Exam 17: Partnerships and S Corporations

Exam 1: An Introduction to Taxation104 Questions

Exam 2: Determination of Tax138 Questions

Exam 3: Gross Income: Inclusions132 Questions

Exam 4: Gross Income: Exclusions107 Questions

Exam 5: Property Transactions: Capital Gains and Losses133 Questions

Exam 6: Deductions and Losses130 Questions

Exam 7: Itemized Deductions114 Questions

Exam 8: Losses and Bad Debts114 Questions

Exam 9: Employee Expenses and Deferred Compensation135 Questions

Exam 10: Depreciation, Cost Recovery, Amortization, and Depletion93 Questions

Exam 11: Accounting Periods and Methods107 Questions

Exam 12: Property Transactions: Nontaxable Exchanges115 Questions

Exam 13: Property Transactions: Section 1231 and Recapture100 Questions

Exam 14: Special Tax Computation Methods, Tax Credits, and Payment of Tax117 Questions

Exam 15: Tax Research127 Questions

Exam 16: Corporations137 Questions

Exam 17: Partnerships and S Corporations133 Questions

Exam 18: Taxes and Investment Planning81 Questions

Select questions type

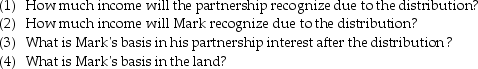

Mark receives a nonliquidating distribution of $10,000 cash and a parcel of land having an adjusted basis of $18,000 and a fair market value of $25,000.

a. Mark's basis in his partnership interest prior to the distribution is $50,000.

b. Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

b. Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

(Essay)

4.9/5  (35)

(35)

S corporation shareholders who own more than 2% of the outstanding stock are eligible for the following tax-free benefits

(Multiple Choice)

4.8/5  (39)

(39)

On April 4, 2014, Joan contributes business equipment (she had purchased on October 23, 2010)having a $45,000 FMV and a $40,000 adjusted basis to the EJK Partnership in exchange for a 25% interest in the capital and profits. The basis of the property and the date the holding period begins for the partnership is

(Multiple Choice)

4.9/5  (41)

(41)

Many professional service partnerships have adopted the LLP form primarily because it

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following assets may cause a partner to recognize ordinary income rather than capital gain on the sale of a partnership interest?

(Multiple Choice)

4.8/5  (35)

(35)

Separately stated items are allocated to the S corporation shareholders based on the number of shares of stock owned on the last day of the S corporation's taxable year.

(True/False)

4.8/5  (44)

(44)

A business distributes land to one of its owners. The business purchased the land a few years ago for $15,000, but it is now worth $35,000. Compare the treatment of this distribution when made by a partnership as opposed to an S corporation. Consider the impact on the business and the partner/shareholder and the determination of basis in the property.

(Essay)

4.9/5  (51)

(51)

The corporate built-in gains tax does not apply to a corporation that has always been taxed as an S corporation.

(True/False)

4.7/5  (32)

(32)

Limited liability of partners or members is an advantage of all the following with the exception of

(Multiple Choice)

4.9/5  (40)

(40)

Martha transferred property with a FMV of $60,000 (adjusted basis $30,000), which is subject to a $40,000 mortgage in exchange for a one-third interest in a partnership. The partnership has no other liabilities. The partners of MNO own the partnership equally. The partnership's basis in the property contributed is

(Multiple Choice)

4.9/5  (45)

(45)

On July 1, Joseph, a 10% owner, sells his interest in ABC Partnership to Andy, an outsider, for $165,000 cash and the release from $20,000 of partnership liabilities. Joseph's partnership interest at the beginning of the year was $120,000. The partnership earned income through June 30 of $100,000. Joseph's share of partnership liabilities increased by $5,000 from January 1 to June 30. What are the tax consequences to Joseph on the sale of his partnership interest (assume the partnership does not hold any inventory or unrealized receivables)?

(Multiple Choice)

4.8/5  (41)

(41)

The basis of a partner's interest in a partnership is adjusted to reflect each partner's share of income and deduction items only if a distribution is made to the partners.

(True/False)

4.9/5  (40)

(40)

David and Joycelyn form an equal partnership in the current year. No special allocation is provided for in the partnership agreement. During the year David contributes land having a $90,000 basis and a $100,000 FMV in exchange for the initial partnership interest. In addition, the partnership earns $50,000 of ordinary income while partnership liabilities increase from zero to $30,000 by the end of the tax year. The partnership earns $20,000 of tax-exempt interest during the year. David's basis at the end of the current year is

(Multiple Choice)

4.7/5  (42)

(42)

Dori and Matt will be equal owners of a new business and will be making cash contributions to start up the business. They expect substantial losses in the early years so the business will take out a loan from the bank which Dori and Matt will have to guarantee. For tax purposes, the preferred business form for these early years will be

(Multiple Choice)

4.7/5  (42)

(42)

Marisa has a 75% interest in the MM Partnership. She sells the partnership a building used in her business for $150,000. Her adjusted basis of the building was $120,000. Marisa had used straight-line depreciation. What are the tax consequences to Marisa of this transaction?

(Essay)

4.9/5  (37)

(37)

Members of a single family may be counted as one shareholder for S corporation purposes.

(True/False)

4.9/5  (40)

(40)

On January 1 of this year (assume not a leap year), Anne bought 50% of a calendar year S corporation. Anne purchased the remaining 50% on July 1. Anne's adjusted basis in the stock is $277,000 before any basis adjustments are taken into account. For this year, the corporation had a net operating loss of $365,000. What is the amount of the corporation's loss that Anne can deduct on her current individual income tax return?

(Multiple Choice)

4.9/5  (35)

(35)

Ariel receives from her partnership a nonliquidating distribution of $9,000 cash plus a parcel of land. The partnership had purchased the land five years ago for $20,000, but it is worth $28,000 at the time of the distribution. Ariel's predistribution basis is $17,000. How much income will Ariel recognize due to the distribution, and what is her basis in the land?

(Multiple Choice)

4.8/5  (38)

(38)

On July 1, Alexandra contributes business equipment (which she had purchased two years ago)having a $45,000 FMV and a $40,000 adjusted basis to the AX Partnership in exchange for a 25% interest in the capital and profits. The basis of Alexandra's partnership interest is

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following characteristics can disqualify a corporation from S Corporation status?

(Multiple Choice)

4.8/5  (38)

(38)

Showing 101 - 120 of 133

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)