Exam 4: Determination of Tax

Exam 1: Tax Research111 Questions

Exam 2: an Introduction to Taxation106 Questions

Exam 3: Corporate Formations and Capital Structure122 Questions

Exam 4: Determination of Tax144 Questions

Exam 5: The Corporate Income Tax126 Questions

Exam 6: Gross Income: Inclusions139 Questions

Exam 7: Corporate Nonliquidating Distributions112 Questions

Exam 8: Gross Income: Exclusions112 Questions

Exam 9: Other Corporate Tax Levies103 Questions

Exam 10: Property Transactions: Capital Gains and Losses141 Questions

Exam 11: Corporate Liquidating Distributions102 Questions

Exam 12: Deductions and Losses138 Questions

Exam 13: Corporate Acquisitions and Reorganizations100 Questions

Exam 14: Itemized Deductions122 Questions

Exam 15 Consolidated Tax Returns99 Questions

Exam 16: Losses and Bad Debts117 Questions

Exam 17: Partnership Formation and Operation115 Questions

Exam 18: Employee Expenses and Deferred Compensation147 Questions

Exam 19: Special Partnership Issues107 Questions

Exam 20: Depreciation,cost Recovery,amortization,and Depletion99 Questions

Exam 21: Corporations103 Questions

Exam 22: Accounting Periods and Methods114 Questions

Exam 23: The Gift Tax103 Questions

Exam 24: Property Transactions: Nontaxable Exchanges118 Questions

Exam 25: The Estate Tax107 Questions

Exam 26: Property Transactions: Section 1231 and Recapture109 Questions

Exam 27: Income Taxation of Trusts and Estates105 Questions

Exam 28: Special Tax Computation Methods,tax Credits,and Payment of Tax130 Questions

Exam 29: Administrative Procedures102 Questions

Select questions type

Frank,age 17,received $4,000 of dividends and $1,500 from a part-time job.Frank is a dependent of his parents who are in the 28% percent bracket.Frank's 2015 taxable income is

(Multiple Choice)

4.8/5  (35)

(35)

Generally,itemized deductions are personal expenses specifically allowed by the tax law.

(True/False)

4.8/5  (33)

(33)

Husband and wife,who live in a common law state,are eligible to file a joint return for 2015,but elect to file separately.They do not have dependents.Wife has adjusted gross income of $25,000 and has $2,200 of expenditures which qualify as itemized deductions.She is entitled to one exemption.Husband deducts itemized deductions of $11,200.What is the taxable income for the wife?

(Multiple Choice)

4.9/5  (41)

(41)

Paul and Sally file a joint return showing $87,000 of AGI (with no exclusions under Secs.911,931,and 933).They have three dependent children ages 6,8,and 13.What is the amount of their child credit?

(Multiple Choice)

4.8/5  (38)

(38)

All of the following items are generally excluded from income except

(Multiple Choice)

4.7/5  (44)

(44)

When a spouse dies,the surviving spouse for the year of death

(Multiple Choice)

4.9/5  (44)

(44)

Dave,age 59 and divorced,is the sole support of his mother age 83,who is a resident of a local nursing home for the entire year.Dave's mother had no income for the year.Dave's filing status and exemptions claimed are

(Multiple Choice)

4.9/5  (35)

(35)

Tony supports the following individuals during the current year: Miranda,his former mother-in-law who lives in her own home and has no gross income; his cousin,Jeff,age 23,who is a full-time student,earns $7,000 during the year,and lives with Tony all year long; and Matt,age 22,who is Tony's brother,is a full-time student living on campus and earns $8,000 during the year.How many dependency exemptions may Tony claim?

(Multiple Choice)

4.7/5  (44)

(44)

Hannah is single with no dependents and has a salary of $102,000 for 2015,along with tax exempt interest income of $3,000 from a municipality.Her itemized deductions total $6,600.

Required: Compute her taxable income

(Essay)

4.8/5  (28)

(28)

The person claiming a dependency exemption under a multiple support declaration must provide more than 25% of the dependent's support.

(True/False)

4.8/5  (33)

(33)

Although exclusions are usually not reported on an individual's income tax return,interest income on state and local government bonds must be reported on the tax return.

(True/False)

4.7/5  (39)

(39)

Form 4868,a six-month extension of time to file,allows a taxpayer to

(Multiple Choice)

4.7/5  (36)

(36)

Keith,age 17,is a dependent of his parents.During 2015,he received $3,000 of dividend income.The parent's marginal rate is 28% and Keith's rate is 10%.Keith's tax is

(Multiple Choice)

4.8/5  (35)

(35)

Amanda has two dependent children,ages 10 and 12.She earned $15,000 from her waitress job.How much of her child credit is refundable?

(Multiple Choice)

4.8/5  (38)

(38)

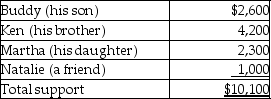

Blaine Greer lives alone.His support comes from the following sources:  Assuming a multiple support declaration exists,which of the individuals may claim Blaine as a dependent?

Assuming a multiple support declaration exists,which of the individuals may claim Blaine as a dependent?

(Multiple Choice)

4.8/5  (35)

(35)

Generally,in the case of a divorced couple,the parent who has physical custody of a child for the greater part of the year is entitled to the dependency exemption.

(True/False)

4.7/5  (45)

(45)

Paul and Hannah,who are married and file a joint return,are in the process of adopting a child who is born in December 2015.The child,a son,comes to live with them a week after his birth on December 12.The adoption is not finalized until February of 2016.What tax issues are present in this situation?

(Essay)

4.8/5  (43)

(43)

Lewis,who is single,is claimed as a dependent on his parents' tax return.He received $2,000 during the year in dividends,which was his only income.What is his standard deduction for 2015?

(Multiple Choice)

4.9/5  (32)

(32)

Showing 21 - 40 of 144

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)