Exam 13: Current Liabilities and Contingencies

Exam 1: Financial Accounting and Accounting Standards103 Questions

Exam 2: Conceptual Framework for Financial Reporting155 Questions

Exam 3: The Accounting Information System144 Questions

Exam 4: Income Statement and Related Information139 Questions

Exam 5: Balance Sheet and Statement of Cash Flows127 Questions

Exam 6: Accounting and the Time Value of Money152 Questions

Exam 7: Cash and Receivables173 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach173 Questions

Exam 9: Inventories: Additional Valuation Issues168 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment170 Questions

Exam 11: Depreciation, Impairments, and Depletion156 Questions

Exam 12: Intangible Assets171 Questions

Exam 13: Current Liabilities and Contingencies170 Questions

Exam 14: Long-Term Liabilities140 Questions

Exam 15: Stockholders Equity155 Questions

Exam 17: Investments141 Questions

Exam 18: Revenue Recognition145 Questions

Exam 19: Accounting for Income Taxes127 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits137 Questions

Exam 21: Accounting for Leases128 Questions

Exam 22: Accounting Changes and Error Analysis103 Questions

Exam 23: Statement of Cash Flows143 Questions

Exam 24: Full Disclosure in Financial Reporting108 Questions

Exam 25: Appendix89 Questions

Select questions type

A company offers a cash rebate of $2 on each $6 package of batteries sold during 2014. Historically, 10% of customers mail in the rebate form. During 2014, 6,000,000 packages of batteries are sold, and 210,000 $2 rebates are mailed to customers. What is the rebate expense and liability, respectively, shown on the 2014 financial statements dated December 31?

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following is not a correct statement about sales taxes?

(Multiple Choice)

4.8/5  (39)

(39)

Use the following information for questions 127, 128, and 129.

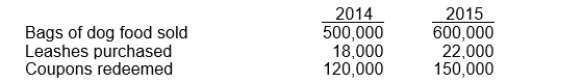

Muggs Co. includes one coupon in each bag of dog food it sells. In return for eight coupons, customers receive a leash. The leashes cost Muggs $3 each. Muggs estimates that 45 percent of the coupons will be redeemed. Data for 2014 and 2015 are as follows:  -The premium liability at December 31, 2015 is

-The premium liability at December 31, 2015 is

(Multiple Choice)

4.9/5  (36)

(36)

An electronics store is running a promotion where for every video game purchased, the customer receives a coupon upon checkout to purchase a second game at a 50% discount. The coupons expire in one year. The store normally recognized a gross profit margin of 40% of the selling price on video games. How would the store account for a purchase using the discount coupon?

(Multiple Choice)

4.8/5  (37)

(37)

Overton Corporation, a manufacturer of household paints, is preparing annual financial statements at December 31, 2014. Because of a recently proven health hazard in one of its paints, the government has clearly indicated its intention of having Overton recall all cans of this paint sold in the last six months. The management of Overton estimates that this recall would cost $800,000. What accounting recognition, if any, should be accorded this situation?

(Multiple Choice)

4.8/5  (39)

(39)

What condition(s) is/are necessary to recognize an asset retirement obligation?

(Multiple Choice)

4.9/5  (42)

(42)

Craig borrowed $350,000 on October 1, 2014 and is required to pay $360,000 on March 1, 2015. What amount is the note payable recorded at on October 1, 2014 and how much interest is recognized from October 1 to December 31, 2014?

(Multiple Choice)

4.9/5  (33)

(33)

includes one coupon in each bag of dog food it sells. In return for 4 coupons, customers receive a dog toy that the company purchases for $1.50 each. Sterling's experience indicates that 60 percent of the coupons will be redeemed. During 2014, 100,000 bags of dog food were sold, 12,000 toys were purchased, and 40,000 coupons were redeemed. During 2015, 120,000 bags of dog food were sold, 16,000 toys were purchased, and 60,000 coupons were redeemed.

InstructionsDetermine the premium expense to be reported in the income statement and the premium liability on the balance sheet for 2014 and 2015.

(Essay)

4.9/5  (38)

(38)

The effective interest on a 12-month, zero-interest-bearing note payable of $300,000, discounted at the bank at 7% is

(Multiple Choice)

4.7/5  (40)

(40)

Under IFRS, short-term obligations expected to be refinanced can be classified as noncurrent if the refinancing is completed:

(Multiple Choice)

4.8/5  (29)

(29)

Which of the following terms is associated with recording a contingent liability?

(Multiple Choice)

4.8/5  (37)

(37)

Accumulated rights exist when an employer has an obligation to make payment to an employee even after terminating his employment.

(True/False)

4.8/5  (40)

(40)

Companies report the amount of social security taxes withheld from employees as well as the companies' matching portion as current liabilities until they are remitted.

(True/False)

4.9/5  (42)

(42)

A company discloses gain contingencies in the notes only when a high probability exists for realizing them.

(True/False)

4.7/5  (36)

(36)

A provision differs from other liabilities in that there is greater uncertainty about the timing and amount of settlement.

(True/False)

4.9/5  (34)

(34)

Short-term debt obligations are classified as current liabilities unless an agreement to refinance is completed before the financial statements are issued.

(True/False)

4.9/5  (40)

(40)

Information available prior to the issuance of the financial statements indicates that it is probable that, at the date of the financial statements, a liability has been incurred for obligations related to product warranties. The amount of the loss involved can be reasonably estimated. Based on the above facts, an estimated loss contingency should be

(Multiple Choice)

4.8/5  (32)

(32)

Showing 81 - 100 of 170

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)