Exam 10: Plant Assets, Natural Resources, and Intangible Assets

Exam 1: Accounting in Action220 Questions

Exam 2: The Recording Process192 Questions

Exam 3: Adjusting the Accounts216 Questions

Exam 4: Completing the Accounting Cycle203 Questions

Exam 5: Accounting for Merchandising Operations221 Questions

Exam 6: Inventories204 Questions

Exam 7: Accounting Information Systems139 Questions

Exam 8: Fraud, Internal Control, and Cash212 Questions

Exam 9: Accounting for Receivables220 Questions

Exam 10: Plant Assets, Natural Resources, and Intangible Assets293 Questions

Exam 11: Current Liabilities and Payroll Accounting207 Questions

Exam 12: Accounting for Partnerships210 Questions

Exam 13: Corporations: Organization and Capital Stock Transactions195 Questions

Exam 14: Corporations: Dividends, Retained Earnings, and Income Reporting176 Questions

Exam 15: Long-Term Liabilities215 Questions

Exam 16: Investments178 Questions

Exam 17: Statement of Cash Flows203 Questions

Exam 18: Financial Analysis: the Big Picture225 Questions

Exam 19: Managerial Accounting197 Questions

Exam 20: Job Order Costing199 Questions

Exam 21: Process Costing198 Questions

Exam 22: Cost-Volume-Profit217 Questions

Exam 23: Incremental Analysis208 Questions

Exam 24: Budgetary Planning207 Questions

Exam 25: Budgetary Control and Responsibility Accounting207 Questions

Exam 26: Standard Costs and Balanced Scorecard221 Questions

Select questions type

Angie's Blooms purchased a delivery van for $20,000. The company was given a $2,000 cash discount by the dealer, and paid $1,000 sales tax. Annual insurance on the van is $500. As a result of the purchase, by how much will Angie's Blooms increase its van account?

(Multiple Choice)

5.0/5  (47)

(47)

If disposal of a plant asset occurs during the year, depreciation is

(Multiple Choice)

4.8/5  (36)

(36)

On July 1, 2010, Jenks Company purchased the copyright to Jackson Computer tutorials for $162,000. It is estimated that the copyright will have a useful life of 5 years with an estimated salvage value of $12,000. The amount of Amortization Expense recognized for the year 2010 would be

(Multiple Choice)

4.9/5  (38)

(38)

Yanik Company's delivery truck, which originally cost $70,000, was destroyed by fire. At the time of the fire, the balance of the Accumulated Depreciation account amounted to $47,500. The company received $40,000 reimbursement from its insurance company. The gain or loss as a result of the fire was

(Multiple Choice)

4.9/5  (38)

(38)

A company purchased factory equipment for $250,000. It is estimated that the equipment will have a $25,000 salvage value at the end of its estimated 5-year useful life. If the company uses the double-declining-balance method of depreciation, the amount of annual depreciation recorded for the second year after purchase would be

(Multiple Choice)

4.8/5  (33)

(33)

Sargent Corporation bought equipment on January 1, 2010. The equipment cost $90,000 and had an expected salvage value of $15,000. The life of the equipment was estimated to be 6 years. The book value of the equipment at the beginning of the third year would be

(Multiple Choice)

5.0/5  (33)

(33)

Nicklaus Company has decided to sell one of its old machines on June 30, 2010. The machine was purchased for $120,000 on January 1, 2006, and was depreciated on a straight-line basis for 10 years with no salvage value. If the machine was sold for $39,000, what was the amount of the gain or loss recorded at the time of the sale?

(Multiple Choice)

4.9/5  (36)

(36)

The book value of an asset will equal its fair market value at the date of sale if

(Multiple Choice)

4.8/5  (40)

(40)

A machine with a cost of $160,000 has an estimated salvage value of $10,000 and an estimated useful life of 5 years or 15,000 hours. It is to be depreciated using the units-of-activity method of depreciation. What is the amount of depreciation for the second full year, during which the machine was used 5,000 hours?

(Multiple Choice)

4.9/5  (45)

(45)

If an acquired franchise or license has an indefinite life, the cost of the asset is not amortized.

(True/False)

4.8/5  (39)

(39)

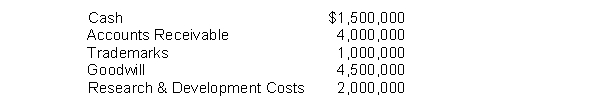

Given the following account balances at year end, compute the total intangible assets on the balance sheet of Kepler Enterprises.

(Multiple Choice)

4.9/5  (37)

(37)

Depletion expense for a period is only recognized on natural resources that have been extracted and sold during the period.

(True/False)

4.9/5  (35)

(35)

Three factors that affect the computation of periodic depreciation expense are (1) _______________, (2) _______________, and (3) _________________.

(Short Answer)

4.9/5  (40)

(40)

Kemp Company purchased factory equipment with an invoice price of $80,000. Other costs incurred were freight costs, $1,100; installation wiring and foundation, $2,200; material and labor costs in testing equipment, $700; oil lubricants and supplies to be used with equipment, $500; fire insurance policy covering equipment, $1,400. The equipment is estimated to have a $5,000 salvage value at the end of its 5-year useful service life.

Instructions

(a) Compute the acquisition cost of the equipment. Clearly identify each element of cost.

(b) If the double-declining-balance method of depreciation was used, the constant percentage applied to a declining book value would be __________.

(Essay)

4.9/5  (38)

(38)

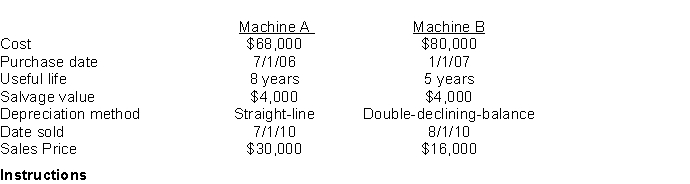

Tidwell Company sold the following two machines in 2010:  Journalize all entries required to update depreciation and record the sales of the two assets in 2010. The company has recorded depreciation on the machine through December 31, 2009.

Journalize all entries required to update depreciation and record the sales of the two assets in 2010. The company has recorded depreciation on the machine through December 31, 2009.

(Essay)

4.8/5  (33)

(33)

A-Amortization P-Depletion

D-Depreciation N-None of these

1. Goodwill

2. Land

3. Buildings

4. Patents

5. Copyrights

6. Research and development costs

7. Timberlands

8. Franchises (indefinite life)

9. Licenses (limited life)

10. Land Improvements

11. Oil Deposits

12. Equipment

(Essay)

4.9/5  (44)

(44)

A loss on disposal of a plant asset is reported in the financial statements

(Multiple Choice)

5.0/5  (51)

(51)

The cost of demolishing an old building on land that has been acquired so that a new building can be constructed should be charged to the ______________ account.

(Short Answer)

4.8/5  (43)

(43)

A plant asset originally cost $48,000 and was estimated to have a $3,000 salvage value at the end of its 5-year useful life. If at the end of three years, the asset was sold for $9,000, and had accumulated depreciation recorded of $27,000, the company should recognize a ______________ on disposal in the amount of $____________.

(Short Answer)

4.8/5  (41)

(41)

Showing 41 - 60 of 293

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)