Exam 10: Plant Assets, Natural Resources, and Intangible Assets

Exam 1: Accounting in Action220 Questions

Exam 2: The Recording Process192 Questions

Exam 3: Adjusting the Accounts216 Questions

Exam 4: Completing the Accounting Cycle203 Questions

Exam 5: Accounting for Merchandising Operations221 Questions

Exam 6: Inventories204 Questions

Exam 7: Accounting Information Systems139 Questions

Exam 8: Fraud, Internal Control, and Cash212 Questions

Exam 9: Accounting for Receivables220 Questions

Exam 10: Plant Assets, Natural Resources, and Intangible Assets293 Questions

Exam 11: Current Liabilities and Payroll Accounting207 Questions

Exam 12: Accounting for Partnerships210 Questions

Exam 13: Corporations: Organization and Capital Stock Transactions195 Questions

Exam 14: Corporations: Dividends, Retained Earnings, and Income Reporting176 Questions

Exam 15: Long-Term Liabilities215 Questions

Exam 16: Investments178 Questions

Exam 17: Statement of Cash Flows203 Questions

Exam 18: Financial Analysis: the Big Picture225 Questions

Exam 19: Managerial Accounting197 Questions

Exam 20: Job Order Costing199 Questions

Exam 21: Process Costing198 Questions

Exam 22: Cost-Volume-Profit217 Questions

Exam 23: Incremental Analysis208 Questions

Exam 24: Budgetary Planning207 Questions

Exam 25: Budgetary Control and Responsibility Accounting207 Questions

Exam 26: Standard Costs and Balanced Scorecard221 Questions

Select questions type

The depreciation method that applies a constant percentage to depreciable cost in calculating depreciation is

(Multiple Choice)

4.9/5  (37)

(37)

On January 2, 2010, Milroy Company purchased a patent for $200,000. The patent has an 8-year estimated useful life and a legal life of 20 years.

Instructions

Prepare the journal entry to record patent amortization.

(Essay)

4.8/5  (42)

(42)

Using the units-of-activity method of depreciating factory equipment will generally result in more depreciation expense being recorded over the life of the asset than if the straight-line method had been used.

(True/False)

4.7/5  (25)

(25)

Karnes Company purchased a truck for $57,000. The company expected the truck to last four years or 100,000 miles, with an estimated residual value of $6,000 at the end of that time. During the second year the truck was driven 27,000 miles. Compute the depreciation for the second year under each of the methods below and place your answers in the blanks provided.

Units-of-activity $

Double-declining-balance $

(Essay)

4.8/5  (33)

(33)

Land improvements should be depreciated over the useful life of the

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following assets does not decline in service potential over the course of its useful life?

(Multiple Choice)

4.8/5  (37)

(37)

On January 1, 2008, Reyes Company purchased a computer system for $20,500. The system had an estimated useful life of 5 years and no salvage value. At January 1, 2010, the company revised the remaining useful life to two years. What amount of depreciation will be recorded for 2010 and 2011?

(Essay)

4.7/5  (30)

(30)

Drago Company purchased equipment on January 1, 2010, at a total invoice cost of $600,000. The equipment has an estimated salvage value of $15,000 and an estimated useful life of 5 years. What is the amount of accumulated depreciation at December 31, 2011, if the straight-line method of depreciation is used?

(Multiple Choice)

4.8/5  (35)

(35)

A plant asset cost $45,000 when it was purchased on January 1, 2003. It was depreciated by the straight-line method based on a 9-year life with no salvage value. On June 30, 2010, the asset was discarded with no cash proceeds. What gain or loss should be recognized on the retirement?

(Multiple Choice)

4.8/5  (39)

(39)

If disposal of a plant asset occurs at any time during the year, ___________________ for the fraction of the year to the date of disposal must be recorded.

(Short Answer)

4.8/5  (41)

(41)

Which depreciation method is most frequently used in businesses today?

(Multiple Choice)

4.7/5  (37)

(37)

Presented below are two independent situations:

(a) Waner Company exchanged an old machine (cost $100,000 less $60,000 accumulated depreciation) plus $7,000 cash for a new machine. The old machine had a fair market value of $36,000. Prepare the entry to record the exchange of assets by Waner Company.

(b) Fisher Company trades old equipment (cost $90,000 less $54,000 accumulated deprecia-tion) for new equipment. Fisher paid $36,000 cash in the trade. The old equipment that was traded had a fair market value of $54,000. Prepare the entry to record the exchange of assets by Fisher Company. The transaction has commercial substance.

(Essay)

4.8/5  (41)

(41)

The declining-balance method of computing depreciation expense involves multiplying a _______________ book value by a _______________ percentage.

(Short Answer)

4.8/5  (47)

(47)

Payne Company purchased equipment in 2003 for $90,000 and estimated a $6,000 salvage value at the end of the equipment's 10-year useful life. At December 31, 2009, there was $58,800 in the Accumulated Depreciation account for this equipment using the straight-line method of depreciation. On March 31, 2010, the equipment was sold for $24,000.

Prepare the appropriate journal entries to remove the equipment from the books of Payne Company on March 31, 2010.

(b) Judson Company sold a machine for $15,000. The machine originally cost $35,000 in 2007 and $8,000 was spent on a major overhaul in 2010 (charged to Machine account). Accumulated Depreciation on the machine to the date of disposal was $28,000.

Prepare the appropriate journal entry to record the disposition of the machine.

(c) Donahue Company sold office equipment that had a book value of $6,000 for $8,000. The office equipment originally cost $20,000 and it is estimated that it would cost $25,000 to replace the office equipment.

Prepare the appropriate journal entry to record the disposition of the office equipment.

(Essay)

5.0/5  (34)

(34)

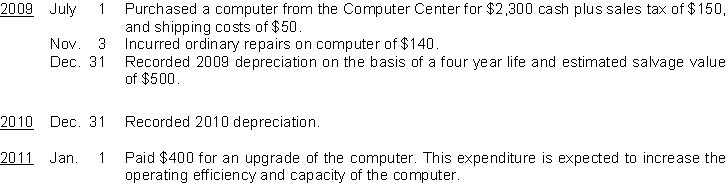

Eckan Word Processing Service uses the straight-line method of depreciation. The company's fiscal year end is December 31. The following transactions and events occurred during the first three years.  Instructions

Prepare the necessary entries. (Show computations.)

Instructions

Prepare the necessary entries. (Show computations.)

(Essay)

4.7/5  (37)

(37)

A plant asset was purchased on January 1 for $50,000 with an estimated salvage value of $10,000 at the end of its useful life. The current year's Depreciation Expense is $5,000 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $25,000. The remaining useful life of the plant asset is

(Multiple Choice)

5.0/5  (38)

(38)

Mehring Company reported net sales of $270,000, net income of $54,000, beginning total assets of $240,000, and ending total assets of $360,000. What was the company's asset turnover ratio?

(Multiple Choice)

4.9/5  (35)

(35)

The cost of a patent should be amortized over its legal life or useful life, whichever is shorter.

(True/False)

4.8/5  (41)

(41)

Showing 101 - 120 of 293

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)