Exam 8: Segment and Interim Reporting

Exam 19: Accounting for Estates and Trusts85 Questions

Exam 18: Accounting and Reporting for Private Not-For-Profit Organizations74 Questions

Exam 17: Accounting for State and Local Governments, Part II51 Questions

Exam 16: Accounting for State and Local Governments, Part I87 Questions

Exam 15: Partnerships: Termination and Liquidation73 Questions

Exam 14: Partnerships: Formation and Operation91 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations88 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission79 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards65 Questions

Exam 10: Translation of Foreign Currency Financial Statements101 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk108 Questions

Exam 8: Segment and Interim Reporting120 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues119 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions126 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership128 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition123 Questions

Exam 2: Consolidation of Financial Information124 Questions

Exam 1: The Equity Method of Accounting for Investments123 Questions

Select questions type

According to authoritative accounting literature, which of the following are required to be disclosed in interim reports?

(Multiple Choice)

4.9/5  (30)

(30)

Which of the following is not correct regarding inventory procedures reported in an interim financial statement?

(Multiple Choice)

4.8/5  (46)

(46)

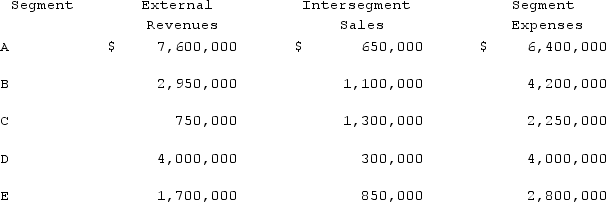

Natarajan, Inc. had the following operating segments, with the indicated amounts of segment revenues and segment expenses:  For purposes of the profit or loss test, segment C's operating profit or (loss) is

For purposes of the profit or loss test, segment C's operating profit or (loss) is

(Multiple Choice)

5.0/5  (37)

(37)

The following items are required to be disclosed for each operating segment except:

(Multiple Choice)

4.9/5  (26)

(26)

How does a company measure income tax expense to be reported in an interim period?

(Essay)

4.8/5  (36)

(36)

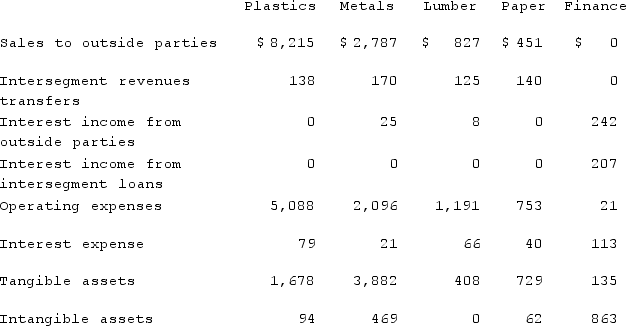

Faru Co. identified five industry segments: (1) plastics, (2) metals, (3) lumber, (4) paper, and (5) finance. The company properly consolidated the segments when it prepared its annual financial statements. Information describing each segment is presented below (in thousands).  Prepare the profit or loss test and determine which of these segments was separately reportable.

Prepare the profit or loss test and determine which of these segments was separately reportable.

(Essay)

4.8/5  (41)

(41)

Which items of information are required to be included in interim reports for each operating segment?

(Essay)

4.8/5  (45)

(45)

Which tests must a company use to determine which operating segments require separate disclosure?

(Multiple Choice)

4.8/5  (35)

(35)

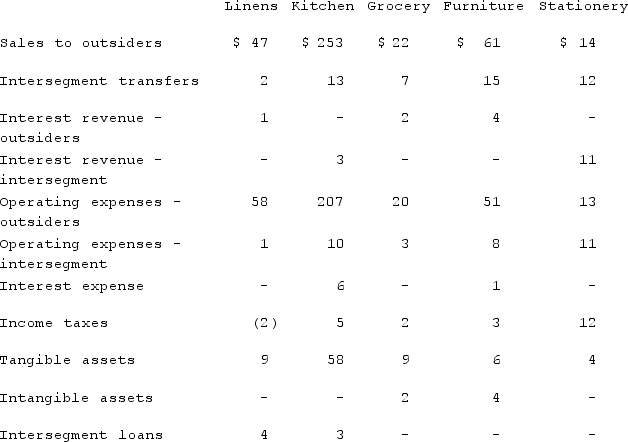

Blanton Corporation is comprised of five operating segments. Information about each of these segments is as follows (in thousands):  Required:

A) Which operating segments are reportable under the revenue test?

B) What is the total amount of revenues in applying the revenue test?

C) Which operating segments are reportable under the profit or loss test?

D) In applying the profit or loss test, what is the minimum amount an operating segment must have in order to meet the profit or loss test for a reportable segment?

E) Which operating segments are reportable under the asset test?

F) In applying the asset test, what is the minimum amount an operating segment must have in order to meet the asset test for a reportable segment?

G) Which operating segments are reportable?

H) According to the test results for reportable segments, is there a sufficient number of reported segments or should any additional segments also be disclosed? Explain the reason for your conclusion.

Required:

A) Which operating segments are reportable under the revenue test?

B) What is the total amount of revenues in applying the revenue test?

C) Which operating segments are reportable under the profit or loss test?

D) In applying the profit or loss test, what is the minimum amount an operating segment must have in order to meet the profit or loss test for a reportable segment?

E) Which operating segments are reportable under the asset test?

F) In applying the asset test, what is the minimum amount an operating segment must have in order to meet the asset test for a reportable segment?

G) Which operating segments are reportable?

H) According to the test results for reportable segments, is there a sufficient number of reported segments or should any additional segments also be disclosed? Explain the reason for your conclusion.

(Essay)

4.8/5  (41)

(41)

Betsy Kirkland, Inc. incurred a flood loss during the first quarter of 2021 that is deemed both unusual and not expected to recur again in the near future. The loss is considered immaterial to the twelve-month period, but is material in amount relative to the first quarter. The proper accounting treatment in the first quarter interim statement is to:

(Multiple Choice)

4.9/5  (39)

(39)

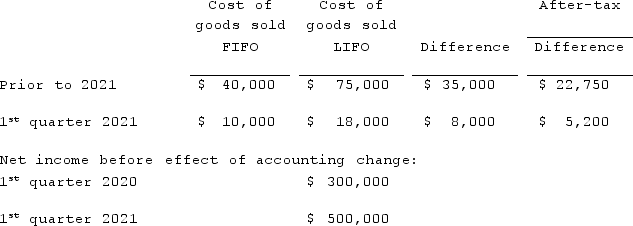

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2021. Baker has an effective income tax rate of 35% and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2021, compute net income per common share.

Assuming Baker makes the change in the first quarter of 2021, compute net income per common share.

(Multiple Choice)

4.8/5  (44)

(44)

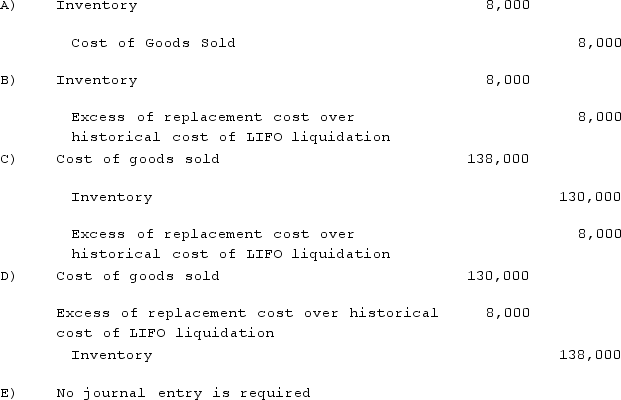

Cement Company, Inc. began the first quarter with 1,000 units of inventory costing $25 per unit. During the first quarter, 3,000 units were purchased at a cost of $40 per unit, and sales of 3,400 units at $65 per units were made. During the second quarter, the company expects to replace the units of beginning inventory sold at a cost of $45 per unit. Cement Company uses the LIFO method to account for inventory.What is the correct journal entry to record cost of goods sold at the end of the first quarter?

(Multiple Choice)

4.8/5  (31)

(31)

How should seasonal revenues be reported in an interim report?

(Multiple Choice)

4.8/5  (32)

(32)

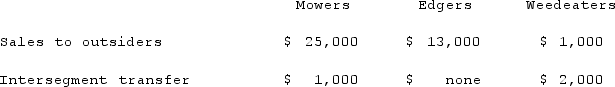

Peterson Corporation has three operating segments with the following information:  What is the minimum amount of revenue an operating segment must have to be considered a reportable segment?

What is the minimum amount of revenue an operating segment must have to be considered a reportable segment?

(Multiple Choice)

4.9/5  (42)

(42)

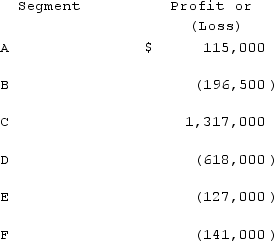

Nigel Corp. had six different operating segments reporting the following operating profit and loss figures:  Which one of the following statements is true?

Which one of the following statements is true?

(Multiple Choice)

4.9/5  (42)

(42)

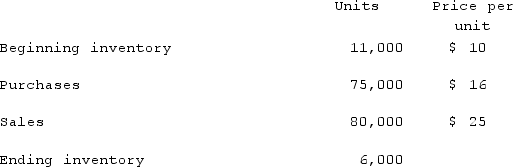

The following information for Urbanski Corporation relates to the three months ending June 30, 2021:  Urbanski uses the LIFO method to account for inventory, and expects at least 15,000 units to be on hand in the ending inventory at year-end. Purchases made in the last six months are expected to cost an average of $18 per unit.Prepare the journal entries to reflect the sales and cost of goods sold, assuming Urbanski expects to maintain 11,000 units in inventory at year-end.

Urbanski uses the LIFO method to account for inventory, and expects at least 15,000 units to be on hand in the ending inventory at year-end. Purchases made in the last six months are expected to cost an average of $18 per unit.Prepare the journal entries to reflect the sales and cost of goods sold, assuming Urbanski expects to maintain 11,000 units in inventory at year-end.

(Essay)

4.9/5  (40)

(40)

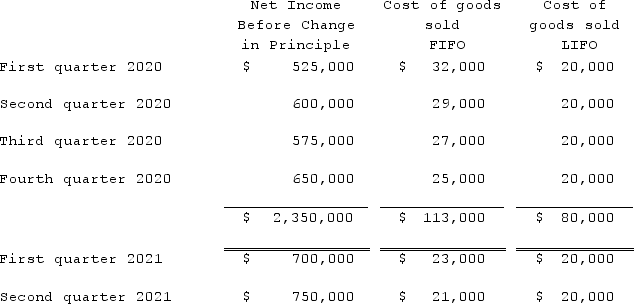

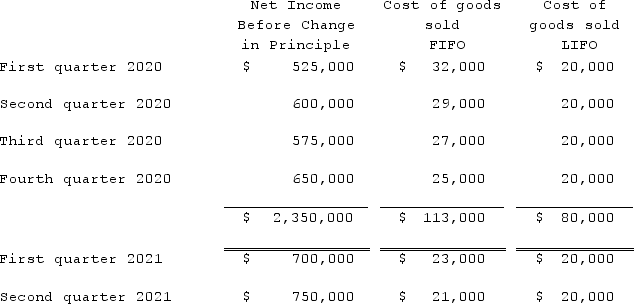

Harrison Company, Inc. began operations on January 1, 2020, and applied the LIFO method for inventory valuation. On June 10, 2021, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:  The LIFO method was applied during the first quarter of 2021 and the FIFO method was applied during the second quarter of 2021 in computing income, above. Harrison's effective income tax rate is 40%. Harrison has 500,000 shares of common stock outstanding at all times.Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30, 2020 and 2021.

The LIFO method was applied during the first quarter of 2021 and the FIFO method was applied during the second quarter of 2021 in computing income, above. Harrison's effective income tax rate is 40%. Harrison has 500,000 shares of common stock outstanding at all times.Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30, 2020 and 2021.

(Essay)

4.8/5  (35)

(35)

What related items need to be disclosed in regard to total segment assets?

(Essay)

4.9/5  (44)

(44)

According to International Financial Reporting Standards (IFRS), all of the following are part of minimum components of interim financial reporting except:

(Multiple Choice)

5.0/5  (36)

(36)

Harrison Company, Inc. began operations on January 1, 2020, and applied the LIFO method for inventory valuation. On June 10, 2021, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:  The LIFO method was applied during the first quarter of 2021 and the FIFO method was applied during the second quarter of 2021 in computing income, above. Harrison's effective income tax rate is 40%. Harrison has 500,000 shares of common stock outstanding at all times.Compute the after-tax effect of Harrison's change in inventory method.

The LIFO method was applied during the first quarter of 2021 and the FIFO method was applied during the second quarter of 2021 in computing income, above. Harrison's effective income tax rate is 40%. Harrison has 500,000 shares of common stock outstanding at all times.Compute the after-tax effect of Harrison's change in inventory method.

(Essay)

4.8/5  (32)

(32)

Showing 101 - 120 of 120

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)