Exam 15: The Term Structure of Interest Rates

Exam 1: The Investment Environment51 Questions

Exam 2: Financial Markets, Asset Classes and Financial Instruments82 Questions

Exam 3: How Securities Are Traded65 Questions

Exam 4: Mutual Funds and Other Investment Companies59 Questions

Exam 5: Risk, Return, and the Historical Record64 Questions

Exam 6: Capital Allocation to Risky Assets59 Questions

Exam 7: Optimal Risky Portfolios63 Questions

Exam 8: Index Models76 Questions

Exam 9: The Capital Asset Pricing Model71 Questions

Exam 10: Arbitrage Pricing Theory and Multifactor Models of Risk and Return62 Questions

Exam 11: The Efficient Market Hypothesis42 Questions

Exam 12: Behavioural Finance and Technical Analysis41 Questions

Exam 13: Empirical Evidence on Security Returns41 Questions

Exam 14: Bond Prices and Yields110 Questions

Exam 15: The Term Structure of Interest Rates58 Questions

Exam 16: Managing Bond Portfolios69 Questions

Exam 17: Macroeconomic and Industry Analysis67 Questions

Exam 18: Equity Valuation Models106 Questions

Exam 19: Financial Statement Analysis71 Questions

Exam 20: Options Markets: Introduction88 Questions

Exam 21: Option Valuation85 Questions

Exam 22: Futures Markets85 Questions

Exam 23: Futures, Swaps, and Risk Management51 Questions

Exam 24: Portfolio Performance Evaluation68 Questions

Exam 25: International Diversification48 Questions

Exam 26: Hedge Funds46 Questions

Exam 27: The Theory of Active Portfolio Management48 Questions

Exam 28: Investment Policy and the Framework of the Cfa Institute76 Questions

Select questions type

The yield curve shows at any point in time

Free

(Multiple Choice)

4.9/5  (33)

(33)

Correct Answer:

C

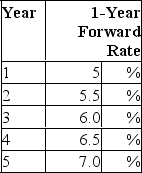

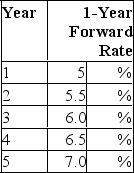

Calculate the price at the beginning of year 1 of an 8% annual coupon bond with face value $1,000 and 5 years to maturity.

Calculate the price at the beginning of year 1 of an 8% annual coupon bond with face value $1,000 and 5 years to maturity.

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

C

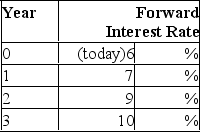

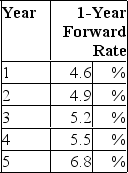

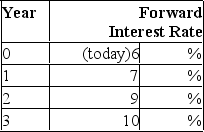

Suppose that all investors expect that interest rates for the 4 years will be as follows:  What is the price of a 2-year maturity bond with a 10% coupon rate paid annually? (Par value = $1,000)

What is the price of a 2-year maturity bond with a 10% coupon rate paid annually? (Par value = $1,000)

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

D

Given the yield on a 3-year zero-coupon bond is 7.2% and forward rates of 6.1% in year 1 and 6.9% in year 2, what must be the forward rate in year 3?

(Multiple Choice)

4.9/5  (40)

(40)

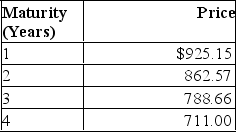

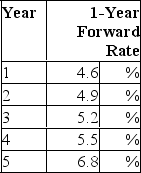

The following is a list of prices for zero-coupon bonds with different maturities and par values of $1,000.  According to the expectations theory, what is the expected forward rate in the third year?

According to the expectations theory, what is the expected forward rate in the third year?

(Multiple Choice)

4.8/5  (35)

(35)

What would the yield to maturity be on a four-year zero-coupon bond purchased today?

What would the yield to maturity be on a four-year zero-coupon bond purchased today?

(Multiple Choice)

4.8/5  (30)

(30)

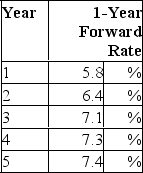

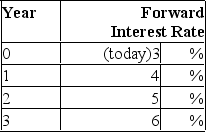

What should the purchase price of a 5-year zero-coupon bond be if it is purchased today and has face value of $1,000?

What should the purchase price of a 5-year zero-coupon bond be if it is purchased today and has face value of $1,000?

(Multiple Choice)

4.8/5  (38)

(38)

Suppose that all investors expect that interest rates for the 4 years will be as follows:  What is the price of a 2-year maturity bond with a 5% coupon rate paid annually? (Par value = $1,000.)

What is the price of a 2-year maturity bond with a 5% coupon rate paid annually? (Par value = $1,000.)

(Multiple Choice)

4.7/5  (38)

(38)

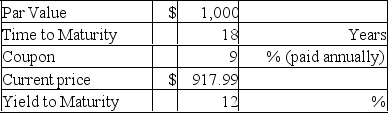

Given the bond described above, if interest were paid semi-annually (rather than annually) and the bond continued to be priced at $917.99, the resulting effective annual yield to maturity would be

Given the bond described above, if interest were paid semi-annually (rather than annually) and the bond continued to be priced at $917.99, the resulting effective annual yield to maturity would be

(Multiple Choice)

4.9/5  (28)

(28)

What should the purchase price of a 2-year zero-coupon bond be if it is purchased at the beginning of year 2 and has face value of $1,000?

What should the purchase price of a 2-year zero-coupon bond be if it is purchased at the beginning of year 2 and has face value of $1,000?

(Multiple Choice)

4.7/5  (37)

(37)

Given the yield on a 3-year zero-coupon bond is 7% and forward rates of 6% in year 1 and 6.5% in year 2, what must be the forward rate in year 3?

(Multiple Choice)

4.8/5  (29)

(29)

Suppose that all investors expect that interest rates for the 4 years will be as follows:  What is the yield to maturity of a 3-year zero-coupon bond?

What is the yield to maturity of a 3-year zero-coupon bond?

(Multiple Choice)

4.8/5  (46)

(46)

If the value of a Treasury bond was lower than the value of the sum of its parts (STRIPPED cash flows), you could

(Multiple Choice)

4.9/5  (37)

(37)

What should the purchase price of a 1-year zero-coupon bond be if it is purchased today and has face value of $1,000?

What should the purchase price of a 1-year zero-coupon bond be if it is purchased today and has face value of $1,000?

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following combinations will result in a sharply-increasing yield curve?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 1 - 20 of 58

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)