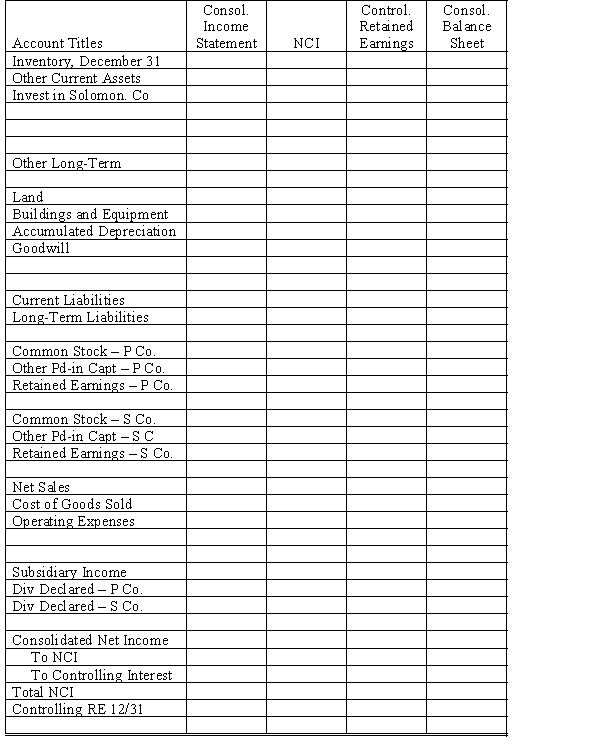

Patrick & Solomon scenario:

On January 1, 20X1, Patrick Company purchased 60% of the common stock of Solomon Company for $180,000. On this date, Solomon had common stock, other paid-in capital, and retained earnings of $20,000, $60,000, and $120,000 respectively.

On January 1, 20X1, the only tangible asset of Solomon that was undervalued was land, which was worth $15,000 more than book value.

On January 1, 20X2, Patrick Company purchased an additional 30% of the common stock of Solomon Company for $140,000.

Net income and dividends for 2 years for Solomon Company were:

In the last quarter of 20X2, Solomon sold $80,000 of goods to Patrick, at a gross profit rate of 30%. On December 31, 20X2, $20,000 of these goods are in Patrick's ending inventory.

-Refer to Patrick and Solomon. In both 20X1 and 20X2, Patrick has accounted for its investment in Solomon using the cost method.

Required:

a.

Using the information above or on the separate worksheet, prepare necessary determination and distribution of excess schedules for the two purchases.

b.

Complete the Figure 7-2 worksheet for consolidated financial statements for 20X2.

In the last quarter of 20X2, Solomon sold $80,000 of goods to Patrick, at a gross profit rate of 30%. On December 31, 20X2, $20,000 of these goods are in Patrick's ending inventory.

-Refer to Patrick and Solomon. In both 20X1 and 20X2, Patrick has accounted for its investment in Solomon using the cost method.

Required:

a.

Using the information above or on the separate worksheet, prepare necessary determination and distribution of excess schedules for the two purchases.

b.

Complete the Figure 7-2 worksheet for consolidated financial statements for 20X2.

(Essay)

4.8/5  (41)

(41)

Partridge & Sparrow scenario:

Partridge purchased a 60% interest in Sparrow on January 1, 20X1, for $240,000. At the time of the purchase, Sparrow had the following stockholders' equity:

Any excess is attributable to equipment with a 10-year life. On January 1, 20X6, the retained earnings of Sparrow was $175,000.

-Refer to Partridge and Sparrow. During the first 6 months of 20X6, $25,000 was earned by Company S. The entire investment was sold for $300,000 on July 1, 20X6. The gain (loss) was ____.

Any excess is attributable to equipment with a 10-year life. On January 1, 20X6, the retained earnings of Sparrow was $175,000.

-Refer to Partridge and Sparrow. During the first 6 months of 20X6, $25,000 was earned by Company S. The entire investment was sold for $300,000 on July 1, 20X6. The gain (loss) was ____.

(Multiple Choice)

4.9/5  (38)

(38)

Pine & Scent scenario:

Pine Company purchased a 60% interest in the Scent Company on January 1, 20X1 for $360,000. On that date, the stockholders' equity of Scent Company was $450,000. Any excess cost on 1/1/X1 was attributable to goodwill. Pine purchased another 20% interest on January 1, 20X4 for $200,000. On January 1, 20X4, Scent Company's stockholders' equity was $700,000, the entire increase due to retained earnings.

-Refer to the Pine and Scent scenario. The excess of cost over book on the new block of stock is ____.

(Multiple Choice)

4.8/5  (31)

(31)

A new subsidiary is being formed. The parent company purchased 70% of the shares for $20 per share. The remaining shares were sold to a variety of outside interests for an average of $22 per share. The consolidated statements will show

(Multiple Choice)

4.9/5  (28)

(28)

Patrick & Solomon scenario:

On January 1, 20X1, Patrick Company purchased 60% of the common stock of Solomon Company for $180,000. On this date, Solomon had common stock, other paid-in capital, and retained earnings of $20,000, $60,000, and $120,000 respectively.

On January 1, 20X1, the only tangible asset of Solomon that was undervalued was land, which was worth $15,000 more than book value.

On January 1, 20X2, Patrick Company purchased an additional 30% of the common stock of Solomon Company for $140,000.

Net income and dividends for 2 years for Solomon Company were:

In the last quarter of 20X2, Solomon sold $80,000 of goods to Patrick, at a gross profit rate of 30%. On December 31, 20X2, $20,000 of these goods are in Patrick's ending inventory.

-Refer to Patrick and Solomon. In both 20X1 and 20X2, Patrick has accounted for its investment in Solomon using the simple equity method.

Required:

a.

Using the information from the scenario or on the separate worksheet, prepare necessary determination and distribution of excess schedules for the two purchases.

b.

Complete the Figure 7-3 worksheet for consolidated financial statements for 20X2.

In the last quarter of 20X2, Solomon sold $80,000 of goods to Patrick, at a gross profit rate of 30%. On December 31, 20X2, $20,000 of these goods are in Patrick's ending inventory.

-Refer to Patrick and Solomon. In both 20X1 and 20X2, Patrick has accounted for its investment in Solomon using the simple equity method.

Required:

a.

Using the information from the scenario or on the separate worksheet, prepare necessary determination and distribution of excess schedules for the two purchases.

b.

Complete the Figure 7-3 worksheet for consolidated financial statements for 20X2.

(Essay)

4.8/5  (26)

(26)

On January 1, 20X1, Pepper Company purchased 90% of the common stock of Salt Company for $360,000 when Salt had total shareholders' equity as follows:

8\% Preferred Stock, \ 100 par \ 100,000 Common Stock, \ 10 par 50,000 Other Paid-in Capital 120,000 Retained Earnings \ 180,000 Total \ 450,000 Any excess of cost over book value on this date is attributed to a patent, to be amortized over 10 years. The 8% preferred stock is cumulative, non-participating, and has a liquidating value of par plus dividends in arrears. There were no preferred dividends in arrears on January 1, 20X1. Pepper elected to account for its investment in Salt using the simple equity method.

During 20X1, Salt had a net loss of $10,000 and paid no dividends. In 20X2, Salt had net income of $100,000 and paid dividends totaling $36,000.

During 20X2, Salt sold merchandise to Pepper for $40,000, of which $20,000 is still held by Pepper on December 31, 20X2. Salt's usual gross profit is 40%.

Required:

Complete the Figure 7-8 worksheet for consolidated financial statements for the year ended December 31, 20X2.

(Essay)

4.8/5  (32)

(32)

Poplar & Sequoia scenario:

On January 1, 20X1, Poplar Company acquired 80% of the common stock of Sequoia Company for $400,000. On this date, Sequoia had total owners' equity of $400,000. The excess of cost over book value was due to a patent with remaining life of 10 years. Poplar adopted the simple equity method to account for its investment in Sequoia.

Sequoia's income for the three years 20X1 through 20X3 is $80,000, $60,000, and $100,000 respectively. All income is earned evenly throughout the year; Sub has paid no dividends.

On July 1, 20X3, Poplar Company sold 10% of the total stock of Sequoia for $70,000, reducing its investment percentage to 70%.

-Refer to Poplar and Sequoia. Prepare Poplar's general journal entries for 20X3.

(Essay)

4.8/5  (36)

(36)

A subsidiary company may have preferred stock as part of its equity structure. Further, suppose that the preferred stock is cumulative and in arrears on dividends.

Required:

a.

What is the impact of the preferred stock on the excess of cost over book value on the original controlling investment in common stock?

b.

What is the impact of the preferred stock on the annual distribution of income?

c.

What is the theory followed in consolidated reporting when the parent purchases a portion of the subsidiary's preferred stock?

(Essay)

4.8/5  (45)

(45)

Showing 21 - 35 of 35

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)