Exam 10: Plant Assets, Natural Resources, and Intangible Assets

Exam 1: Accounting in Action220 Questions

Exam 2: The Recording Process192 Questions

Exam 3: Adjusting the Accounts216 Questions

Exam 4: Completing the Accounting Cycle203 Questions

Exam 5: Accounting for Merchandising Operations221 Questions

Exam 6: Inventories204 Questions

Exam 7: Accounting Information Systems139 Questions

Exam 8: Fraud, Internal Control, and Cash212 Questions

Exam 9: Accounting for Receivables220 Questions

Exam 10: Plant Assets, Natural Resources, and Intangible Assets293 Questions

Exam 11: Current Liabilities and Payroll Accounting207 Questions

Exam 12: Accounting for Partnerships210 Questions

Exam 13: Corporations: Organization and Capital Stock Transactions195 Questions

Exam 14: Corporations: Dividends, Retained Earnings, and Income Reporting176 Questions

Exam 15: Long-Term Liabilities215 Questions

Exam 16: Investments178 Questions

Exam 17: Statement of Cash Flows203 Questions

Exam 18: Financial Analysis: the Big Picture225 Questions

Exam 19: Managerial Accounting197 Questions

Exam 20: Job Order Costing199 Questions

Exam 21: Process Costing198 Questions

Exam 22: Cost-Volume-Profit217 Questions

Exam 23: Incremental Analysis208 Questions

Exam 24: Budgetary Planning207 Questions

Exam 25: Budgetary Control and Responsibility Accounting207 Questions

Exam 26: Standard Costs and Balanced Scorecard221 Questions

Select questions type

Dodd Delivery Company and Hess Delivery Company exchanged delivery trucks on January 1, 2010. Dodd's truck cost $84,000, had accumulated depreciation of $69,000, and has a fair market value of $9,000. Hess's truck cost $63,000, had accumulated depreciation of $54,000, and has a fair market value of $9,000.

Instructions

(a) Journalize the exchange for Dodd Delivery Company.

(b) Journalize the exchange for Hess Delivery Company.

(Essay)

4.8/5  (36)

(36)

The calculation of depreciation using the declining balance method,

(Multiple Choice)

4.8/5  (36)

(36)

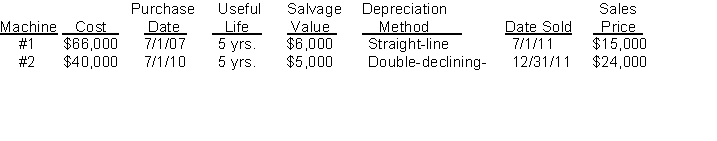

Hanshew's Lumber Mill sold two machines in 2011. The following information pertains to the two machines:  balance

Instructions

(a) Compute the depreciation on each machine to the date of disposal.

(b) Prepare the journal entries in 2011 to record 2011 depreciation and the sale of each machine.

balance

Instructions

(a) Compute the depreciation on each machine to the date of disposal.

(b) Prepare the journal entries in 2011 to record 2011 depreciation and the sale of each machine.

(Essay)

4.8/5  (23)

(23)

The factor that is not relevant in computing depreciation is

(Multiple Choice)

4.8/5  (35)

(35)

Yocum Company purchased equipment on January 1 at a list price of $50,000, with credit terms 2/10, n/30. Payment was made within the discount period and Yocum was given a $1,000 cash discount. Yocum paid $2,500 sales tax on the equipment, and paid installation charges of $880. Prior to installation, Yocum paid $2,000 to pour a concrete slab on which to place the equipment. What is the total cost of the new equipment?

(Multiple Choice)

4.9/5  (43)

(43)

If the proceeds from the sale of a plant asset exceed its ______________, a gain on disposal will occur.

(Short Answer)

4.8/5  (40)

(40)

An asset that cannot be sold individually in the market place is

(Multiple Choice)

4.8/5  (40)

(40)

On January 1, a machine with a useful life of five years and a residual value of $15,000 was purchased for $45,000. What is the depreciation expense for year 2 under the double-declining-balance method of depreciation?

(Multiple Choice)

4.9/5  (36)

(36)

If fully depreciated equipment that cost $10,000 with no salvage value is retired, the entry to record the retirement requires a debit to the ___________________________ account and a credit to the _____________________ account.

(Short Answer)

4.8/5  (36)

(36)

The ________________ method of computing depreciation expense results in an equal amount of periodic depreciation throughout the service life of the plant asset.

(Short Answer)

4.9/5  (36)

(36)

A gain or loss on disposal of a plant asset is determined by comparing the

(Multiple Choice)

4.9/5  (41)

(41)

With the exception of land, plant assets experience a ______________ in service potential over their useful lives.

(Short Answer)

4.9/5  (42)

(42)

On January 2, 2010, Harlan Company purchased a patent for $38,000. The patent has an estimated useful life of 25 years and a 20-year legal life. What entry would the company make at December 31, 2010 to record amortization expense on the patent?

(Essay)

4.9/5  (32)

(32)

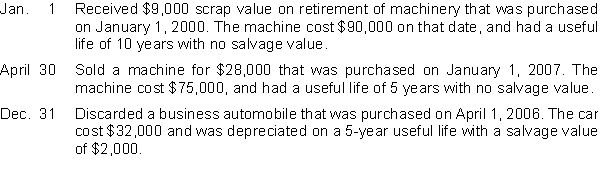

Presented below are selected transactions for Corbin Company for 2010.  Instructions

Journalize all entries required as a result of the above transactions. Corbin Company uses the straight-line method of depreciation and has recorded depreciation through December 31, 2009.

Instructions

Journalize all entries required as a result of the above transactions. Corbin Company uses the straight-line method of depreciation and has recorded depreciation through December 31, 2009.

(Essay)

4.7/5  (39)

(39)

If the proceeds from the sale of a plant asset exceed its book value, a gain on disposal occurs.

(True/False)

4.8/5  (44)

(44)

On July 1, 2010, Hale Kennels sells equipment for $66,000. The equipment originally cost $180,000, had an estimated 5-year life and an expected salvage value of $30,000. The accumulated depreciation account had a balance of $105,000 on January 1, 2010, using the straight-line method. The gain or loss on disposal is

(Multiple Choice)

4.8/5  (36)

(36)

Henson Company incurred $300,000 of research and development costs in its laboratory to develop a new product. It spent $40,000 in legal fees for a patent granted on January 2, 2010. On July 31, 2010, Henson paid $30,000 for legal fees in a successful defense of the patent. What is the total amount that should be debited to Patents through July 31, 2010?

(Multiple Choice)

4.8/5  (27)

(27)

During the current year, Penny Company incurred several expenditures. Briefly explain whether the expenditures listed below should be recorded as an operating expense or as an intangible asset. If you view the expenditure as an intangible asset, indicate the number of years over which the asset should be amortized. Explain your answer.

(a) Spent $30,000 in legal costs in a patent defense suit. The patent was unsuccessfully defended.

(b) Purchased a trademark from another company. The trademark can be renewed indefinitely. Penny Company expects the trademark to contribute to revenue indefinitely.

(c) Penny Company acquires a patent for $2,000,000. The company selling the patent has spent $1,000,000 on the research and development of it. The patent has a remaining life of 15 years.

(d) Penny Company is spending considerable time and money in developing a different patent for another product. So far $3,000,000 has been spent this year on research and development. Penny Company is very confident they will obtain this patent in the next few years.

(Essay)

4.9/5  (36)

(36)

Neosho Mining invested $960,000 in a mine estimated to have 1,200,000 tons of ore with no salvage value. During the first year, 200,000 tons of ore were mined and sold.

Instructions

Prepare the journal entry to record depletion expense.

(Essay)

4.8/5  (35)

(35)

Recording depreciation each period is an application of the matching principle.

(True/False)

4.9/5  (33)

(33)

Showing 201 - 220 of 293

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)