Exam 4: Determination of Tax

Exam 1: Tax Research111 Questions

Exam 2: an Introduction to Taxation106 Questions

Exam 3: Corporate Formations and Capital Structure122 Questions

Exam 4: Determination of Tax144 Questions

Exam 5: The Corporate Income Tax126 Questions

Exam 6: Gross Income: Inclusions139 Questions

Exam 7: Corporate Nonliquidating Distributions112 Questions

Exam 8: Gross Income: Exclusions112 Questions

Exam 9: Other Corporate Tax Levies103 Questions

Exam 10: Property Transactions: Capital Gains and Losses141 Questions

Exam 11: Corporate Liquidating Distributions102 Questions

Exam 12: Deductions and Losses138 Questions

Exam 13: Corporate Acquisitions and Reorganizations100 Questions

Exam 14: Itemized Deductions122 Questions

Exam 15 Consolidated Tax Returns99 Questions

Exam 16: Losses and Bad Debts117 Questions

Exam 17: Partnership Formation and Operation115 Questions

Exam 18: Employee Expenses and Deferred Compensation147 Questions

Exam 19: Special Partnership Issues107 Questions

Exam 20: Depreciation,cost Recovery,amortization,and Depletion99 Questions

Exam 21: Corporations103 Questions

Exam 22: Accounting Periods and Methods114 Questions

Exam 23: The Gift Tax103 Questions

Exam 24: Property Transactions: Nontaxable Exchanges118 Questions

Exam 25: The Estate Tax107 Questions

Exam 26: Property Transactions: Section 1231 and Recapture109 Questions

Exam 27: Income Taxation of Trusts and Estates105 Questions

Exam 28: Special Tax Computation Methods,tax Credits,and Payment of Tax130 Questions

Exam 29: Administrative Procedures102 Questions

Select questions type

Sean and Martha are both over age 65 and Martha is considered blind by tax law standards.Their total income in 2015 from part-time jobs and interest income from a bank savings account is $60,000.Their itemized deductions are $12,000.

Required: Compute their taxable income.

(Essay)

4.7/5  (43)

(43)

Annisa,who is 28 and single,has adjusted gross income of $55,000 and itemized deductions of $5,000.In 2015,Annisa will have taxable income of

(Multiple Choice)

4.8/5  (39)

(39)

You may choose married filing jointly as your filing status if you are married and both you and your spouse agree to file a joint return.Which of the following facts would prevent you from being considered married for filing purposes?

(Multiple Choice)

4.8/5  (27)

(27)

Mia is a single taxpayer with projected AGI of $255,000 in 2015.She is considering selling a long-term investment before year-end.She expects to realize a gain of $25,000.If Mia sells the investment by December 31,her 2015 taxable income will increase by $25,000.

(True/False)

4.8/5  (36)

(36)

Sally divorced her husband three years ago and has not remarried.Since the divorce she has maintained her home in which she and her now sixteen-year-old daughter reside.The daughter is a qualified child.Sally signed the dependency exemption over to her ex-spouse by filing the appropriate IRS form.What is Sally's filing status for the current year and how many exemptions may she claim?

(Multiple Choice)

5.0/5  (36)

(36)

In order to shift the taxation of dividend income from a parent to a child,

(Multiple Choice)

4.9/5  (36)

(36)

Lester,a widower qualifying as a surviving spouse,has $209,000 of salary,five personal and dependency exemptions and itemizes deductions.Lester must use which form to report his taxable income?

(Multiple Choice)

4.9/5  (40)

(40)

An individual who is claimed as a dependent by another person is not entitled to a personal exemption on his or her own return.

(True/False)

4.7/5  (33)

(33)

Which of the following dependent relatives does not have to live in the same household as the taxpayer who is claiming head of household filing status?

(Multiple Choice)

4.8/5  (35)

(35)

The requirement to file a tax return is based on the individual's adjusted gross income.

(True/False)

4.8/5  (38)

(38)

Shane and Alyssa (a married couple)have AGI of $345,000 in 2015.They bought a house this year and paid $16,000 of interest expense on the mortgage and paid $6,500 of property taxes.They will be allowed a deduction from AGI of

(Multiple Choice)

5.0/5  (49)

(49)

Foreign exchange student Yung lives with Harold and Betty while he studies in the US.He moved into their home January 5,2015 and has resided with them for the remainder of the year.Yung does not pay anything for his room and board.Harold and Betty provide all of Yung's meals.Yung receives a scholarship to pay for his tuition,books and fees.He works on campus,earning $4,000 a year.What tax issues should Harold and Betty consider?

(Essay)

4.8/5  (43)

(43)

A married person who files a separate return can claim a personal exemption for his spouse if the spouse is not the dependent of another and has

(Multiple Choice)

4.7/5  (41)

(41)

A corporation has revenue of $350,000 and deductible business expenses of $240,000.What is the federal income tax,before credits?

(Multiple Choice)

4.7/5  (43)

(43)

Generally,when a married couple files a joint return,each spouse is liable for one-half of the entire tax and any penalties incurred.

(True/False)

4.9/5  (39)

(39)

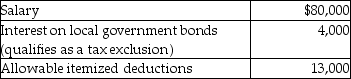

A single taxpayer provided the following information for 2015:  What is taxable income?

What is taxable income?

(Multiple Choice)

4.8/5  (42)

(42)

Alexis and Terry have been married five years and file joint tax returns.Alexis began embezzling funds from her employer during the third year of their marriage.Last year,Alexis suddenly left the country and Terry does not know where she is.In the current year,Terry learned that the IRS had assessed him $27,000 in unpaid taxes due to Alexis's embezzlement.What tax issue(s)are present in Terry's situation? What questions would you ask Terry to determine his appropriate response to the IRS?

(Essay)

4.9/5  (37)

(37)

Rob is a taxpayer in the top tax bracket,with over a million in taxable income.He plans to sell stock held long-term for a $100,000 gain.This sale will result in an increase to his tax liability of

(Multiple Choice)

4.8/5  (32)

(32)

A building used in a business is sold after five years of use for a gain.The gain will be treated as a long-term capital gain.

(True/False)

4.9/5  (33)

(33)

Suri,age 8,is a dependent of her parents and has unearned income of $6,000.She must file her own tax return.

(True/False)

4.9/5  (43)

(43)

Showing 61 - 80 of 144

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)