Exam 10: Foreign Currency Transactions

Exam 1: Business Combinations: New Rules for a Long-Standing Business Practice46 Questions

Exam 2: Consolidated Statements: Date of Acquisition41 Questions

Exam 3: Consolidated Statements: Subsequent to Acquisition34 Questions

Exam 4: Intercompany Transactions: Merchandise, Plant Assets, and Notes38 Questions

Exam 5: Intercompany Transactions: Bonds and Leases52 Questions

Exam 6: Cash Flow, Eps, and Taxation46 Questions

Exam 7: Special Issues in Accounting for an Investment in a Subsidiary39 Questions

Exam 9: The International Accounting Environment14 Questions

Exam 10: Foreign Currency Transactions67 Questions

Exam 11: Translation of Foreign Financial Statements73 Questions

Exam 12: Interim Reporting and Disclosures About Segments of an Enterprise56 Questions

Exam 13: Partnerships: Characteristics, Formation, and Accounting for Activities45 Questions

Exam 14: Partnerships: Ownership Changes and Liquidations57 Questions

Exam 15: Governmental Accounting: the General Fund and the Account Groups74 Questions

Exam 16: Governmental Accounting: Other Governmental Funds, Proprietary Funds, and Fiduciary Funds58 Questions

Exam 17: Financial Reporting Issues29 Questions

Exam 18: Accounting for Private Not-For-Profit Organizations55 Questions

Exam 19: Accounting for Not-For-Profit Colleges and Universities and Health Care Organizations79 Questions

Exam 20: Estates and Trusts: Their Nature and the Accountants Role52 Questions

Exam 21: Debt Restructuring, Corporate Reorganizations, and Liquidations43 Questions

Exam 22: Accounting for Influential Investments13 Questions

Exam 23: Derivatives and Related Accounting Issues45 Questions

Select questions type

Which of the following statements is true concerning forward contracts classified as hedges of an identifiable foreign currency commitment?

(Multiple Choice)

4.7/5  (44)

(44)

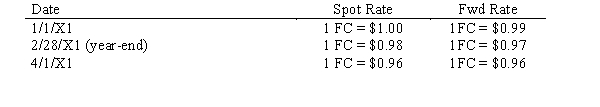

On January 1, 20X1, a domestic firm agrees to sell goods to a foreign customer, with delivery to be made and payment to be received on April 1, 20X1. The goods are valued at 50,000 FC. On January 1, 20X1, the domestic firm purchased a 90-day forward contract to sell 50,000 FC. Exchange rates on selected dates are as follows:  Discount rate = 10%

Required:

Prepare the journal entries needed to properly reflect the sales transaction and the forward exchange contract. The forward contract meets the conditions necessary to be classified as a hedge on an identifiable foreign currency commitment. Include the table to calculate the split between exchange gains or losses on the contract due to changes in spot rates and the changes in time value.

Discount rate = 10%

Required:

Prepare the journal entries needed to properly reflect the sales transaction and the forward exchange contract. The forward contract meets the conditions necessary to be classified as a hedge on an identifiable foreign currency commitment. Include the table to calculate the split between exchange gains or losses on the contract due to changes in spot rates and the changes in time value.

(Essay)

4.8/5  (38)

(38)

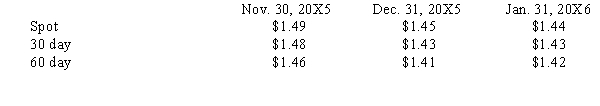

Wild, Inc. sold merchandise for 500,000 FC to a foreign vendor on November 30, 20X5. Payment in foreign currency is due January 31, 20X6. Exchange rates to purchase 1 foreign currency unit are as follows:  In the year in which the sale was made, 20X5, what amount should Wild report as foreign exchange gain/loss from this transaction?

In the year in which the sale was made, 20X5, what amount should Wild report as foreign exchange gain/loss from this transaction?

(Multiple Choice)

4.8/5  (40)

(40)

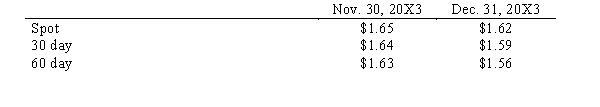

Hugh, Inc. purchased merchandise for 300,000 FC from a British vendor on November 30, 20X3. Payment in British pounds is due January 31, 20X4. Exchange rates to purchase 1 FC is as follows:  In the December 31, 20X3 income statement, what amount should Hugh report as foreign exchange gain from this transaction?

In the December 31, 20X3 income statement, what amount should Hugh report as foreign exchange gain from this transaction?

(Multiple Choice)

4.7/5  (32)

(32)

Differentiate between the following monetary systems: floating system, controlled float system and tiered system.

(Essay)

4.9/5  (33)

(33)

Given the following information for a 90 day contract:  What will be the forward rate?

What will be the forward rate?

(Multiple Choice)

4.8/5  (46)

(46)

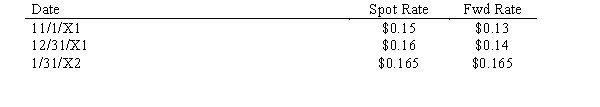

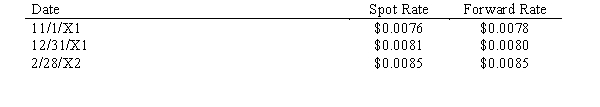

On November 1, 20X1, a U.S. company purchased inventory from a foreign supplier for 100,000 FC, with payment to be made on January 31, 20X2, in FC. To hedge against fluctuations in exchange rates, the firm entered into a forward exchange contract on November 1 to purchase 100,000 FC on January 31, 20X2. The U.S. firm has a December 31 year end for accounting purposes. The following exchange rates may apply:  Discount rate = 12%. The transaction qualifies for treatment as a cash flow hedge.

Required:

Make all the necessary journal entries for the U.S. firm relative to these events occurring between November 1, 20X1, and January 31, 20X2.

Discount rate = 12%. The transaction qualifies for treatment as a cash flow hedge.

Required:

Make all the necessary journal entries for the U.S. firm relative to these events occurring between November 1, 20X1, and January 31, 20X2.

(Essay)

4.9/5  (28)

(28)

The best definition for direct quotes would be "direct quotes measure

(Multiple Choice)

4.7/5  (38)

(38)

Rex Corporation, a U.S. firm with a calendar accounting year, agreed to buy a specially made truck from a Japanese firm for delivery on February 28, 20X2 with payment due on that date. On the same date the agreement was signed, November 1, 20X1, a forward contract due on February 28, 20X2, was also signed to purchase 1,000,000 yen, the contract price of the truck. Exchange rates were as follows:  Discount rate = 8%

Required:

Prepare the journal entries needed to properly reflect the purchase and forward contract through the end of the fiscal year.

Discount rate = 8%

Required:

Prepare the journal entries needed to properly reflect the purchase and forward contract through the end of the fiscal year.

(Essay)

4.9/5  (31)

(31)

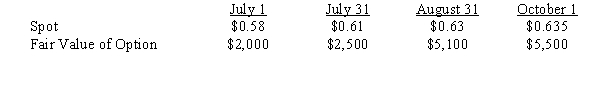

On 7/1, a company forecasts the purchase of 10,000 units of inventory from a foreign vendor. The forecasted cost is estimated to be 150,000 FC. It is estimated inventory will be delivered 11/1. Also, on 7/1, the company purchased a call option to buy 150,000 FC at a strike price of $0.60 anytime during October. An option premium of $2,000 was paid.  Required:

Prepare the journal entries required through 10/1.

Required:

Prepare the journal entries required through 10/1.

(Essay)

4.7/5  (38)

(38)

Which of the following is not true concerning the accounting for hedges of forecasted transactions using an option?

(Multiple Choice)

4.8/5  (37)

(37)

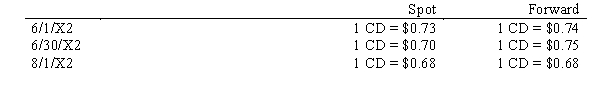

On 6/1/X2, an American firm purchased a inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 8/1/X2. Also on 6/1/X2, the American firm entered into a forward contract to purchase 100,000 Canadian dollars for delivery on 8/1/X2. The exchange rates were as follows:  The American firm's fiscal year end is 6/30/X2. The changes in the value of the forward contract should be discounted at 8%. What is the value of the Forward Contract on 6/30/X2?

The American firm's fiscal year end is 6/30/X2. The changes in the value of the forward contract should be discounted at 8%. What is the value of the Forward Contract on 6/30/X2?

(Multiple Choice)

4.9/5  (41)

(41)

For a hedge on an exposed position, describe the process of valuing the forward contract as of the fiscal period end date.

(Essay)

4.8/5  (34)

(34)

A U.S. company that has purchased inventory from a German vendor would be exposed to a net exchange gain on the unpaid balance if the

(Multiple Choice)

4.7/5  (34)

(34)

A U.S. company that has sold its product to a German firm would be exposed to a net exchange gain on the unpaid receivable if the

(Multiple Choice)

4.8/5  (31)

(31)

A U.S. firm has purchased, for 50,000 FC, an electric generator from a foreign firm. The exchange rates were 1 FC = $0.80 on the delivery date and 1 FC = $0.76 when the payable was paid. What is the final recorded value of the equipment if the two-transaction method is used?

(Multiple Choice)

4.7/5  (39)

(39)

The accounting treatment given a cash flow hedge of a forecasted transaction continues unless:

(Multiple Choice)

4.9/5  (41)

(41)

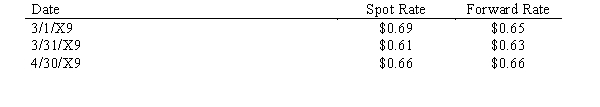

Remle Corporation is a U.S. corporation that sold merchandise a foreign manufacturer on March 1, 20X9 for 200,000 foreign currency units. The funds will be received on April 30, 20X9. On March 1, 20X9 Wolters also entered into a forward contract to sell 200,000 foreign currency units on April 30, 20X9. Remle has a March 31 year end.

Exchange rates are as follows:  Required:

Prepare the journal entries to record the transactions through April 30, 20X9. March 31 is the fiscal period end. Ignore the split between spot gain/loss and time value and Cost of Goods Sold.

Required:

Prepare the journal entries to record the transactions through April 30, 20X9. March 31 is the fiscal period end. Ignore the split between spot gain/loss and time value and Cost of Goods Sold.

(Essay)

4.8/5  (38)

(38)

On January 1, 20X1, a U.S. firm bought a truck from a foreign firm for 10,000 FC, to be paid on March 1 in FC. The spot rate was 1 FC = $1.25 on January 1 and 1 FC = $1.265 on March 1. To protect themselves from exchange rate changes, the U.S. firm entered into a forward exchange contract on January 1 to buy FC on March 1 for $1.28.

Required:

Make all the necessary journal entries to record the transactions for the U.S. firm on January 1 and March 1. Ignore the split between spot gain/loss and time value.

(Essay)

4.8/5  (37)

(37)

Showing 21 - 40 of 67

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)