Exam 22: Evaluating Variances From Standard Costs

Exam 1: Introduction to Accounting and Business235 Questions

Exam 2: Analyzing Transactions238 Questions

Exam 3: The Adjusting Process209 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Accounting Systems201 Questions

Exam 6: Accounting for Merchandising Businesses236 Questions

Exam 7: Inventories208 Questions

Exam 8: Internal Control and Cash190 Questions

Exam 9: Receivables196 Questions

Exam 10: Long-Term Assets: Fixed and Intangible223 Questions

Exam 11: Current Liabilities and Payroll201 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies205 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends217 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes181 Questions

Exam 15: Investments and Fair Value Accounting171 Questions

Exam 16: Statement of Cash Flows189 Questions

Exam 17: Financial Statement Analysis201 Questions

Exam 18: Introduction to Managerial Accounting247 Questions

Exam 19: Job Order Costing195 Questions

Exam 20: Process Cost Systems198 Questions

Exam 21: Cost-Volume-Profit Analysis225 Questions

Exam 22: Evaluating Variances From Standard Costs174 Questions

Exam 23: Decentralized Operations218 Questions

Exam 24: Differential Analysis, Product Pricing, and Activity-Based Costing177 Questions

Exam 25: Capital Investment Analysis189 Questions

Select questions type

The following data relate to direct labor costs for the current period:Standard costs36,000 hours at $22.00Actual costs35,000 hours at $23.00What is the direct labor time variance?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following is not a reason standard costs are separated into two components?

(Multiple Choice)

4.9/5  (30)

(30)

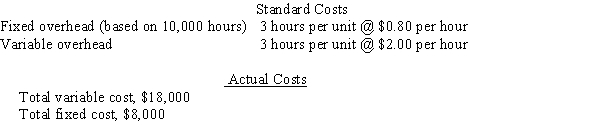

Use this information to answer the questions that follow.

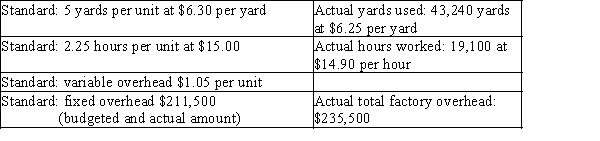

The standard costs and actual costs for factory overhead for the manufacture of 2,500 units of actual production are as follows:

-The total factory overhead cost variance is

-The total factory overhead cost variance is

(Multiple Choice)

4.8/5  (28)

(28)

The difference between the standard cost of a product and its actual cost is called a variance.

(True/False)

4.9/5  (32)

(32)

If a company records inventory purchases at standard cost and also records purchase price variances, prepare the journal entry for a purchase of widgets that were bought at $7.45 per unit and have a standard cost of $7.15. The total amount owed to the vendor for this purchase is $33,525.

(Essay)

4.8/5  (31)

(31)

Use this information to answer the questions that follow.

The standard costs and actual costs for factory overhead for the manufacture of 2,500 units of actual production are as follows:

-The variable factory overhead controllable variance is

-The variable factory overhead controllable variance is

(Multiple Choice)

4.9/5  (36)

(36)

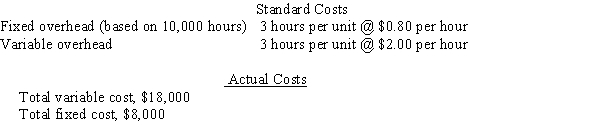

The formula to compute the direct materials price variance is to calculate the difference between

(Short Answer)

4.9/5  (31)

(31)

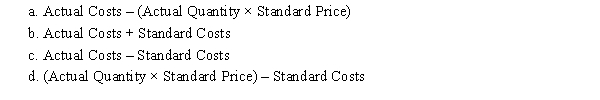

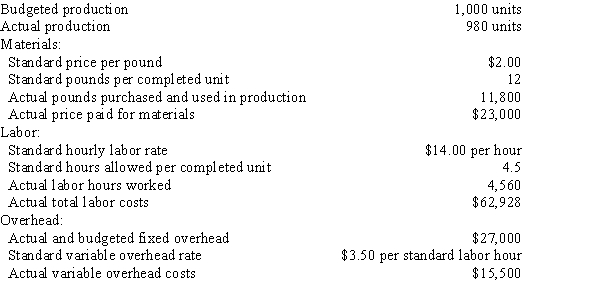

Use this information for Zoyza Company to answer the questions that follow.

The following data are given for Zoyza Company:

Overhead is applied on standard labor hours.

-The variable factory overhead controllable variance is

Overhead is applied on standard labor hours.

-The variable factory overhead controllable variance is

(Multiple Choice)

5.0/5  (45)

(45)

A company must choose either a standard system or nonfinancial performance measures to evaluate the performance of a company.

(True/False)

4.9/5  (32)

(32)

Prepare an income statement for the year ended December 31, through the gross profit for Baxter Company using the following information. Baxter Company sold 8,600 units at $125 per unit. Normal production is 9,000 units.

(Do not round fixed overhead rate calculation when determining fixed factory overhead volume variance.)

(Essay)

4.8/5  (49)

(49)

If the standard to produce a given amount of product is 2,000 units of direct materials at $12 and the actual is 1,600 units at $13, the direct materials quantity variance is $5,200 favorable.

(True/False)

4.8/5  (29)

(29)

Ideal standards are developed under conditions that assume no idle time, no machine breakdowns, and no materials spoilage.

(True/False)

4.7/5  (35)

(35)

Japan Company produces lamps that require 2.25 standard hours per unit at an hourly rate of $15.00 per hour. Production of 7,700 units required 19,250 hours at an hourly rate of $14.90 per hour.?What is the direct labor

(a) rate variance,

(b) time variance, and

(c) total cost variance?

(Essay)

4.8/5  (29)

(29)

The standard costs and actual costs for direct materials for the manufacture of 3,000 actual units of product are as follows:Standard CostsDirect materials (per completed unit)1,040 kilograms at $8.75Actual CostsDirect materials2,000 kilograms at $8.00The direct materials price variance is

(Multiple Choice)

4.9/5  (35)

(35)

Robin Company purchased on account and used 520 pounds of direct materials to produce a product with a 510-pound standard direct materials requirement. The standard materials price is $2.10 per pound. The actual materials price was $2.00 per pound.Prepare the journal entries to record

(1) the purchase of the materials and

(2) the material entering production.

(Essay)

5.0/5  (30)

(30)

At the end of the fiscal year, variances from standard costs are usually transferred to the

(Multiple Choice)

4.8/5  (37)

(37)

Use this information for Taylor Company to answer the questions that follow.

The following data are given for Taylor Company:

Overhead is applied based on standard labor hours.

-Compute the direct materials price and quantity variances for Taylor Company.

Overhead is applied based on standard labor hours.

-Compute the direct materials price and quantity variances for Taylor Company.

(Essay)

4.8/5  (25)

(25)

An example of a nonfinancial measure is the number of customer complaints.

(True/False)

4.7/5  (32)

(32)

Showing 141 - 160 of 174

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)