Exam 17: Partnerships and S Corporations

Exam 1: An Introduction to Taxation104 Questions

Exam 2: Determination of Tax138 Questions

Exam 3: Gross Income: Inclusions132 Questions

Exam 4: Gross Income: Exclusions107 Questions

Exam 5: Property Transactions: Capital Gains and Losses133 Questions

Exam 6: Deductions and Losses130 Questions

Exam 7: Itemized Deductions114 Questions

Exam 8: Losses and Bad Debts114 Questions

Exam 9: Employee Expenses and Deferred Compensation135 Questions

Exam 10: Depreciation, Cost Recovery, Amortization, and Depletion93 Questions

Exam 11: Accounting Periods and Methods107 Questions

Exam 12: Property Transactions: Nontaxable Exchanges115 Questions

Exam 13: Property Transactions: Section 1231 and Recapture100 Questions

Exam 14: Special Tax Computation Methods, Tax Credits, and Payment of Tax117 Questions

Exam 15: Tax Research127 Questions

Exam 16: Corporations137 Questions

Exam 17: Partnerships and S Corporations133 Questions

Exam 18: Taxes and Investment Planning81 Questions

Select questions type

Because a partnership is a pass-through entity rather than a taxable entity, partnerships need not file tax returns.

(True/False)

4.9/5  (40)

(40)

In 2014, Phuong transferred land having a $150,000 FMV and a $120,000 adjusted basis, which is subject to a $110,000 mortgage in exchange for a one-third interest in the DSF Partnership. Phuong had purchased the land in 2012, but the mortgage was not taken out until 2013. The partnership owes no other liabilities. Phuong, Austin, and Alison share profits and losses equally and each has a one-third interest in partnership capital. The partnership's holding period for the land transferred by partner Phuong commences in

(Multiple Choice)

4.7/5  (27)

(27)

Gain is recognized by an S corporation when it distributes appreciated property to its shareholders.

(True/False)

4.9/5  (27)

(27)

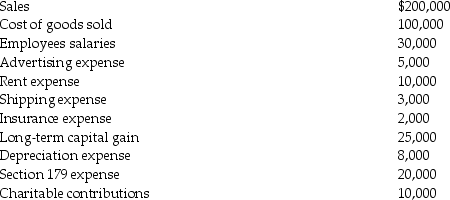

Longhorn Partnership reports the following items at the end of the current year:

What is the partnership's ordinary income? Which items are separately-stated?

What is the partnership's ordinary income? Which items are separately-stated?

(Essay)

4.7/5  (44)

(44)

In a limited partnership, the limited partners are liable for partnership debts only to the extent of their investment in the partnership plus any amount they commit to contribute to the partnership if called upon.

(True/False)

4.9/5  (37)

(37)

An LLC that elects to be taxed like a partnership is also classified as a partnership for legal purposes.

(True/False)

4.9/5  (34)

(34)

Raina owns 100% of Tribo Inc., an S corporation. She started the business this year with a $100,000 capital contribution. In addition, the business borrowed $50,000 from the bank which she had to guarantee. Tribo incurred a first year operating loss of $170,000. Raina will deduct an ordinarly loss this year of

(Multiple Choice)

4.8/5  (42)

(42)

Chen contributes a building worth $160,000 (adjusted basis $180,000)and $40,000 in services to a partnership for a partnership interest. Chen's basis in the partnership interest is

(Multiple Choice)

4.9/5  (35)

(35)

The income of a single member LLC is taxed to its owner under the sole proprietorship rules if no election to be taxed as a corporation is made.

(True/False)

4.8/5  (40)

(40)

What are special allocations of partnership items and when are they permitted?

(Essay)

4.8/5  (37)

(37)

Losses are disallowed on sales or exchanges between a partner and the partnership if the partner owns directly or indirectly more than a 50% interest in the capital or profits.

(True/False)

4.8/5  (41)

(41)

An S corporation can have both voting and nonvoting common stock as long as the shares of stock have identical rights to share in the profits and assets of the corporation.

(True/False)

5.0/5  (28)

(28)

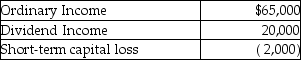

Bryan Corporation, an S corporation since its organization, is owned entirely by Mr. Bryan. The corporation uses a calendar year as its taxable year. Mr. Bryan paid $120,000 for his Bryan stock when the corporation was formed on January 1 of this year. For this year, Bryan Corporation reported the following results:  Distributions of $40,000 were made during the year. What is the basis of Mr. Bryan's stock on December 31?

Distributions of $40,000 were made during the year. What is the basis of Mr. Bryan's stock on December 31?

(Multiple Choice)

4.9/5  (38)

(38)

Atiqa receives a nonliquidating distribution of land from her partnership. The partnership purchased the land five years ago for $20,000. At the time of the distribution, it is worth $28,000. Prior to the distribution, Atiqa's basis in her partnership interest is $37,000. Due to the distribution Atiqa and the partnership will recognize income of

(Multiple Choice)

5.0/5  (35)

(35)

If a partner contributes property to a partnership, and that property is subject to a liability, the noncontributing partners increase the basis of their partnership interests by their share of the partnership liabilities that were transferred to the partnership.

(True/False)

4.8/5  (32)

(32)

Voluntary revocation of an S corporation election is permitted only if consent is obtained from all shareholders.

(True/False)

4.7/5  (44)

(44)

Tonya is the 100% shareholder of a corporation established five years ago. It has always been an S corporation. After adjustment for this year's corporate income, but before taking distributions into account, Tonya has a $50,000 stock basis. The corporation pays Tonya a $60,000 cash distribution. As a result of this distribution, Tonya will have an ending stock basis and recognize income of

(Multiple Choice)

4.8/5  (32)

(32)

A nonliquidating distribution of cash or property from the partnership to a partner is generally treated as a tax-free return of capital to the extent of a partner's basis.

(True/False)

4.9/5  (34)

(34)

The partnership's assumption of a liability from a partner is treated as a cash distribution to the partner whose liability is assumed, which decreases his basis in the partnership.

(True/False)

4.8/5  (37)

(37)

Showing 61 - 80 of 133

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)