Exam 21: Forward and Futures Contracts

Exam 1: The Investment Setting78 Questions

Exam 2: The Asset Allocation Decision80 Questions

Exam 3: Selecting Investments in a Global Market80 Questions

Exam 4: Organization and Functioning of Securities Markets91 Questions

Exam 5: Security-Market Indexes84 Questions

Exam 6: Efficient Capital Markets90 Questions

Exam 7: An Introduction to Portfolio Management97 Questions

Exam 8: An Introduction to Asset Pricing Models119 Questions

Exam 9: Multifactor Models of Risk and Return59 Questions

Exam 10: Analysis of Financial Statements89 Questions

Exam 11: Introduction to Security Valuation86 Questions

Exam 12: Macroanalysis and Microvaluation of the Stock Market119 Questions

Exam 13: Industry Analysis90 Questions

Exam 14: Company Analysis and Stock Valuation133 Questions

Exam 15: Technical Analysis83 Questions

Exam 16: Equity Portfolio Management Strategies58 Questions

Exam 17: Bond Fundamentals89 Questions

Exam 18: The Analysis and Valuation of Bonds108 Questions

Exam 19: Bond Portfolio Management Strategies87 Questions

Exam 20: An Introduction to Derivative Markets and Securities108 Questions

Exam 21: Forward and Futures Contracts99 Questions

Exam 22: Option Contracts106 Questions

Exam 23: Swap Contracts, Convertible Securities, and Other Embedded Derivatives87 Questions

Exam 24: Professional Money Management, Alternative Assets, and Industry Ethics102 Questions

Exam 25: Evaluation of Portfolio Performance96 Questions

Select questions type

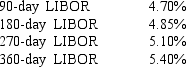

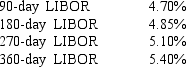

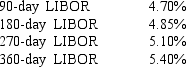

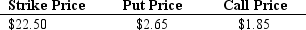

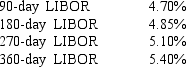

Exhibit 21.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

As a relationship officer for a money-center commercial bank, one of your corporate accounts has just approached you about a one-year loan for $3,000,000. The customer would pay a quarterly interest expense based on the prevailing level of LIBOR at the beginning of each quarter. As is the bank's convention on all such loans, the amount of the interest payment would then be paid at the end of the quarterly cycle when the new rate for the next cycle is determined. You observe the following LIBOR yield curve in the cash market:

-A bond portfolio manager expects a cash inflow of $12,000,000. The manager plans to hedge potential risk with a Treasury futures contract with a value of $105,215. The conversion factor between the CTD and the bond specified in the Treasury futures contract is 0.85. The duration of bond portfolio is 8 years, and the duration of the CTD bond is 6.5 years. Indicate the number of contracts required and whether the position to be taken is short or long.

-A bond portfolio manager expects a cash inflow of $12,000,000. The manager plans to hedge potential risk with a Treasury futures contract with a value of $105,215. The conversion factor between the CTD and the bond specified in the Treasury futures contract is 0.85. The duration of bond portfolio is 8 years, and the duration of the CTD bond is 6.5 years. Indicate the number of contracts required and whether the position to be taken is short or long.

(Multiple Choice)

4.9/5  (36)

(36)

Exhibit 21.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

As a relationship officer for a money-center commercial bank, one of your corporate accounts has just approached you about a one-year loan for $3,000,000. The customer would pay a quarterly interest expense based on the prevailing level of LIBOR at the beginning of each quarter. As is the bank's convention on all such loans, the amount of the interest payment would then be paid at the end of the quarterly cycle when the new rate for the next cycle is determined. You observe the following LIBOR yield curve in the cash market:

-Refer to Exhibit 21.3. What is the implied 90-day forward rate at the beginning of the second quarter?

-Refer to Exhibit 21.3. What is the implied 90-day forward rate at the beginning of the second quarter?

(Multiple Choice)

4.8/5  (28)

(28)

Exhibit 21.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

As a relationship officer for a money-center commercial bank, one of your corporate accounts has just approached you about a one-year loan for $3,000,000. The customer would pay a quarterly interest expense based on the prevailing level of LIBOR at the beginning of each quarter. As is the bank's convention on all such loans, the amount of the interest payment would then be paid at the end of the quarterly cycle when the new rate for the next cycle is determined. You observe the following LIBOR yield curve in the cash market:

-Refer to Exhibit 21.3. If 90-day LIBOR rises to the levels "predicted" by the implied forward rates, what will the dollar level of the bank's interest receipt be at the end of the second quarter?

-Refer to Exhibit 21.3. If 90-day LIBOR rises to the levels "predicted" by the implied forward rates, what will the dollar level of the bank's interest receipt be at the end of the second quarter?

(Multiple Choice)

5.0/5  (38)

(38)

The most popular financial futures in terms of average daily volume is the

(Multiple Choice)

5.0/5  (34)

(34)

Exhibit 21.11

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider a portfolio manager with a $10,000,000 equity portfolio under management. The manager wishes to hedge against a decline in share values using stock index futures. Currently a stock index future is priced at 1350 and has a multiplier of 250. The portfolio beta is 1.50.

-Refer to Exhibit 21.11. Assume that a month later the equity portfolio has a market value of $10,000,000 and the stock index future is priced at 1300 with a multiplier of 250. Calculate the profit (loss) on the stock index futures position.

(Multiple Choice)

4.8/5  (38)

(38)

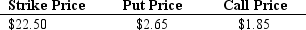

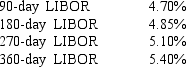

Exhibit 22.8

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider the following information on put and call options for a common stock

-Since futures contracts are "marked-to-market" daily, the gains and losses are settled daily.

-Since futures contracts are "marked-to-market" daily, the gains and losses are settled daily.

(True/False)

4.9/5  (37)

(37)

Exhibit 21.9

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

As a portfolio manager, you are responsible for a $150 million portfolio, 90 percent of which is invested in equities, with a portfolio beta of 1.25. You are utilizing the S&P 500 as your passive benchmark. Currently the S&P 500 is valued at 1202. The value of the S&P 500 futures contract is equal to $250 times the value of the index. The beta of the futures contract is 1.0.

-Refer to Exhibit 21.9. If you anticipate a cash outflow of $5 million next week, how many futures contracts should you buy or sell in order to mitigate the effect of this outflow on the portfolio's performance (rounded to the nearest integer)?

(Multiple Choice)

4.9/5  (42)

(42)

Interest rate parity is a key concept in managing risk in the commodities market.

(True/False)

4.8/5  (37)

(37)

Exhibit 22.8

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider the following information on put and call options for a common stock

-Some forward contracts, particularly in the foreign exchange market, are quite standard and liquid.

-Some forward contracts, particularly in the foreign exchange market, are quite standard and liquid.

(True/False)

4.9/5  (33)

(33)

Exhibit 21.10

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The S&P 500 stock index is at 1300. The annualized interest rate is 4.0% and the annualized dividend is 2%. You are currently considering purchasing a 2-month futures contract for your portfolio.

-Refer to Exhibit 21.10. Calculate the current price of the futures contract.

(Multiple Choice)

4.9/5  (40)

(40)

Exhibit 21.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

As a relationship officer for a money-center commercial bank, one of your corporate accounts has just approached you about a one-year loan for $3,000,000. The customer would pay a quarterly interest expense based on the prevailing level of LIBOR at the beginning of each quarter. As is the bank's convention on all such loans, the amount of the interest payment would then be paid at the end of the quarterly cycle when the new rate for the next cycle is determined. You observe the following LIBOR yield curve in the cash market:

-Refer to Exhibit 21.3. If 90-day LIBOR rises to the levels "predicted" by the implied forward rates, what will the dollar level of the bank's interest receipt be at the end of the fourth quarter?

-Refer to Exhibit 21.3. If 90-day LIBOR rises to the levels "predicted" by the implied forward rates, what will the dollar level of the bank's interest receipt be at the end of the fourth quarter?

(Multiple Choice)

4.8/5  (42)

(42)

Exhibit 21.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

As a relationship officer for a money-center commercial bank, one of your corporate accounts has just approached you about a one-year loan for $3,000,000. The customer would pay a quarterly interest expense based on the prevailing level of LIBOR at the beginning of each quarter. As is the bank's convention on all such loans, the amount of the interest payment would then be paid at the end of the quarterly cycle when the new rate for the next cycle is determined. You observe the following LIBOR yield curve in the cash market:

-Refer to Exhibit 21.3. Assuming the yields inferred from the Eurodollar futures contract prices for the next three settlement periods are equal to the implied forward rates, calculate the dollar value of the annuity that would leave the bank indifferent between making the floating-rate loan and hedging it in the futures market, and making a one-year fixed-rate loan.

-Refer to Exhibit 21.3. Assuming the yields inferred from the Eurodollar futures contract prices for the next three settlement periods are equal to the implied forward rates, calculate the dollar value of the annuity that would leave the bank indifferent between making the floating-rate loan and hedging it in the futures market, and making a one-year fixed-rate loan.

(Multiple Choice)

4.9/5  (36)

(36)

Exhibit 21.5

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The S&P 500 stock index is at 1100. The annualized interest rate is 3.5% and the annualized dividend is 2%.

-Refer to Exhibit 21.5. If the futures contract was currently available for 1250, indicate the appropriate strategy that would earn an arbitrage profit.

(Multiple Choice)

4.9/5  (36)

(36)

The Chicago Board of Trade (CBT) uses conversion factors to correct for differences in deliverable bonds.

(True/False)

4.9/5  (37)

(37)

If you have entered into a currency futures hedge for the Japanese yen in connection with buying Japanese equipment, if the yen goes from 110 yen/$1 to 100 yen/$1, you will lose in the spot market but have an offsetting gain in the futures market.

(True/False)

4.7/5  (41)

(41)

The basis (Bt,T) at time t between the spot price (St) and a futures contract expiring at time T (Ft,T) is: St -Ft,T.

(True/False)

4.8/5  (37)

(37)

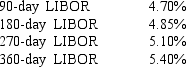

Exhibit 21.7

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Assume that you observe the following prices in the T-Bill and Eurodollar futures markets

-Refer to Exhibit 21.7. Assume that a month later the price of the September T-Bill future is 96.25 and the price of the Eurodollar future is 95.9. Calculate the profit on the T-Bill futures position.

-Refer to Exhibit 21.7. Assume that a month later the price of the September T-Bill future is 96.25 and the price of the Eurodollar future is 95.9. Calculate the profit on the T-Bill futures position.

(Multiple Choice)

4.8/5  (37)

(37)

Exhibit 21.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

As a relationship officer for a money-center commercial bank, one of your corporate accounts has just approached you about a one-year loan for $3,000,000. The customer would pay a quarterly interest expense based on the prevailing level of LIBOR at the beginning of each quarter. As is the bank's convention on all such loans, the amount of the interest payment would then be paid at the end of the quarterly cycle when the new rate for the next cycle is determined. You observe the following LIBOR yield curve in the cash market:

-Assume that you manage an equity portfolio. The portfolio beta is 1.15. You anticipate a rise in equity values and wish to increase equity exposure on $500 million of the portfolio. Calculate the number of contracts you would need to hedge your position and indicate whether you would go short or long. Assume that the price of the S&P 500 futures contract is 1105 and the multiplier is 250.

-Assume that you manage an equity portfolio. The portfolio beta is 1.15. You anticipate a rise in equity values and wish to increase equity exposure on $500 million of the portfolio. Calculate the number of contracts you would need to hedge your position and indicate whether you would go short or long. Assume that the price of the S&P 500 futures contract is 1105 and the multiplier is 250.

(Multiple Choice)

4.8/5  (39)

(39)

The bond that maximizes the difference between the invoice price and the delivery price is referred to as the

(Multiple Choice)

5.0/5  (40)

(40)

Exhibit 21.10

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The S&P 500 stock index is at 1300. The annualized interest rate is 4.0% and the annualized dividend is 2%. You are currently considering purchasing a 2-month futures contract for your portfolio.

-Refer to Exhibit 21.10. If the futures contract was currently available for 1280, indicate the appropriate strategy that would earn an arbitrage profit.

(Multiple Choice)

4.9/5  (45)

(45)

Showing 41 - 60 of 99

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)