Exam 25: International Diversification

Exam 1: The Investment Environment51 Questions

Exam 2: Financial Markets, Asset Classes and Financial Instruments82 Questions

Exam 3: How Securities Are Traded65 Questions

Exam 4: Mutual Funds and Other Investment Companies59 Questions

Exam 5: Risk, Return, and the Historical Record64 Questions

Exam 6: Capital Allocation to Risky Assets59 Questions

Exam 7: Optimal Risky Portfolios63 Questions

Exam 8: Index Models76 Questions

Exam 9: The Capital Asset Pricing Model71 Questions

Exam 10: Arbitrage Pricing Theory and Multifactor Models of Risk and Return62 Questions

Exam 11: The Efficient Market Hypothesis42 Questions

Exam 12: Behavioural Finance and Technical Analysis41 Questions

Exam 13: Empirical Evidence on Security Returns41 Questions

Exam 14: Bond Prices and Yields110 Questions

Exam 15: The Term Structure of Interest Rates58 Questions

Exam 16: Managing Bond Portfolios69 Questions

Exam 17: Macroeconomic and Industry Analysis67 Questions

Exam 18: Equity Valuation Models106 Questions

Exam 19: Financial Statement Analysis71 Questions

Exam 20: Options Markets: Introduction88 Questions

Exam 21: Option Valuation85 Questions

Exam 22: Futures Markets85 Questions

Exam 23: Futures, Swaps, and Risk Management51 Questions

Exam 24: Portfolio Performance Evaluation68 Questions

Exam 25: International Diversification48 Questions

Exam 26: Hedge Funds46 Questions

Exam 27: The Theory of Active Portfolio Management48 Questions

Exam 28: Investment Policy and the Framework of the Cfa Institute76 Questions

Select questions type

Which equity index had the highest volatility in terms of U.S.dollar-denominated returns for the period of five years ending in October 2016?

(Multiple Choice)

4.9/5  (33)

(33)

The possibility of experiencing a drop in revenue or an increase in cost in an international transaction due to a change in foreign exchange rates is called

(Multiple Choice)

4.8/5  (32)

(32)

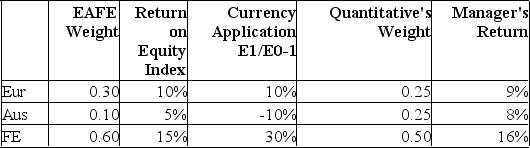

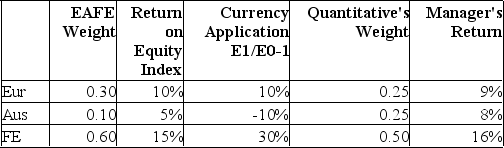

The manager of Quantitative International Fund uses EAFE as a benchmark.Last year's performance for the fund and the benchmark were as follows:  Calculate Quantitative's country selection return contribution.

Calculate Quantitative's country selection return contribution.

(Multiple Choice)

4.7/5  (34)

(34)

The interest rate on a 1-year Canadian security is 7.8%.The current exchange rate is C$ = US $0.79.The 1-year forward rate is C$ = US $0.77.The return (denominated in U.S.$) that a U.S.investor can earn by investing in the Canadian security is

(Multiple Choice)

4.7/5  (24)

(24)

In 2015, the U.S.equity market represented __________ of the world equity market.

(Multiple Choice)

4.9/5  (37)

(37)

The present exchange rate is C$ = U.S.$0.78.The 1-year future rate is C$ = U.S.$0.76.The yield on a 1-year U.S.bill is 4%.A yield of __________ on a 1-year Canadian bill will make an investor indifferent between investing in the U.S.bill and the Canadian bill.

(Multiple Choice)

4.8/5  (32)

(32)

Assume there is a fixed exchange rate between the Canadian and U.S.dollar.The expected return and standard deviation of return on the U.S.stock market are 18% and 15%, respectively.The expected return and standard deviation on the Canadian stock market are 13% and 20%, respectively.The covariance of returns between the U.S.and Canadian stock markets is 1.5%. If you invested 50% of your money in the Canadian stock market and 50% in the U.S.stock market, the expected return on your portfolio would be

(Multiple Choice)

4.9/5  (32)

(32)

The manager of Quantitative International Fund uses EAFE as a benchmark.Last year's performance for the fund and the benchmark were as follows:  Calculate Quantitative's stock selection return contribution.

Calculate Quantitative's stock selection return contribution.

(Multiple Choice)

4.7/5  (37)

(37)

__________ refers to the possibility of expropriation of assets, changes in tax policy, and the possibility of restrictions on foreign exchange transactions.

(Multiple Choice)

4.7/5  (29)

(29)

Suppose the 1-year risk-free rate of return in Canada is 4% and the 1-year risk-free rate of return in Britain is 6%.The current exchange rate is 1 pound = Cad.$1.67.A 1-year future exchange rate of __________ for the pound would make a Canadian investor indifferent between investing in the Canadian security and investing in the British security.

(Multiple Choice)

4.9/5  (40)

(40)

Suppose the 1-year risk-free rate of return in Canada.is 4.5% and the 1-year risk-free rate of return in Britain is 7.7%.The current exchange rate is 1 pound = Cad.$1.60.A 1-year future exchange rate of __________ for the pound would make a Canadian investor indifferent between investing in the Canadian security and investing in the British security.

(Multiple Choice)

4.8/5  (34)

(34)

The interplay between interest rate differentials and exchange rates, such that each adjusts until the foreign exchange market and the money market reach equilibrium, is called the

(Multiple Choice)

4.8/5  (35)

(35)

Which equity index had the lowest volatility in terms of U.S.dollar-denominated returns for the period of five years ending in October 2016?

(Multiple Choice)

4.8/5  (35)

(35)

Which country has the largest stock market compared to GDP?

(Multiple Choice)

4.8/5  (26)

(26)

The possibility of experiencing a drop in revenue or an increase in cost in an international transaction due to a change in foreign exchange rates is called

(Multiple Choice)

4.9/5  (30)

(30)

Showing 21 - 40 of 48

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)