Exam 4: Determination of Tax

Exam 1: Tax Research111 Questions

Exam 2: an Introduction to Taxation106 Questions

Exam 3: Corporate Formations and Capital Structure122 Questions

Exam 4: Determination of Tax144 Questions

Exam 5: The Corporate Income Tax126 Questions

Exam 6: Gross Income: Inclusions139 Questions

Exam 7: Corporate Nonliquidating Distributions112 Questions

Exam 8: Gross Income: Exclusions112 Questions

Exam 9: Other Corporate Tax Levies103 Questions

Exam 10: Property Transactions: Capital Gains and Losses141 Questions

Exam 11: Corporate Liquidating Distributions102 Questions

Exam 12: Deductions and Losses138 Questions

Exam 13: Corporate Acquisitions and Reorganizations100 Questions

Exam 14: Itemized Deductions122 Questions

Exam 15 Consolidated Tax Returns99 Questions

Exam 16: Losses and Bad Debts117 Questions

Exam 17: Partnership Formation and Operation115 Questions

Exam 18: Employee Expenses and Deferred Compensation147 Questions

Exam 19: Special Partnership Issues107 Questions

Exam 20: Depreciation,cost Recovery,amortization,and Depletion99 Questions

Exam 21: Corporations103 Questions

Exam 22: Accounting Periods and Methods114 Questions

Exam 23: The Gift Tax103 Questions

Exam 24: Property Transactions: Nontaxable Exchanges118 Questions

Exam 25: The Estate Tax107 Questions

Exam 26: Property Transactions: Section 1231 and Recapture109 Questions

Exam 27: Income Taxation of Trusts and Estates105 Questions

Exam 28: Special Tax Computation Methods,tax Credits,and Payment of Tax130 Questions

Exam 29: Administrative Procedures102 Questions

Select questions type

What options are available for reporting and paying tax on the unearned income of a child under age 24?

(Essay)

4.9/5  (33)

(33)

Satish,age 11,is a dependent of his parents.His only source of income in 2015 is $3,000 of interest income on bonds given him by his grandparents.Satish's marginal rate is 10%,and his parent's marginal rate is 28%.Satish's tax is

(Multiple Choice)

4.8/5  (47)

(47)

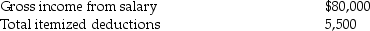

Steve Greene,age 66,is divorced with no dependents.In 2015 Steve had income and expenses as follows:  Compute Steve's taxable income for 2015.Show all calculations.

Compute Steve's taxable income for 2015.Show all calculations.

(Essay)

4.8/5  (31)

(31)

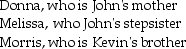

John supports Kevin,his cousin,who lived with him throughout 2015.John also supports three other individuals who do not live with him:  Assume that Donna,Melissa,Morris and Kevin each earn less than $4,000.How many personal and dependency exemptions may John claim?

Assume that Donna,Melissa,Morris and Kevin each earn less than $4,000.How many personal and dependency exemptions may John claim?

(Multiple Choice)

4.9/5  (39)

(39)

Maxine,who is 76 years old and single,is appropriately claimed as a dependent on her daughter Beth's tax return.During 2015 she received $500 interest on a savings account.She had a part time job that earned $3,000.Her total itemized deductions were $1,300.

Required: Compute Maxine's taxable income for 2015.Show all calculations.

(Essay)

4.8/5  (34)

(34)

In 2015,Sam is single and rents an apartment for which he pays $800 per month and makes charitable contributions of $1,000.Sam's adjusted gross income is $47,000.

Required: Compute his taxable income.Show all calculations.

(Essay)

4.9/5  (36)

(36)

Juanita's mother lives with her.Juanita purchased clothing for her mother costing $1,000 and provided her with a room that Juanita estimates she could have rented for $4,000.Juanita spent $5,000 on groceries she shared with her mother.Juanita also paid $700 for her mother's health insurance coverage.How much of these costs is considered support?

(Multiple Choice)

4.8/5  (33)

(33)

If a 13-year-old has earned income of $500 and unearned income of $2,500,all of the income can be reported on the parent's return.

(True/False)

5.0/5  (38)

(38)

In October 2014,Joy and Paul separated and have not lived with each other since,but they are still legally married.They do not file a joint return.Joy supports their children after the separation and pays the cost of maintaining their home.Joy's filing status in 2014 and 2015 is,respectively,

(Multiple Choice)

4.9/5  (42)

(42)

Oscar and Diane separated in June of this year although they continue to live in the same town.They have twin sons,Blake and Cliff,who remain in the family home with Diane.Oscar's income this year was $45,000 while Diane worked only part-time and made $15,000.Oscar also gambles heavily but told Diane that he had no winnings this year.What tax issues should they consider?

(Essay)

4.8/5  (32)

(32)

To qualify as an abandoned spouse,the taxpayer is not required to

(Multiple Choice)

4.8/5  (34)

(34)

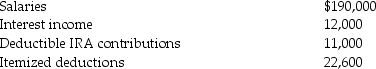

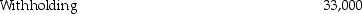

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2015.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

e.What is the amount of their tax due or (refund due)?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

e.What is the amount of their tax due or (refund due)?

(Essay)

4.8/5  (38)

(38)

Tax returns from individual and corporate taxpayers are due on the 15th day of the third month following the close of the tax year.

(True/False)

4.9/5  (38)

(38)

For 2015,unearned income in excess of $2,100 of a child under age 18 is generally taxed at the parents' rate.

(True/False)

4.9/5  (36)

(36)

Refundable tax credits are allowed to reduce or totally eliminate a taxpayer's tax liability but any credits in excess of the tax liability are lost.

(True/False)

4.8/5  (28)

(28)

Charlie is claimed as a dependent on his parents' tax return in 2015.He received $8,000 during the year from a part-time acting job,which was his only income.What is his standard deduction?

(Multiple Choice)

4.8/5  (42)

(42)

For purposes of the dependency exemption,a qualifying child may not provide more than one-half of his or her own support during the year.

(True/False)

4.9/5  (29)

(29)

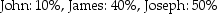

Anna is supported entirely by her three sons John,James,and Joseph who provide for her support in the following percentages:  Assuming a multiple support declaration exists,which of the brothers may claim his mother as a dependent?

Assuming a multiple support declaration exists,which of the brothers may claim his mother as a dependent?

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following credits is considered a refundable credit?

(Multiple Choice)

4.8/5  (36)

(36)

Showing 121 - 140 of 144

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)