Exam 1: Business Combinations: New Rules for a Long-Standing Business Practice

Exam 1: Business Combinations: New Rules for a Long-Standing Business Practice32 Questions

Exam 2: Consolidated Statements: Date of Acquisition29 Questions

Exam 3: Consolidated Statements: Subsequent to Acquisition30 Questions

Exam 4: Intercompany Transactions: Merchandise, Plant Assets, and Notes29 Questions

Exam 5: Intercompany Transactions: Bonds and Leases54 Questions

Exam 6: Cash Flow, Eps, and Taxation44 Questions

Exam 7: Special Issues in Accounting for an Investment in a Subsidiary35 Questions

Exam 8: Subsidiary Equity Transactions; Indirect and Mutual Holdings36 Questions

Exam 9: The International Accounting Environment28 Questions

Exam 10: Foreign Currency Transactions61 Questions

Exam 11: Translation of Foreign Financial Statements62 Questions

Exam 12: Interim Reporting and Disclosures About Segments of an Enterprise50 Questions

Exam 13: Partnerships: Characteristics, Formation, and Accounting for Activities32 Questions

Exam 14: Partnerships: Ownership Changes and Liquidations48 Questions

Exam 15: Governmental Accounting: the General Fund and the Account Groups53 Questions

Exam 16: Governmental Accounting: Other Governmental Funds, Proprietary Funds, and Fiduciary Funds43 Questions

Exam 17: Financial Reporting Issues29 Questions

Exam 18: Accounting for Private Not-For-Profit Organizations45 Questions

Exam 19: Accounting for Not-For-Profit Colleges and Universities and Health Care Organizations64 Questions

Exam 20: Estates and Trusts: Their Nature and the Accountants Role46 Questions

Exam 21: Debt Restructuring, Corporate Reorganizations, and Liquidations44 Questions

Select questions type

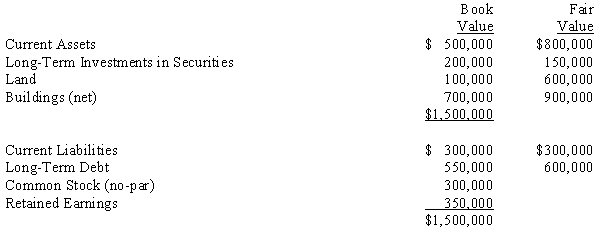

On January 1, 20X1, Honey Bee Corporation purchased the net assets of Green Hornet Company for $1,500,000. On this date, a condensed balance sheet for Green Hornet showed:

Required:

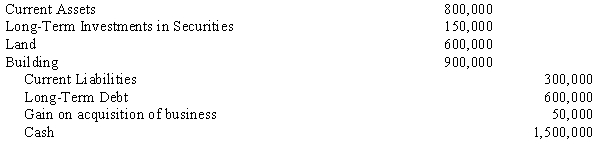

Record the entry on Honey Bee's books for the acquisition of Green Hornet's net assets.

Required:

Record the entry on Honey Bee's books for the acquisition of Green Hornet's net assets.

Free

(Essay)

4.9/5  (33)

(33)

Correct Answer:

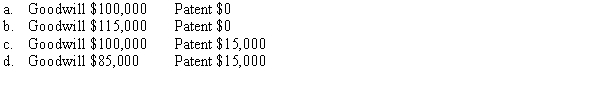

Orbit Inc. purchased Planet Co. in 20X3. At that time an existing patent was not recorded as a separately identified intangible asset. At the end of fiscal year 20X4, the patent is valued at $15,000, and goodwill has a book value of $100,000. How should intangible assets be reported at the beginning of fiscal year 20X5?

Free

(Short Answer)

4.9/5  (36)

(36)

Correct Answer:

A

Publics Company acquired the net assets of Citizen Company during 20X5. The purchase price was $800,000. On the date of the transaction, Citizen had no long-term investments in marketable equity securities and $400,000 in liabilities. The fair value of Citizen assets on the acquisition date was as follows: Current assets \ 800,000 Noncurrent assets 600,000 \1 ,400,000 How should Publics account for the $200,000 difference between the fair value of the net assets acquired, $1,000,000, and the cost, $800,000?

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

C

Which of the following income factors should not be factored into an estimation of goodwill?

(Multiple Choice)

4.9/5  (30)

(30)

A controlling interest in a company implies that the parent company

(Multiple Choice)

4.8/5  (37)

(37)

Goodwill represents the excess cost of an acquisition over the

(Multiple Choice)

4.9/5  (38)

(38)

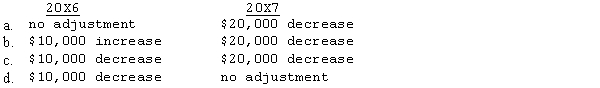

In performing impairment test for goodwill, the company had the following 20X6 and 20X7 information available. 206 207 F air value of the reporting unit \ 350,000 \ 400,000 Net book value (including \ 50,000 goodwill) \ 360,000 \ 380,000 Assume that the carry value of the identifiable assets are a reasonable approximation of their fair values. Based upon this information what are the 20X6 and 20X7 adjustment to goodwill, if any?

(Short Answer)

5.0/5  (41)

(41)

Mans Company is about to purchase the net assets of Eagle Incorporated, which has the following balance sheet:

Assets

Accounts receivable \ 60,000 Inventory 100,000 Equipment \ 90,000 Accumulated depreciation (50,000) 40,000 Land and buildings \ 300,000 Accumulated depreciation (100,000) 200,000 Goodwill 60,000 Total assets \4 60,000

Liabilities and Stockholders' Equity

Bonds payable \ 80,000 Common stock, \ 10 par 200,000 Paid-in capital in excess of par 100,000 Retained earnings 80,000 Total liabilities and equity \4 60,000 Mans has secured the following fair values of Eagle's accounts:

Inventory \ 130,000 Equipment 60,000 Land and buildings 260,000 Bonds payable 60,000 Acquisition costs were $20,000.

Required:

Record the entry for the purchase of the net assets of Eagle by Mans at the following cash prices:

a.

$450,000

b.

$310,000

c.

$480,000

(Essay)

4.8/5  (41)

(41)

Balter Inc. acquired Jersey Company on January 1, 20X5. When the purchase occurred Jersey Company had the following information related to fixed assets: Land \ 80,000 Building 200,000 Accumulated Depreciation (100,000) Equipment 100,000 Accumulated Depreciation (50,000) The building has a 10-year remaining useful life and the equipment has a 5-year remaining useful life. The fair value of the assets on that date were:

Land \ 100,000 Building 130,000 Equipment 75,000 What is the 20X5 depreciation expense Balter will record related to purchasing Jersey Company?

(Multiple Choice)

4.8/5  (33)

(33)

Polk issues common stock to acquire all the assets of the Sam Company on January 1, 20X5. There is a contingent share agreement, which states that if the income of the Sam Division exceeds a certain level during 20X5 and 20X6, additional shares will be issued on January 1, 20X7. The impact of issuing the additional shares is to

(Multiple Choice)

4.8/5  (38)

(38)

Cozzi Company is being purchased and has the following balance sheet as of the purchase date: Current assets \ 200,000 Liabilities \ 90,000 Fixed assets 180,000 Equity 290,000 Total \3 80,000 Total \3 80,000 The price paid for Cozzi's net assets is $500,000. The fixed assets have a fair value of $220,000, and the liabilities have a fair value of $110,000. The amount of goodwill to be recorded in the purchase is ____.

(Multiple Choice)

4.8/5  (33)

(33)

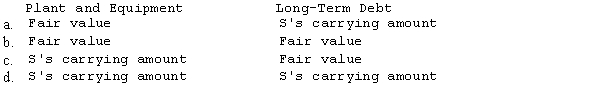

Company B acquired the net assets of Company S in exchange for cash. The acquisition price exceeds the fair value of the net assets acquired. How should Company B determine the amounts to be reported for the plant and equipment, and for long-term debt of the acquired Company S?

(Short Answer)

4.8/5  (34)

(34)

The Blue Reef Company purchased the net assets of the Pink Coral Company on January 1, 20X1, and made the following entry to record the purchase:

Current Assets 100,000 Equipment 150,000 Land 50,000 Buildings 300,000 Goodwill 100,000 Liabilities 80,000 Common Stock, \ 1 Par 100,000 Paid-in Capital in Excess of Par 520,000 Required:

Make the required entry on January 1, 20X3, assuming that additional shares would be issued on that date to compensate for any fall in the value of Blue Reef common stock below $16 per share. The settlement would be to cure the deficiency by issuing added shares based on their fair value on January 1, 20X3. The fair price of the shares on January 1, 20X3 was $10.

(Essay)

4.8/5  (35)

(35)

Poplar Corp. acquires the net assets of Sapling Company, which has the following balance sheet:

Accounts Receivable \ 50,000 Inventory 80,000 Equipment, Net 50,000 Land \& Building, Net 120,000 Total Assets \ 300,000 Bonds Payable \ 90,000 Common Stock 100,000 Retained Eamings 110,000 Total Liabilities and Stockhol ders' Equity \ 300,000 Fair values on the date of acquisition:

Accounts Receivable \ 50,000 Inventory 100,000 Equipment 30,000 Land \& Building 180,000 Customer List 30,000 Bonds Payable 100,000 Acqui sition costs: \ 10,000 If Poplar paid $300,000 what journal entries would be recorded by both Poplar Corp. and Sapling Company?

(Essay)

4.7/5  (29)

(29)

ACME Co. paid $110,000 for the net assets of Comb Corp. At the time of the acquisition the following information was available related to Comb's balance sheet:

-Refer to ACME Co. and Comb Corp. What amount of gain (loss) on disposal of a business should Comb Corp. recognize?

-Refer to ACME Co. and Comb Corp. What amount of gain (loss) on disposal of a business should Comb Corp. recognize?

(Multiple Choice)

4.7/5  (38)

(38)

On January 1, 20X1 the fair values of Pink Coral's net assets were as follows:

Current Assets 100,000 Equipment 150,000 Land 50,000 Buildings 300,000 Liabilities 80,000 On January 1, 20X1, Blue Reef Company purchased the net assets of the Pink Coral Company by issuing 100,000 shares of its $1 par value stock when the fair value of the stock was $6.20. It was further agreed that Blue Reef would pay an additional amount on January 1, 20X3, if the average income during the 2-year period of 20X1-20X2 exceeded $80,000 per year. The expected value of this consideration was calculated as $184,000; the measurement period is one year.

Required: Prepare Blue Reef's entries:

a) on January 1, 20X1 to record the acquisition

b) on August 1, 20X1 to revise the contingent consideration to $170,000

c) on January 1, 20X3 to settle the contingent consideration clause of the agreement for $175,000

(Essay)

4.8/5  (26)

(26)

Separately identified intangible assets are accounted for by amortizing:

(Multiple Choice)

4.8/5  (48)

(48)

Vibe Company purchased the net assets of Atlantic Company in a business combination accounted for as a purchase. As a result, goodwill was recorded. For tax purposes, this combination was considered to be a tax-free merger. Included in the assets is a building with an appraised value of $210,000 on the date of the business combination. This asset had a net book value of $70,000, based on the use of accelerated depreciation for accounting purposes. The building had an adjusted tax basis to Atlantic (and to Vibe as a result of the merger) of $120,000. Assuming a 36% income tax rate, at what amount should Vibe record this building on its books after the purchase?

(Multiple Choice)

4.9/5  (40)

(40)

Acquisition costs such as the fees of accountants and lawyers that were necessary to negotiate and consummate the purchase are

(Multiple Choice)

4.8/5  (34)

(34)

Showing 1 - 20 of 32

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)