Exam 18: Who Gets What the Distribution of Income

Exam 1: Economics and Economic Reasoning158 Questions

Exam 2: The Production Possibility Model, Trade, and Globalization133 Questions

Exam 3: Economic Institutions163 Questions

Exam 4: Supply and Demand182 Questions

Exam 5: Using Supply and Demand163 Questions

Exam 6: Describing Supply and Demand: Elasticities216 Questions

Exam 7: Taxation and Government Intervention201 Questions

Exam 8: Market Failure Versus Government Failure197 Questions

Exam 9: Comparative Advantage, Exchange Rates, and Globalization118 Questions

Exam 10: International Trade Policy99 Questions

Exam 11: Production and Cost Analysis I194 Questions

Exam 12: Production and Cost Analysis II152 Questions

Exam 13: Perfect Competition170 Questions

Exam 14: Monopoly and Monopolistic Competition274 Questions

Exam 15: Oligopoly and Antitrust Policy142 Questions

Exam 16: Real-World Competition and Technology108 Questions

Exam 17: Work and the Labor Market150 Questions

Exam 18: Who Gets What the Distribution of Income131 Questions

Exam 19: The Logic of Individual Choice: the Foundation of Supply and Demand170 Questions

Exam 20: Game Theory, Strategic Decision Making, and Behavioral Economics103 Questions

Exam 21: Thinking Like a Modern Economist97 Questions

Exam 22: Behavioral Economics and Modern Economic Policy126 Questions

Exam 23: Microeconomic Policy, Economic Reasoning, and Beyond134 Questions

Exam 24: Economic Growth, Business Cycles, and Unemployment124 Questions

Exam 25: Measuring and Describing the Aggregate Economy229 Questions

Exam 26: The Keynesian Short-Run Policy Model: Demand-Side Policies220 Questions

Exam 27: The Classical Long-Run Policy Model: Growth and Supply-Side Policies133 Questions

Exam 28: The Financial Sector and the Economy214 Questions

Exam 29: Monetary Policy243 Questions

Exam 30: Financial Crises, Panics, and Unconventional Monetary Policy109 Questions

Exam 31: Deficits and Debt: the Austerity Debate150 Questions

Exam 32: The Fiscal Policy Dilemma119 Questions

Exam 33: Jobs and Unemployment78 Questions

Exam 34: Inflation, Deflation, and Macro Policy175 Questions

Exam 35: International Financial Policy211 Questions

Exam 36: Macro Policy in a Global Setting134 Questions

Exam 37: Structural Stagnation and Globalization125 Questions

Exam 38: Macro Policy in Developing Countries142 Questions

Select questions type

Which of the following Gini coefficients represents the income distribution closest to being equal?

(Multiple Choice)

4.8/5  (31)

(31)

In some countries the tax system is more progressive than in the U.S.What impact does this have on income inequality? What impact do you think this has on entrepreneurial activity?

(Essay)

4.8/5  (31)

(31)

Which of the following statements is a correct interpretation of some economists' views?

(Multiple Choice)

4.8/5  (38)

(38)

An increase in the tax rate can cause total tax collections to fall if:

(Multiple Choice)

4.9/5  (42)

(42)

U.S. poverty figures do not include in-kind transfers or underreporting of income.

(True/False)

4.8/5  (41)

(41)

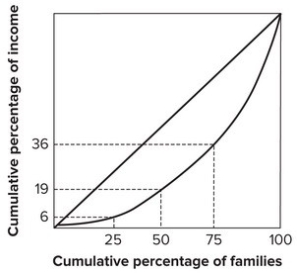

Refer to the graph shown.  The poorest 50 percent of the families earn:

The poorest 50 percent of the families earn:

(Multiple Choice)

5.0/5  (45)

(45)

When measuring income distribution according to class,how does the U.S.compare to most developing countries?

(Essay)

4.9/5  (46)

(46)

On the Lorenz curve, a perfectly equal distribution of income would be represented by:

(Multiple Choice)

4.8/5  (35)

(35)

Showing 121 - 131 of 131

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)