Exam 8: An Introduction to Asset Pricing Models

Exam 1: The Investment Setting78 Questions

Exam 2: The Asset Allocation Decision80 Questions

Exam 3: Selecting Investments in a Global Market80 Questions

Exam 4: Organization and Functioning of Securities Markets91 Questions

Exam 5: Security-Market Indexes84 Questions

Exam 6: Efficient Capital Markets90 Questions

Exam 7: An Introduction to Portfolio Management97 Questions

Exam 8: An Introduction to Asset Pricing Models119 Questions

Exam 9: Multifactor Models of Risk and Return59 Questions

Exam 10: Analysis of Financial Statements89 Questions

Exam 11: Introduction to Security Valuation86 Questions

Exam 12: Macroanalysis and Microvaluation of the Stock Market119 Questions

Exam 13: Industry Analysis90 Questions

Exam 14: Company Analysis and Stock Valuation133 Questions

Exam 15: Technical Analysis83 Questions

Exam 16: Equity Portfolio Management Strategies58 Questions

Exam 17: Bond Fundamentals89 Questions

Exam 18: The Analysis and Valuation of Bonds108 Questions

Exam 19: Bond Portfolio Management Strategies87 Questions

Exam 20: An Introduction to Derivative Markets and Securities108 Questions

Exam 21: Forward and Futures Contracts99 Questions

Exam 22: Option Contracts106 Questions

Exam 23: Swap Contracts, Convertible Securities, and Other Embedded Derivatives87 Questions

Exam 24: Professional Money Management, Alternative Assets, and Industry Ethics102 Questions

Exam 25: Evaluation of Portfolio Performance96 Questions

Select questions type

Tobin's separation theory states that the market is a separate investment from the risk-free security.

Free

(True/False)

4.9/5  (37)

(37)

Correct Answer:

False

The planning period for the CAPM is the same length of time for every investor.

Free

(True/False)

4.8/5  (34)

(34)

Correct Answer:

False

Recently you have received a tip that the stock of Buttercup Industries is going to rise from $76.00 to $85.00 per share over the next year. You know that the annual return on the S&P 500 has been 13% and the 90-day T-bill rate has been yielding 3% per year over the past 10 years. If beta for Buttercup is 1.0, will you purchase the stock?

Free

(Multiple Choice)

4.8/5  (46)

(46)

Correct Answer:

D

Recently you have received a tip that the stock of Bubbly Incorporated is going to rise from $57 to $61 per share over the next year. You know that the annual return on the S&P 500 has been 9.25% and the 90-day T-bill rate has been yielding 3.75% per year over the past 10 years. If beta for Bubbly is 0.85, will you purchase the stock?

(Multiple Choice)

4.8/5  (31)

(31)

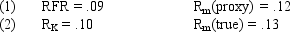

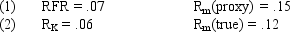

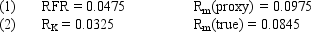

Assume that as a portfolio manager the beta of your portfolio is 1.2 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

(Multiple Choice)

4.9/5  (41)

(41)

Studies have shown the beta is more stable for portfolios than for individual securities.

(True/False)

4.8/5  (34)

(34)

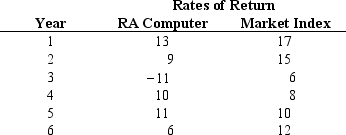

Exhibit 8.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 8.1. Compute the beta for RA Computer using the historic returns presented above.

-Refer to Exhibit 8.1. Compute the beta for RA Computer using the historic returns presented above.

(Multiple Choice)

4.9/5  (43)

(43)

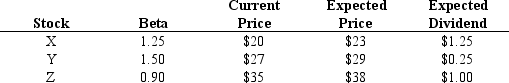

Exhibit 8.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

-Refer to Exhibit 8.2. What are the expected (required) rates of return for the three stocks (in the order X, Y, Z)?

-Refer to Exhibit 8.2. What are the expected (required) rates of return for the three stocks (in the order X, Y, Z)?

(Multiple Choice)

4.7/5  (40)

(40)

Assume that as a portfolio manager the beta of your portfolio is 1.1 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

(Multiple Choice)

4.8/5  (41)

(41)

The betas of those companies compiled by Value Line Investment Services tend to be almost identical to those compiled by Merrill Lynch.

(True/False)

4.8/5  (36)

(36)

Studies have shown that a well-diversified investor needs as few as five stocks.

(True/False)

4.9/5  (31)

(31)

The Capital Market Line (CML) refers only to those portfolios that lie on the line segment that extends from the risk-free asset to the point of tangency on the efficient frontier known as the market portfolio.

(True/False)

4.8/5  (25)

(25)

A friend has information that the stock of Zip Incorporated is going to rise from $62.00 to $65.00 per share over the next year. You know that the annual return on the S&P 500 has been 10% and the 90-day T-bill rate has been yielding 6% per year over the past 10 years. If beta for Zip is 0.9, will you purchase the stock?

(Multiple Choice)

4.8/5  (50)

(50)

Which of the following is not a major difference between the capital market line (CML) and the capital asset pricing model (CAPM)?

(Multiple Choice)

5.0/5  (27)

(27)

Securities with returns that lie below the security market line are undervalued.

(True/False)

4.8/5  (25)

(25)

Under the CAPM framework, the introduction of lending and borrowing at differential rates leads to a non-linear capital market line.

(True/False)

4.9/5  (33)

(33)

Assume that the risk-free rate of return is 3% and the market portfolio on the Capital Market Line (CML) has an expected return of 11% and a standard deviation of 14%. How should you invest $100,000 if you are only willing to accept a total portfolio risk of 8%?

(Multiple Choice)

4.9/5  (39)

(39)

Assume that as a portfolio manager the beta of your portfolio is 0.85 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 1 - 20 of 119

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)