Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing

Exam 1: Introduction to Accounting and Business235 Questions

Exam 2: Analyzing Transactions238 Questions

Exam 3: The Adjusting Process209 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Accounting Systems201 Questions

Exam 6: Accounting for Merchandising Businesses236 Questions

Exam 7: Inventories208 Questions

Exam 8: Internal Control and Cash190 Questions

Exam 9: Receivables196 Questions

Exam 10: Long-Term Assets: Fixed and Intangible223 Questions

Exam 11: Current Liabilities and Payroll201 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies205 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends217 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 15: Investments and Fair Value Accounting171 Questions

Exam 16: Statement of Cash Flows189 Questions

Exam 17: Financial Statement Analysis201 Questions

Exam 18: Introduction to Managerial Accounting247 Questions

Exam 19: Job Order Costing195 Questions

Exam 20: Process Cost Systems198 Questions

Exam 21: Cost-Volume-Profit Analysis225 Questions

Exam 22: Evaluating Variances From Standard Costs174 Questions

Exam 23: Decentralized Operations218 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing177 Questions

Exam 25: Capital Investment Analysis189 Questions

Select questions type

An unfinished desk is produced for $36.00 and sold for $65.00. A finished desk can be sold for $75.00. The additional processing cost to complete the finished desk is $5.95. Provide a differential analysis for further processing.

(Essay)

4.9/5  (37)

(37)

Assume that Widgeon produced enough of the product with the highest contribution margin per unit to use 1,000 hours of machine time. Product demand does not warrant any more production of that product. What is the maximum additional contribution margin that can be realized by utilizing the remaining 1,000 hours on the product with the second highest contribution margin per hour?

(Multiple Choice)

4.8/5  (28)

(28)

Jamison Company produces and sells Product X at a total cost of $25 per unit, of which $15 is product cost and $10 is selling and administrative expenses. In addition, the total cost of $25 is made up of $14 variable cost and $11 fixed cost. The desired profit is $5 per unit. Determine the markup percentage on total cost.

(Short Answer)

4.8/5  (32)

(32)

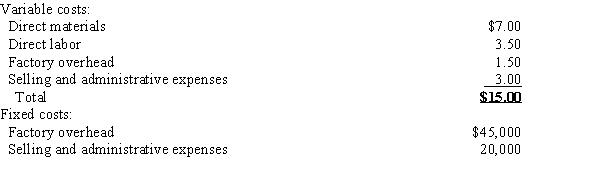

Moon Company uses the variable cost concept of applying the cost-plus approach to product pricing. The costs and expenses of producing and selling 75,000 units of Product T are as follows:  Moon desires a profit equal to an18% rate of return on invested assets of $1,440,000.

(a)Determine the amount of desired profit from the production and sale of Product T.

(b)Determine the total variable costs for the production and sale of 75,000 units of Product T.

(c)Determine the markup percentage for Product T.

(d)Determine the unit selling price of Product T.Round the markup percentage to one decimal place and other intermediate calculations and final answer to two decimal places.

Moon desires a profit equal to an18% rate of return on invested assets of $1,440,000.

(a)Determine the amount of desired profit from the production and sale of Product T.

(b)Determine the total variable costs for the production and sale of 75,000 units of Product T.

(c)Determine the markup percentage for Product T.

(d)Determine the unit selling price of Product T.Round the markup percentage to one decimal place and other intermediate calculations and final answer to two decimal places.

(Essay)

4.8/5  (37)

(37)

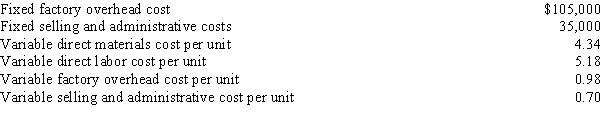

Use this information for Dotterel Corporation to answer the questions that follow.

?

Dotterel Corporation uses the variable cost concept of product pricing. Below is the cost information for the production and sale of 35,000 units of its sole product. Dotterel desires a profit equal to an 11.2% rate of return on invested assets of $350,000.

??

-The dollar amount of the desired profit from the production and sale of the company's product is

-The dollar amount of the desired profit from the production and sale of the company's product is

(Multiple Choice)

4.8/5  (35)

(35)

In deciding whether to accept business at a special price, the short-run price should be set high enough to cover all variable costs and expenses.

(True/False)

4.8/5  (35)

(35)

Which product has the highest contribution margin per machine hour?

(Multiple Choice)

4.8/5  (31)

(31)

Mallory Company produces and sells Product X at a total cost of $35 per unit, of which $28 is product cost and $7 is selling and administrative expenses. In addition, the total cost of $35 is made up of $24 variable cost and $11 fixed cost. The desired profit is $8 per unit. Determine the markup percentage on product cost.

(Short Answer)

4.9/5  (40)

(40)

Match each definition that follows with the term (a-e) it defines.

-Variable manufacturing costs plus variable selling and administrative costs are included in cost per unit

(Multiple Choice)

4.9/5  (40)

(40)

Use this information for Swan Company to answer the questions that follow.

Swan Company produces a product at a total cost of $43 per unit. Of this amount, $8 per unit is selling and administrative costs. The total variable cost is $30 per unit, and the desired profit is $20 per unit.

-What is the overhead allocated to Product B using activity-based costing?

(Multiple Choice)

4.8/5  (40)

(40)

Match each definition that follows with the term (a-e) it defines.

-Combines market-based pricing with a cost-reduction emphasis

(Multiple Choice)

4.8/5  (23)

(23)

Match each definition that follows with the term (a-e) it defines.

-Sets the price according to demand

(Multiple Choice)

4.8/5  (40)

(40)

Since the costs of producing an intermediate product do not change regardless of whether the intermediate product is sold or processed further, these costs are not considered in deciding whether to further process a product.

(True/False)

4.9/5  (32)

(32)

Starling Co. is considering disposing of a machine with a book value of $12,500 and estimated remaining life of five years. The old machine can be sold for $1,500. A new high-speed machine can be purchased at a cost of $25,000. It will have a useful life of five years and no residual value. It is estimated that the annual variable manufacturing costs will be reduced from $26,000 to $23,500 if the new machine is purchased. The differential effect on income for the new machine for the entire five years is a (n)

(Multiple Choice)

4.8/5  (38)

(38)

Yakking Co. manufactures mobile cellular equipment and develops a price for the product by using the variable cost concept. Yakking incurs variable costs of $1,900,000 in the production of 100,000 units while fixed costs total $50,000. The company employs $4,725,000 of assets and wishes to earn a profit equal to a 10% rate of return on assets.

(a)Compute a markup percentage based on variable cost.

(b)Determine a selling price.Round the markup percentage to one decimal place, and other intermediate calculations and final answer to two decimal places.

(Essay)

4.8/5  (29)

(29)

In order to meet the new target cost, how much will it have to cut costs per unit, if any?

(Multiple Choice)

4.8/5  (32)

(32)

What is the amount of the income or loss from the acceptance of the offer?

(Multiple Choice)

4.9/5  (49)

(49)

The product cost concept includes all manufacturing costs plus selling and administrative expenses in the cost amount to which the markup is added to determine product price.

(True/False)

4.7/5  (33)

(33)

Showing 141 - 160 of 177

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)