Exam 9: Net Present Value and Other Investment Criteria

Exam 1: Introduction to Corporate Finance256 Questions

Exam 2: Financial Statements, Cash Flow, and Taxes412 Questions

Exam 3: Working With Financial Statements408 Questions

Exam 4: Long-Term Financial Planning and Corporate Growth379 Questions

Exam 5: Introduction to Valuation: the Time Value of Money280 Questions

Exam 6: Discounted Cash Flow Valuation413 Questions

Exam 7: Interest Rates and Bond Valuation393 Questions

Exam 8: Stock Valuation399 Questions

Exam 9: Net Present Value and Other Investment Criteria415 Questions

Exam 10: Making Capital Investment Decisions363 Questions

Exam 11: Project Analysis and Evaluation425 Questions

Exam 12: Lessons From Capital Market History329 Questions

Exam 13: Return, Risk, and the Security Market Line416 Questions

Exam 14: Cost of Capital377 Questions

Exam 15: Raising Capital337 Questions

Exam 16: Financial Leverage and Capital Structure Policy383 Questions

Exam 17: Dividends and Dividend Policy376 Questions

Exam 18: Short-Term Finance and Planning424 Questions

Exam 19: Cash and Liquidity Management374 Questions

Exam 20: Credit and Inventory Management384 Questions

Exam 21: International Corporate Finance369 Questions

Exam 22: Leasing269 Questions

Exam 23: Mergers and Acquisitions335 Questions

Exam 24: Enterprise Risk Management300 Questions

Exam 25: Options and Corporate Securities445 Questions

Exam 26: Behavioural Finance: Implications for Financial Management76 Questions

Select questions type

A project produces annual net income of $14,600, $18,700, and $23,500 over three years, respectively. The initial cost of the project is $310,800. This cost is depreciated straight-line to a zero book value over three years. What is the average accounting rate of return if the required discount rate is 9 %?

(Multiple Choice)

4.7/5  (31)

(31)

Without using formulas, provide a definition of net present value profile.

(Essay)

4.8/5  (34)

(34)

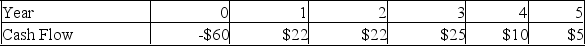

What is the discounted payback of the following project if the required return is 14%?

(Multiple Choice)

4.9/5  (38)

(38)

Which one of the following statements concerning net present value (NPV) is correct?

(Multiple Choice)

5.0/5  (34)

(34)

According to the capital budgeting surveys cited in the text, in general, most financial managers of large Canadian firms:

(Multiple Choice)

4.8/5  (33)

(33)

Without using formulas, provide a definition of discounted payback period.

(Essay)

4.8/5  (36)

(36)

Yancy is considering a project which will produce cash inflows of $900 a year for 4 years. The project has a 9 % required rate of return and an initial cost of $2,800. What is the discounted payback period?

(Multiple Choice)

4.7/5  (27)

(27)

Martha's Cupboards just purchased $172,500 of new equipment. The equipment is expected to increase the net income of the firm by $15,000, $35,000, $25,000, and $10,000 a year in each of the next four years. Martha's uses straight-line depreciation over the projected life of each project. What is the average accounting rate of return on this equipment?

(Multiple Choice)

4.9/5  (42)

(42)

NPV and IRR can lead to different decisions in situations where the IRR is negative.

(True/False)

4.9/5  (37)

(37)

You need to borrow $2,000 quickly, and the local pawn shop will give it to you if you promise to repay them $200.92 monthly over the next year.

Suppose that the pawn shop's cost of funds is 12%, compounded monthly. From its viewpoint, what is the NPV of this deal?

(Multiple Choice)

4.8/5  (32)

(32)

Determining whether to sell bonds or issue stock is a capital budgeting decision.

(True/False)

4.7/5  (37)

(37)

By definition, the net present value is equal to zero when the discount rate is equal to the:

(Multiple Choice)

4.9/5  (36)

(36)

A project will produce cash inflows of $1,750 a year for four years. The project initially costs $10,600 to get started. In year five, the project will be closed and as a result should produce a cash inflow of $8,500. What is the net present value of this project if the required rate of return is 13.75 %?

(Multiple Choice)

4.9/5  (36)

(36)

A four-year project has an initial outlay of $100,000. The future cash inflows from its project are $50,000 for years one and two and $40,000 for years three and four. Given a discount rate of 10%, will the project be accepted?

(Multiple Choice)

4.8/5  (26)

(26)

A financial manager who consistently underestimates the ___________ will tend to incorrectly reject projects that would actually create wealth for the stockholders.

(Multiple Choice)

4.9/5  (38)

(38)

You need to borrow $2,000 quickly, and the local pawn shop will give it to you if you promise to repay them $200.92 monthly over the next year.

Suppose the pawn shop has more customers than funds. Which capital budgeting technique would allow it to rank potential customers in order to maximize current wealth?

(Multiple Choice)

4.8/5  (36)

(36)

A 25- year project has a cost of $1,500,000 and has annual cash flows of $400,000 in years 1-15, and $200,000 in years 16-25. The company's required rate is 14%. Given this information, calculate the payback of the project.

(Multiple Choice)

4.8/5  (41)

(41)

When the present value of the cash inflows exceeds the initial cost of a project, then the project should be:

(Multiple Choice)

4.8/5  (38)

(38)

For a project with an initial investment of $40,000 and cash inflows of $11,000 a year for five years, calculate NPV given a required return of 11.65%.

(Multiple Choice)

5.0/5  (30)

(30)

Showing 361 - 380 of 415

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)